To really understand what’s driving AMD’s recent momentum — and what could keep pushing it through 2025 — you have to look at a few key technical breakthroughs. Not every innovation moves the needle. What matters are the ones that either boost product competitiveness in fast-growing markets (especially AI and data center), allow AMD to charge more, or help them break into entirely new customer segments. Here’s a look at the ones that actually matter for revenue — ranked by near-term impact, not just headline appeal.

Let’s start with the big one: MI350, AMD’s upcoming AI GPU based on its CDNA 4 architecture. Launching in mid-2025, this chip is a massive leap forward — AMD is promising a 35× performance bump over the MI300X. That’s not all marketing fluff either; it comes from higher memory capacity, better bandwidth, and smarter multi-GPU scaling. Importantly, it’s built to slot into the same infrastructure as MI300, which makes it easier and faster for customers to adopt. AMD already has this sampling with hyperscalers, and a large MI355X cluster deal with Oracle is underway. If they hit their targets, this line alone could carry a huge portion of the $5 billion in AI GPU sales AMD is forecasting for this year. Bottom line: MI350 could be the company’s first real shot at challenging Nvidia in inference-heavy AI workloads.

But while MI350 is the future, EPYC Turin — AMD’s latest data center CPU — is what’s driving revenue right now. Built on the Zen 5 core, Turin is all about efficiency and scalability. It’s showing up in over 150 server platforms and more than 30 new cloud instances at AWS, Google, and Oracle. It’s also landing in enterprise IT across industries like telecom, manufacturing, and auto. Turin helped drive a 57% year-over-year jump in AMD’s data center revenue in Q1, and it’s likely going to be a key contributor for the rest of the year. The short version? EPYC is finally breaking into the mainstream — and it’s sticking.

Next up is the MI300X/MI325X series — the chips that are actually shipping now. They’re being used for inference on real workloads, like LLaMA 405B, and they provide a much-needed bridge to the upcoming MI350. The MI325X builds on the MI300X with better memory, but what really matters is compatibility. Customers don’t have to re-architect their stacks to upgrade, which helps AMD keep its momentum going as it builds toward the CDNA 4 generation.

Meanwhile, in the PC world, AMD is making a real push with its Ryzen AI chips. These are the ones with a built-in NPU (neural processing unit), designed to handle local AI tasks — think Copilot in Windows, local LLMs, video upscaling, stuff like that. Since their Q1 launch, Ryzen AI chips have seen notebook sell-through jump 50% quarter-over-quarter, and AMD is seeing a lot more commercial interest, with design wins up 80% year-over-year. Major OEMs like HP, Lenovo, and Asus are already rolling them out. It’s still early days for AI PCs, but Ryzen AI puts AMD in a good spot — especially as Intel tries to hold onto its dominance in the premium laptop market.

On the software side, there’s ROCm, AMD’s answer to Nvidia’s CUDA. It doesn’t directly bring in revenue, but it’s crucial for ecosystem viability. AMD’s moved from quarterly to bi-weekly ROCm updates, and it now supports more than 2 million Hugging Face models — including LLaMA 4 and Google’s Gemma 3 — on day one. That kind of compatibility lowers the switching costs for developers and makes AMD’s Instinct GPUs a more viable alternative for real AI work. ROCm’s still not at CUDA’s level, but AMD is catching up faster than people expected.

Finally, the ZT Systems acquisition rounds out the picture. It’s not a chip, but it matters because it gives AMD the ability to sell full-stack AI systems — complete racks with CPUs, GPUs, and networking, ready to deploy. That’s something Nvidia has done well with its DGX and Blackwell platforms, and AMD didn’t really have a good answer until now. With ZT, AMD can move from selling parts to selling infrastructure — and that’s where the bigger, more strategic deals tend to happen.

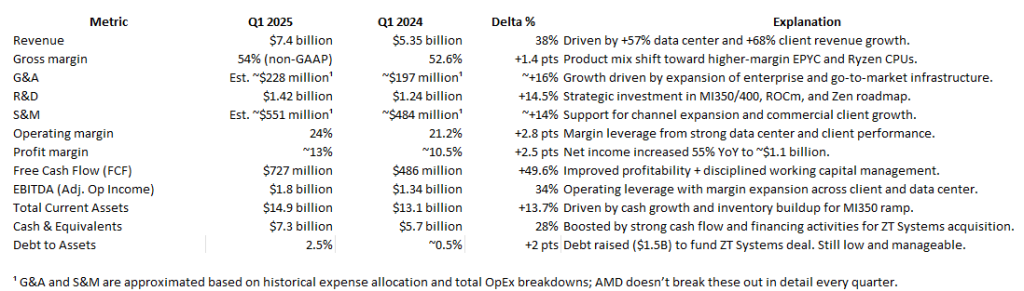

Wrapping-up, keep an eye on these technology drivers because I believe they will be driving the top-line and the margin expansion potential going forward. As a matter of fact, we can already see signals of these tech improvements in the financials.

Source: Author’s Summary

Take notice of the EBITDA margin expand almost at the same rate as the revenue growth. I believe the best is yet to come for AMD.

Leave a comment