QuantumScape CEO’s Vision: Redefining the Future of Energy Storage

QuantumScape’s CEO has laid out a clear direction for where the company’s headed, with a strong focus on long-term growth and how they plan to carve out their place in the energy storage world. At the heart of this plan is a big idea: to shake up how energy is stored, with QuantumScape aiming to lead the way in solid-state lithium-metal batteries.

If you like the post so far, leave your email for more content like this. The post continues below.

To kick things off, the CEO doesn’t just want QuantumScape to be seen as another EV battery company. Sure, electric vehicles are a huge part of the focus right now—because, let’s be honest, they desperately need better batteries—but the goal is much broader. While electric vehicles are the initial focus—because, let’s face it, better, faster-charging, and safer batteries are badly needed—the company’s sights are set on a wide range of industries. Think beyond cars: consumer electronics that last longer and charge faster, energy storage for power grids, and even emerging areas like data centers, drones, robotics, and aviation. The message? Wherever batteries are holding things back, QuantumScape wants to step in.

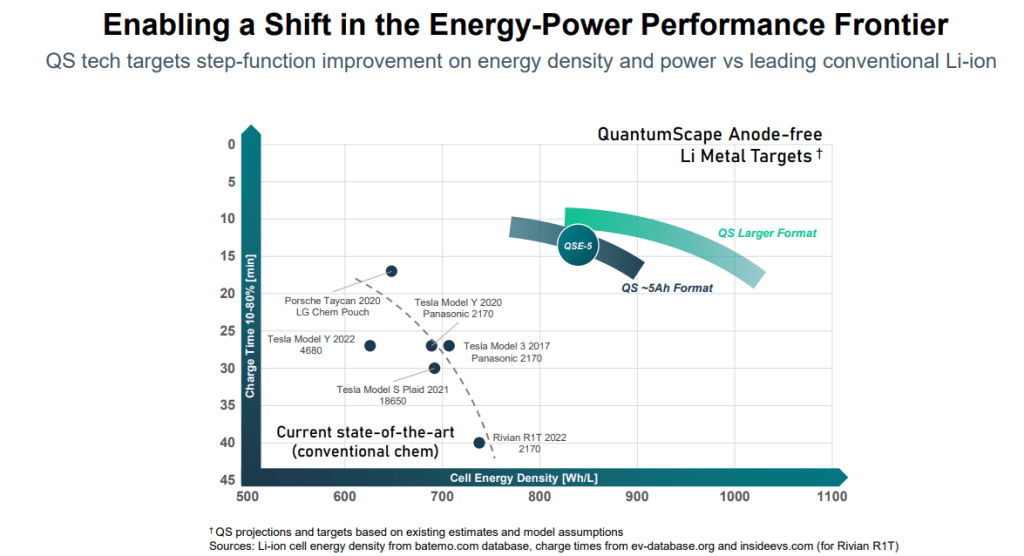

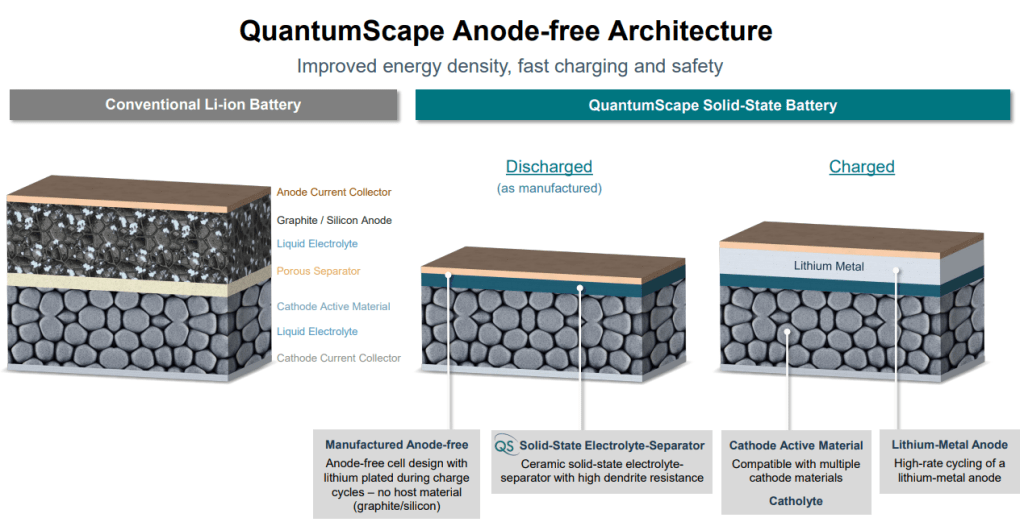

The real backbone of this strategy is their solid-state battery platform, which they call “no-compromise” for good reason. Their tech delivers way more energy density than today’s lithium-ion batteries, charges in just about 12 minutes, and can handle extreme heat—up to 300°C—without flammable liquids.

Source: QS

On top of that, they’ve ditched the graphite anode, which not only lowers costs but also avoids supply chain headaches tied to graphite sourcing. It’s designed to outperform existing tech across the board, giving them a strong shot at wide adoption.

Source: QS

QuantumScape’s 3-Pillar Strategy: Prove, Partner, and Innovate

The roadmap laid out by the CEO rests on three key pillars. First, they’re determined to show this tech works in the real world—not just in a lab. Their QSE-5 battery, now moving into the B1 sample stage, is being tested in everything from vehicles to robotics. The design is flexible enough to be adapted for different shapes and sizes, so it’s not locked into one specific use case.

