Takeaways from the Roku’s 1Q25 earnings release

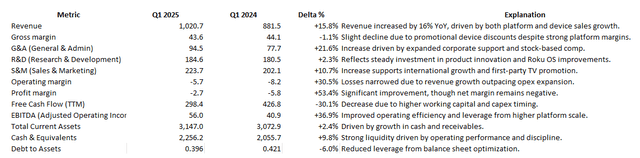

Source: Author’s summary

Yes, Roku’s revenue and EBITDA growth slowed in Q1 2025 — and it’s not just a seasonal blip. Revenue rose 15.8% year-over-year, down from 22.0% in Q4. EBITDA growth also decelerated, landing at 36.9% compared to 62.5% the previous quarter. The slowdown is real, and it’s raising legitimate questions about how well Roku’s monetization strategy is holding up now that scale isn’t the main constraint anymore.

So what does this actually tell us? For starters, engagement still isn’t translating cleanly into revenue. In Q4, Total Reach Campaign (TRC) usage was up 82%, but that surge hasn’t been mirrored in top-line growth — a gap that continued into Q1. That suggests ad yield and efficiency aren’t fully dialed in yet. Roku may be brushing up against short-term ceilings in either ad load or CPMs. It also hints that platform leverage — turning user growth into consistent profitability — may take longer to materialize than investors hoped.

Recalibrating Thesis for Roku

But it’s important to separate signal from noise. This doesn’t necessarily mean the model is broken. Margins are still expanding, just at a slower pace. It also doesn’t mean Roku can’t reaccelerate. The upcoming quarters, with tailwinds like the Olympics and back-to-school ad cycles, could provide a better environment. And from a valuation perspective, the stock doesn’t look overhyped — trading at around 2x sales with positive free cash flow, it’s no longer priced like a high-flyer.

The real shift here is in how Roku should be framed. It’s moving out of “growth stock” territory and into “compounder candidate” territory. The key question now is whether Roku can grow EBITDA and free cash flow by 20–30% annually, even if revenue growth stays in the 12–15% range. If the answer is yes, then the stock remains undervalued — but you’re betting on margin expansion and operating leverage, not explosive revenue gains.

Looking ahead, there are a few markers to watch. The bull case strengthens if EBITDA margins continue climbing toward (or past) 10%, ARPU keeps growing in the double digits, and Roku begins closing the gap between TRC engagement and monetization. You’d also want to see small-business adoption and demand-side platform (DSP) integrations driving more ad demand. On the flip side, it’s a warning sign if revenue growth dips below 12%, quarterly EBITDA stalls under $60–70 million, free cash flow turns structurally negative, or engagement starts plateauing — especially on the TRC or home screen.

At the end of the day, the market’s asking a simple but critical question: Can Roku actually monetize like a platform — not just look like one? If the answer’s yes, this quarter is just a breather before the next leg up. If not, the stock could stay in “show-me” mode for a while.

Peer Comparison for Roku

Shifting gears, let’s try to compare the company’s financials against a set of peers. However, the company doesn’t sit neatly in one category. It’s part CTV infrastructure, part ad tech, part streaming service, and part consumer platform. That kind of overlap makes it tough to find a single, clean comparison. So the smarter move is to build a blended peer group, organized by how each company makes money and what strategic role they play.

Let’s break it down by category:

1. Streaming Platforms (SVOD/AVOD hybrids)

These are companies running both subscription and ad-supported streaming models — similar to Roku Channel’s hybrid approach.

Netflix (NFLX): Their recent ad-tier rollout mirrors Roku’s model, and they bring scale and original content to the table.

Disney (DIS): With both Hulu and Disney+ under its belt, Disney combines subscriptions with ad-supported streaming across a massive content portfolio.

Paramount Global (PARA): Owns Pluto TV, one of the bigger FAST (free ad-supported streaming TV) platforms — a direct comp to Roku Channel.

2. FAST & Ad-Supported Streamers

These are Roku Channel’s most direct competitors in the free, ad-supported space.

Fox Corp (FOXA): Owns Tubi, a pure-play FAST service gaining traction in CTV.

Comcast (CMCSA): Runs Peacock (which mixes SVOD and AVOD) and has a growing presence in smart TV operating systems.

Amazon (AMZN): Fire TV competes with Roku hardware and OS, plus it’s layering in more ad-supported content within Prime Video.

3. Ad Tech Platforms (especially in CTV)

Roku makes a big chunk of its money through ads — both programmatic and direct. So comparing it to pure-play ad tech firms is useful.

The Trade Desk (TTD): The closest comp in terms of ad monetization and targeting in CTV.

4. Platform + Hardware Ecosystem Players

Roku’s model is also tied to its OS and hardware — so you can’t ignore these players.

Apple (AAPL): Apple TV combines OS, hardware, and monetization, just like Roku.

Google (GOOGL): Android TV/Google TV competes directly with Roku’s OS, and YouTube is pushing further into ad-supported streaming.

