Santander presented earnings 32% higher year over year.

There were two main contributors for this result:

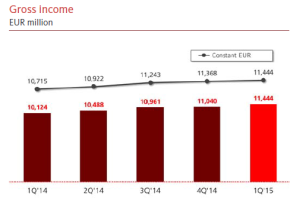

- Higher gross income:

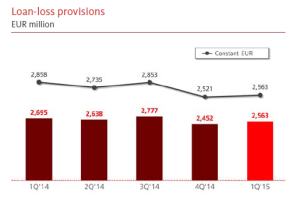

- Lower loan-loss provisions:

The results indicate that Santander is clearly on a normalization cycle. As I said before, the return on equity will be lower than during the pre-crisis period for the whole industry – this was a major structural shift.

In 1Q15, the ROTE for Santander was 11.5% while the bank is targeting a ROTE around 12-14% for 2017. To improve the ROTE, the bank is focusing on:

- Improving customer loyalty and engagement with the bank. A better franchise able to capitalize on the huge clients base will bring in higher profitability.

- Improvement in capital allocation that provide adequate returns and allow lower NPL’s. One example is the joint-venture with Pioneer for an Asset management unit.

This seems a good strategy, since the financial leverage from pre-2007 is no longer available, the improvement in performance has to come from the real business. Getting the best customer through better services is the answer to get a better yield from the banks’ asset base.

Bottom line: Good results for Santander, in line with the expected progress for the normalization of the bank’s results. In the following quarters, I believe this trend might continue.