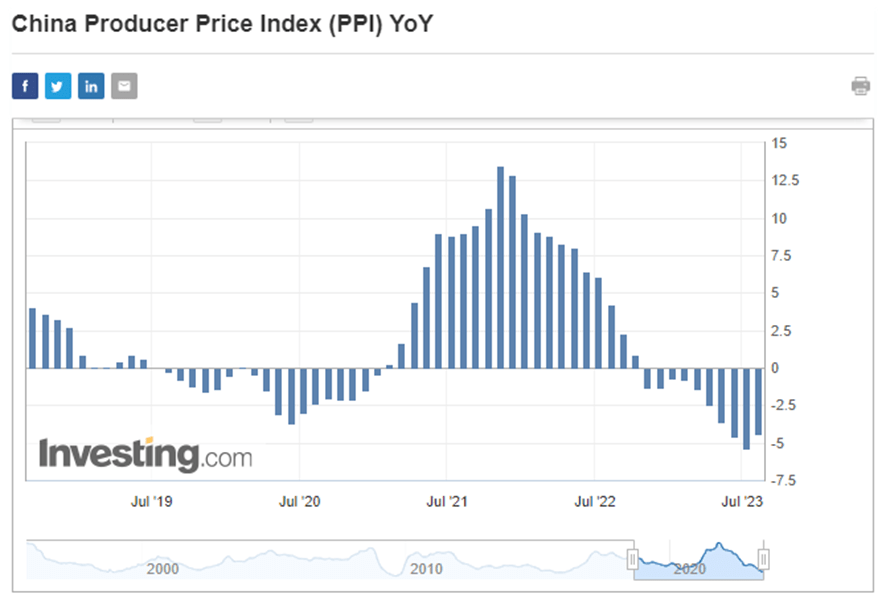

The macro narrative is missing a giant piece of the puzzle. Dive deep into the data, and an understated deflationary shock from China becomes evident. Surprisingly, in the face of a 6% depreciation of the yuan against the USD over the past 12 months – an event that, by all accounts, should be inflationary – we’ve instead witnessed a 4% slump. Those seem to confirm the powerful deflationary forces coming from China.

Source: Seeking Alpha

Source: investing.com

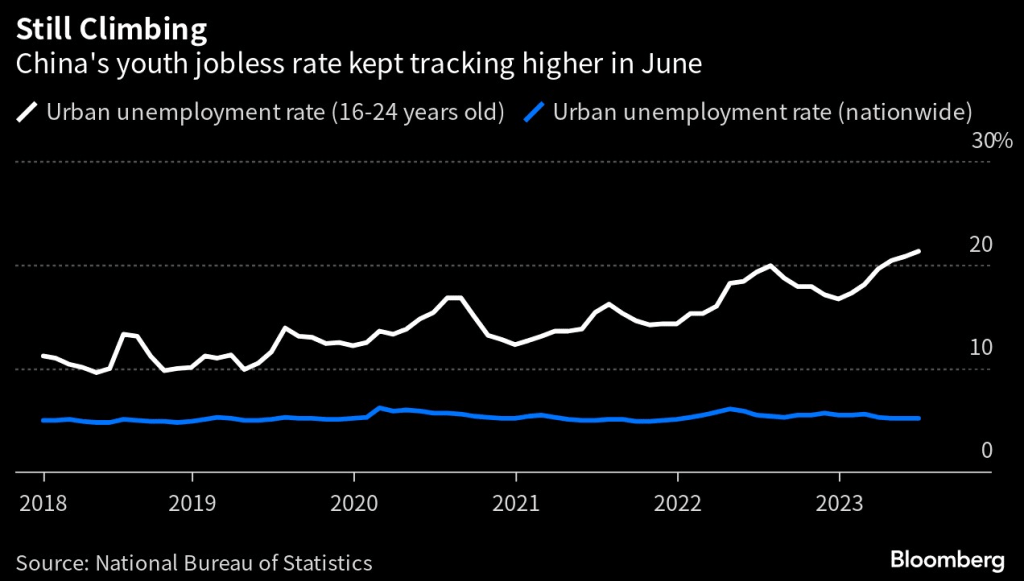

Overlay this with the precarious situation unfolding in the realm of Chinese real estate and trust firms. Defaults are ratcheting up, a clear manifestation of the latent economic challenges China confronts – the ever-looming specters of excessive debt and rampant over-leverage.

Source: Bloomberg via El-Erian

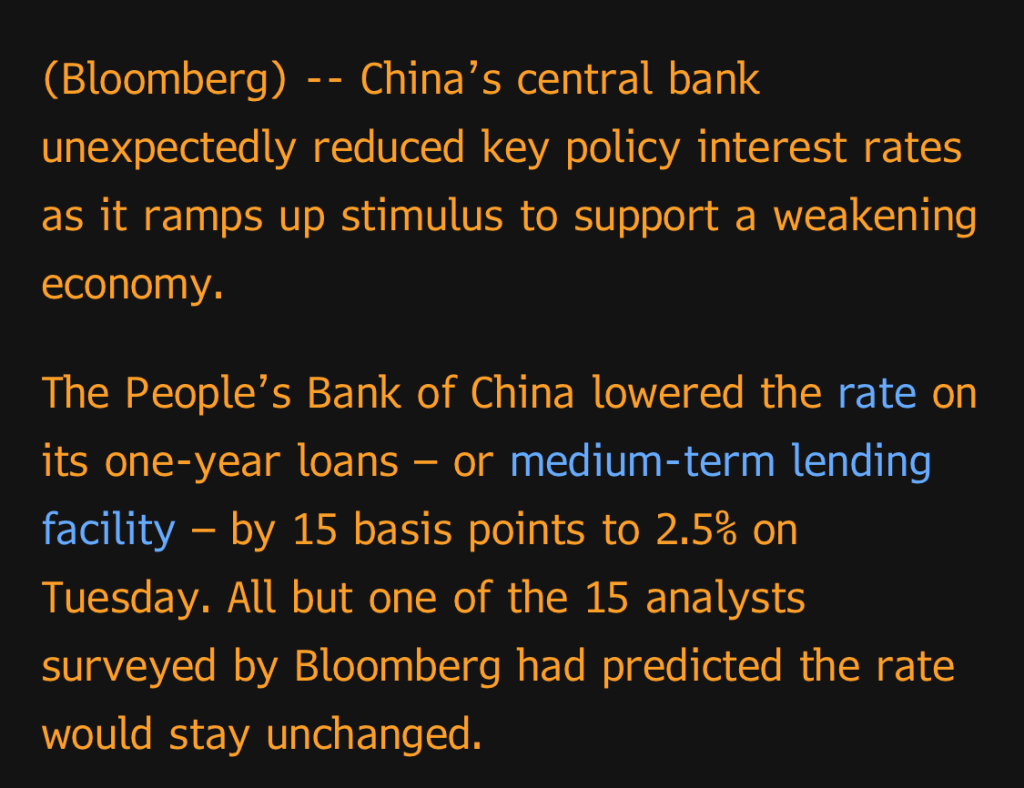

Beijing seems acutely aware of the potential dangers of a runaway yuan depreciation. To arrest this slide, don’t be surprised to see China deploying its arsenal, offloading US dollars in its coffers and actively accumulating yuan. All-in-all, the signs are not good, the dragon might be breathing cold, and the world needs to be prepared.

Via Jim Bianco

Leave a comment