Second, scaling isn’t something they plan to tackle alone. QuantumScape is building a global web of partners—equipment makers, materials suppliers, manufacturers, OEMs—to help bring this vision to life. A good example is their recent collaboration with Murata, who will help scale the production of the ceramic separator, one of the battery’s critical components. The bigger this network grows, the easier it becomes to cut costs, speed things up, and break into new markets.

The third piece is all about keeping the innovation engine running. The company isn’t stopping at one product—they’re set on constantly improving energy density, charging speed, safety, and cost. Every advance feeds into new applications, attracts more partners, and opens up fresh opportunities. It’s a cycle: innovate, grow, repeat.

Scaling for a Trillion-Dollar Market: QuantumScape’s Long-Term Outlook

Looking out over the next decade and beyond, the CEO sees QuantumScape becoming a major player in a solid-state battery market that could top 1 terawatt-hour of production each year by 2040. They’re planning for that kind of scale, even talking about the need for separator production facilities as big as Manhattan. It’s a huge market—potentially worth trillions—and they want a big piece of it.

For investors, there are a few things to keep an eye on. Expect more real-world demos soon, starting with B1 samples in 2025 and customer trials in 2026. More partnerships are on the horizon too, not just with carmakers but across the whole supply chain. The potential rewards here are enticing, but hitting key milestones is critical.

Watch for progress on scaling the Cobra process, delivering B1 samples on time, and locking in new licensing deals. Since QuantumScape’s success also depends on how well their partners perform, the company’s future—and investor confidence—will be shaped by both its own execution and that of its wider ecosystem.

QuantumScape Updated Investment Thesis

With the latest Q1 2025 update and a clearer look at where QuantumScape is heading, there are a few standout reasons why the company might be worth a closer look from investors right now.

One of the more interesting shifts is how they’re moving away from traditional manufacturing and leaning into a more capital-light approach. Instead of pouring money into factories, they’re focusing on turning their tech into licensing deals, using partnerships to get things done. The ongoing collaboration with PowerCo (Volkswagen) is a big part of that, and their recent deal with Murata, aimed at ramping up ceramic film production, shows how they’re pulling in global expertise to help scale—without having to build it all themselves. This kind of setup lets them keep costs down, collect early payments like royalties and engineering fees, and gradually expand their partner base so they’re not too reliant on any single customer.

On the tech side, QuantumScape is still one of the leaders in the push for solid-state batteries. Their QSE-5 platform, which relies on a unique ceramic separator, is designed to deliver across the board—higher energy density, super-fast charging, better heat tolerance, and none of the graphite anodes that traditional batteries need. All of this puts them ahead of most lithium-ion options and even ahead of some other solid-state players. They’re hitting milestones too: B1 samples are expected to go out in 2025, with more hands-on, real-world testing planned for 2026. Internally, their Raptor separator has already beaten expectations, and their newer Cobra process could make production ten times more efficient—exactly what they need to scale properly.

They’ve also laid out a step-by-step plan to bring this all to market. This year, 2025, is about fully switching to Cobra and boosting B1 production. By 2026, they’re aiming for a small-scale but high-profile demo with their launch customer to prove the tech works in real conditions. After that, the goal is to let partners take over more of the production load, which would start bringing in steady royalty income. Sure, the big revenue might not come until after 2026, but with early cash coming in from partners and the promise of high-margin licensing fees, things could shift financially sooner rather than later.

Source: QS

Money-wise, QuantumScape is in a solid place. As of Q1, they’ve got $860.3 million in the bank, which should keep them going well into the second half of 2028. Their spending has stayed under control too—they used $5.8 million in CapEx during Q1 and expect to spend between $45 million and $75 million for the year. They’re also projecting an adjusted EBITDA loss of $250 million to $280 million for 2025, but there’s no immediate pressure to raise money unless a good opportunity comes along.

Looking at the bigger picture, QuantumScape is setting itself up to benefit from rising demand for next-gen batteries in a bunch of different industries. EVs are the first step, but they’re also eyeing things like consumer electronics, grid storage, drones, robotics, and even aviation. The CEO has mentioned that the solid-state battery market could reach over 1 terawatt-hour a year by 2040, and QS wants to be a major player in that space. Their platform model, where they partner up rather than go it alone, helps them scale while tapping into those bigger market trends.

Summary of Investment Theses:

- Capital-light model reduces risk and enables scalable, high-margin growth via licensing.

- Technological superiority gives QuantumScape a significant edge in solid-state battery innovation.

- Clear path to commercialization, with B1 samples in 2025 and demo programs in 2026.

- Strong balance sheet ensures financial stability through key milestones.

- Expanding partner ecosystem (PowerCo, Murata, other OEMs) accelerates industrialization.

- Positioned for massive long-term growth in a >1 TWh solid-state battery market.

If you liked it so far, here you can find a deepdive on valuation.

Disclaimer: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Make a one-time donation

Make a monthly donation

Make a yearly donation

Choose an amount

Or enter a custom amount

Your contribution is appreciated.

Your contribution is appreciated.

Your contribution is appreciated.

DonateDonate monthlyDonate yearly

Leave a comment