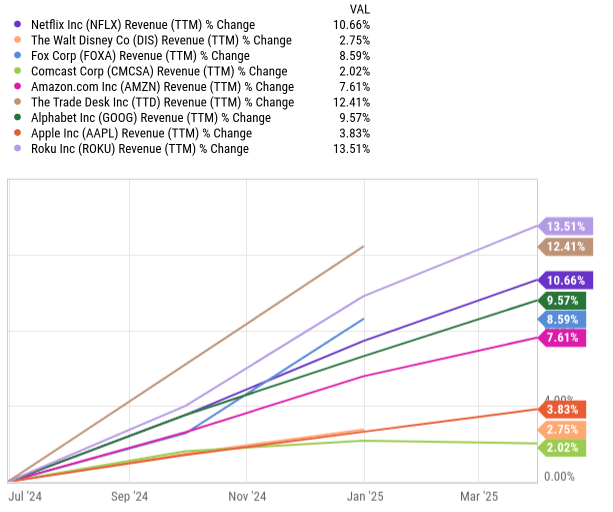

Source: YCharts

Looking at trailing twelve-month (TTM) revenue growth, Roku stands out at the top of the pack with 13.5% growth — ahead of The Trade Desk at 12.4%, Netflix at 10.7%, and well above Alphabet and Amazon, which both came in below 10%. Traditional media players like Disney, Comcast, and Fox are further behind, with most under 9% and Comcast barely scraping past 2%.

The key takeaway here is that Roku is growing faster than both old-school media companies and many tech peers, yet it trades at a fraction of their valuations. The contrast is especially sharp when compared to The Trade Desk — Roku is growing slightly faster, yet trades at under 2x price-to-sales, while TTD sits around 9.5x. That valuation gap underscores the broader point: Roku is executing more like a premium ad-tech platform than a traditional media or device company. The market, it seems, still hasn’t caught up.

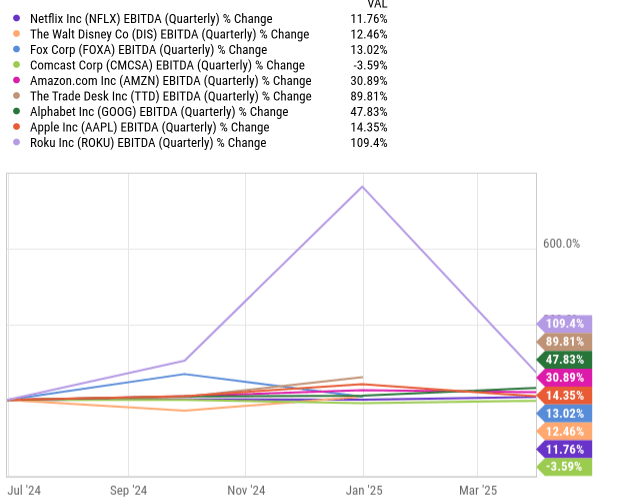

Source: YCharts

The EBITDA growth story is even more compelling. In the latest quarterly numbers, Roku posted a 109.4% year-over-year increase in EBITDA — the highest among all major peers. The Trade Desk followed at 89.8%, with Google and Amazon at 47.8% and 30.9% respectively. Netflix and Apple posted growth in the low double digits, while Disney, Fox, and Comcast hovered around 13%, with Comcast actually in negative territory. Roku’s operating leverage is accelerating faster than any of its comps, which speaks volumes given the ongoing concerns some investors have had about margins. These results show that Roku’s platform monetization is improving meaningfully, and the company is managing costs with increasing discipline. It’s a clear signal that the business has moved well beyond its hardware roots.

Altogether, these performance metrics validate the core investment thesis: Roku isn’t just recovering — it’s outperforming. The company is growing faster than Netflix and Disney, while scaling operating profit faster than The Trade Desk, yet it remains priced like a legacy media device maker. Roku is being misclassified in the market, and that disconnect is precisely where the opportunity lies. If you’re building a forward-looking valuation case, this is where to focus.

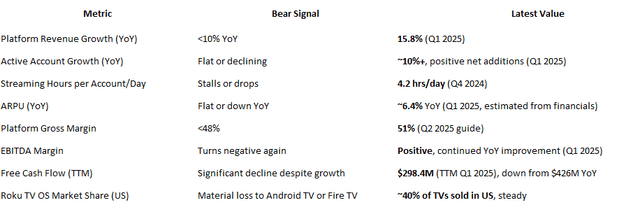

What to watch for in ROKU

To keep a close eye on the bear case for Roku and spot any early cracks in the thesis, it’s smart to focus on the metrics that really matter: how well the platform is monetizing, the health and engagement of the user base, and whether margins are scaling with revenue. These three pillars — monetization efficiency, user quality, and operating leverage — are the foundation of the long thesis. If any of them start to weaken, it could be a sign the story is changing.

Source: Author’s Summary

Wrap up

Roku’s core investment thesis is still intact, though there are early signs that the company is shifting from a hypergrowth story to one of a scaling, maturing platform. The company continues to execute well — expanding monetization across its platform, deepening its hold as the dominant TV operating system in the U.S., and showing meaningful improvements in operating leverage. The growth is real and diversified, but it’s becoming more measured and execution-driven. We’re moving into a phase where success depends less on sheer user growth and more on how well Roku can optimize each piece of its ecosystem.

The key risk — and it hasn’t changed — is the monetization vs. engagement gap. Roku continues to grow user numbers and watch time, but unless that engagement translates into higher ARPU, the rerating case weakens. This remains the single biggest variable in the bull case. The next few quarters need to show progress in bridging that gap, whether through new ad formats, deeper Frndly integration, or more effective home screen monetization.

So here’s the updated framing: Roku is no longer just an ad-tech story in the making — it’s now a scaled, profitable CTV platform. But to earn a higher multiple, it has to prove it can convert that scale into consistently stronger per-user economics. Until then, it’s best thought of as a “compounder in training” — one with strong optionality, a defensible infrastructure advantage, and a platform that’s still maturing into its full monetization potential.

Disclaimer: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Leave a comment