(Photo credit: Sankarshan)

First of all, we have to get the context for this transaction. IBM (IBM) proposed taking over Red Hat (RHT) in a $30 billion deal. There are some specifics that must be covered. One of the most important is the fact that this is a friendly deal, i.e., the acquired management team is on board with the transaction. Jim Whitehurst and his team are actively pursuing the deal and bearing in mind the insiders positions, they have good monetary reasons to do so.

Table 1 – Top direct holders

(Source: Guru Focus)

Another interesting point is the huge premium. During the last two years, Red Hat has been trading between $69.70 and $174.99. The average closing price was around $116, which is remarkably close to the closing price the day before the offer.

Graph 1 – 2-year stock price for Red Hat

(Source: Yahoo Finance)

Finally, taking a look at the deal conference call, we can see that IBM is really betting the ranch on this deal. They seem to believe that Red Hat’s cloud expertise and technology will help them to reignite growth.

Summing up, we should retain that most of the decision makers are aligned with the deal. Both management teams want it while the shareholders will have a nice premium if it goes through. We only lack regulators’ approval to have everyone onboard.

Whole Food Markets and Amazon as a proxy for IBM and Red Hat

The Whole Foods acquisition serves as a good proxy because it was also supported by both management teams. So, let’s see what happened.

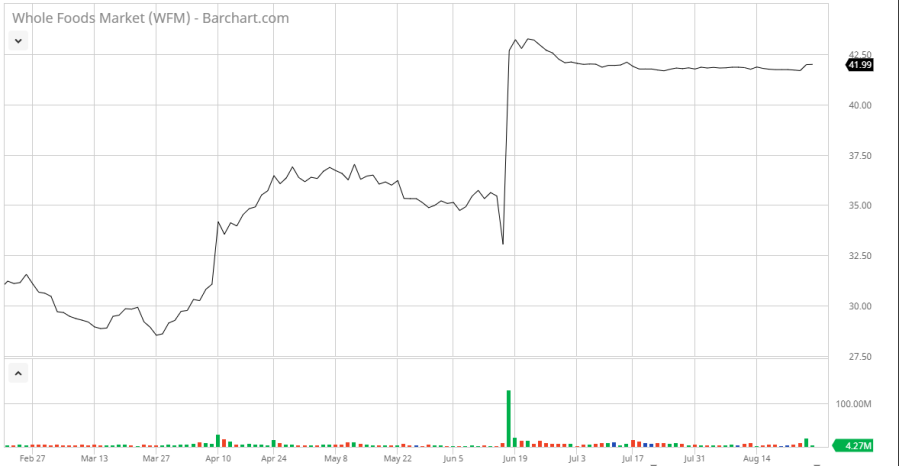

After the announcement of the Whole Food Market acquisition by Amazon (AMZN), the Whole Foods stock price shot up, to around the acquisition price, $42 per share.

Graph 1 – Whole Foods Market before and after Amazon Acquisition offer

(Source: Barchart.com)

Basically, the market assumed a near 100% chance of success. In the first few days, it even reflected a possible competing bidder. But, by then, Amazon used its traditional tactics to avoid getting into a contest.

Now, in the Red Hat case, the deal was announced on a Sunday, and the price was disclosed at $190. The next day saw the stock going up to around $173 and then bounce back to $170. That represents a discount between $17 and $20 per share, in a deal supposed to be closed in less than one year, with every party onboard with it. Does this make sense?

Dissecting Red Hat’s market discount

Since we already know the best outcome, the starting point would be to define the worst likely outcome for this deal. For that, remember that there are some contract clauses that may result in Red Hat having to pay close to $1 billion to IBM if the deal falls apart.

For the sake of simplicity, let us assume that, if the deal falls, the stock price would be back to the pre-announcement level. To that number, we have to take back the per share amount of the deal breaking fee. In other words, the share price would be around $110 ($116 less $5.42).

Therefore, we would be talking about the worst case scenario of $110 per share or, if the deal comes through, a best-case scenario of $190 per share. Since the price is now close to $174, using a simple expected-value to extrapolate the probabilities, we will get around 20% chances of breaking the deal.

Takeaways

In my opinion, this doesn’t make sense. I am not arguing that the deal has a zero chance of falling apart, but around 20% chance seems too much. Although bearing some differences, the Whole Foods acquisition provides us with clues to what should be happening. In my opinion, based on the simplistic analysis in the previous paragraphs, it seems like there is still money left on the table. If the transaction goes through, at the current price of $174, there is still a 9% gain to be made.