After its 1Q25 earnings, it’s clear AMD isn’t just building fast chips anymore, it’s morphing into a full-stack AI compute platform company. The pieces are clicking into place: a credible multi-year roadmap, solid execution across silicon and systems, and growing traction in real AI infrastructure deployments. What makes this even more interesting? The market still values AMD like a component vendor, not a platform player. Meanwhile, it’s starting to look like the only serious alternative to Nvidia in data center AI, at a fraction of the multiple.

Data Center Surge and Product Momentum Reinforce Long-Term AI Thesis

AMD’s latest numbers reinforce its bullish long-term roadmap in AI. Data center revenue jumped 57% year-over-year to $3.7 billion, driven by strong demand for its 4th and 5th Gen EPYC CPUs, along with early traction for its MI300 and I325X accelerators. These results back the core thesis that AMD is gaining ground in AI infrastructure with a multi-generation product strategy.

Hyperscaler adoption is accelerating, too. AMD highlighted key wins, including Oracle and a major frontier model player leveraging Instinct GPUs for real-world inference at scale, not just in pilot tests. These public use cases add credibility to AMD’s position in AI beyond hardware specs alone.

AI GPU TAM Expands With Clear Visibility Into 2026

AMD reiterated its target of $5 billion in AI GPU revenue for 2024, more than doubling last year’s $1.82 billion estimate. This sharp ramp aligns with the original thesis that AMD is catching up fast, and sets the stage for further growth as the MI350 (launching mid-2025) and MI400 (expected in 2026) enter the market.

The MI350 and MI400 are not just spec bumps, they represent serious steps forward. The MI400, in particular, is designed to support rack-scale training and inference, addressing long-standing gaps in AMD’s platform capabilities compared to Nvidia, especially in system-level integration.

Regulatory and Operational Headwinds Add Complexity

Not everything is smooth sailing. New U.S. export controls now require a license for shipping the MI308 to China, which will pull roughly $1.5 billion out of AMD’s 2025 GPU revenue forecast$700 million of that hits in Q2 alone. Despite this, AMD still expects to hit its $5 billion AI GPU target this year. But the loss highlights how vulnerable AMD is to geopolitical shifts, complicating any dominant player narrative.

Additionally, AMD is taking an $800 million inventory-related charge in Q2, directly tied to the China restrictions. This drags GAAP gross margin down to 43% for the quarter (though normalized margins hold at 54%). These charges raise red flags about demand forecasting and supply alignment in a market that’s evolving quickly and unpredictably.

Execution Timeline Holds, System Integration Improving

Despite external challenges, AMD is sticking to its annual cadence of GPU releasesMI300, then MI350, followed by MI400. Partners are already co-developing for MI400, indicating confidence in the roadmap and an ecosystem that’s maturing in parallel.

The ZT Systems acquisition also plugs a strategic hole. With ZT, AMD can now offer integrated, rack-level AI systems putting it on more even footing with NVIDIA’s full-stack DGX approach. This is a critical step toward competing not just at the chip level, but at the system level, which is where a lot of AI infrastructure decisions are made.

ROCm Software Gains Momentum, Reducing CUDA Dependency Risk

On the software front, AMD is picking up speed. ROCm, its open-source software stack for AI, is now updated every two weeks and supports more than 2 million models on Hugging Face. That includes major names like Meta’s LLaMA 4, DeepSeek R1, and Google’s Gemma 3 all with Day-0 support.

This is crucial. The biggest historical knock against AMD in AI has been lackluster software and weak developer tooling compared to NVIDIA’s CUDA ecosystem. Rapid ROCm improvements help reduce that moat and validate AMD’s broader strategy of catching up not just in silicon, but across the stack.

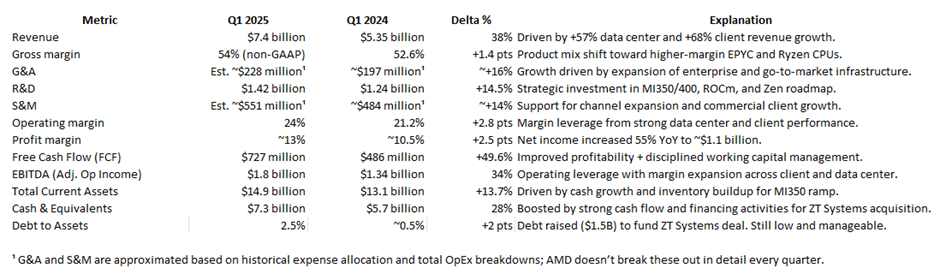

Financials Support Flexibility and Long-Term Investment

Financially, AMD is in a solid spot. Net income rose 55% year-over-year, free cash flow reached $727 million, and the company secured $2.45 billion in capital through a debt raise and commercial paper giving it the flexibility to fund the ZT acquisition and invest in R&D without compromising its balance sheet.

At the same time, AMD returned $749 million to shareholders via buybacks, showing it can both invest in growth and reward investors. That level of capital agility is key as it scales up in a capital-intensive AI arms race.

Source: Author’s summary

Valuation Gap Still Wide: An Underrated AI Play?

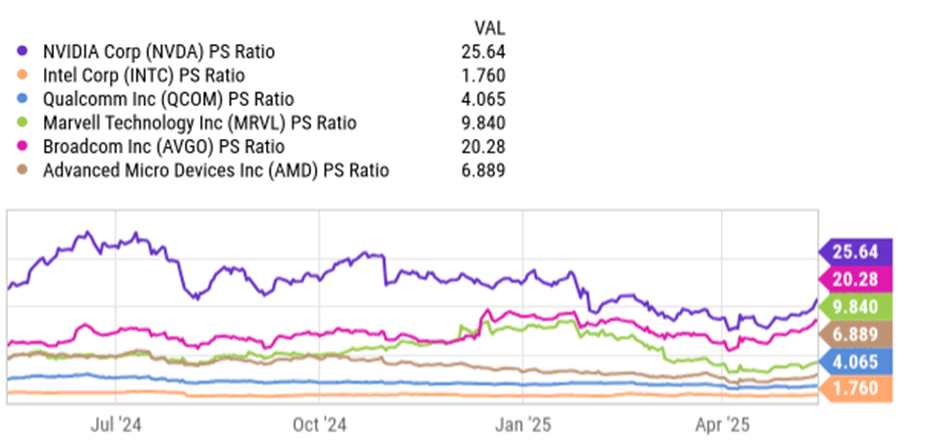

Even after recent gains, AMD still trades at a steep discount to Nvidia, hovering in the mid-teens on a price-to-sales basis, compared to Nvidia’s 30x multiple. If AMD executes well on MI350 and MI400, this valuation gap could begin to close. That re-rating potential is a central part of the investment thesis and remains intact.

When comparing AMD’s valuation, it helps to think beyond just its CPU or GPU business. The company now spans everything from AI acceleration and data center compute to client PCs and embedded systems. So, any meaningful peer set should reflect that full range, even if the comps don’t line up perfectly in terms of business model.

Here’s a more focused group of names that makes for a solid valuation check:

NVIDIA (NVDA): The obvious benchmark for anything AI. Their lead in GPUs and accelerator hardware gives a sense of what the high end of the valuation spectrum looks like.

Intel (INTC): AMD’s historical peer in x86 CPUs and servers. Still relevant as a reference point, especially when looking at margins, scale, and where AMD has pulled ahead.

Qualcomm (QCOM): Not a direct comp on the data center side, but useful for looking at mobile, edge AI, and NPUs, particularly in the context of AI PCs, where both are active.

Marvell (MRVL): More of a niche player, but they’ve leaned heavily into hyperscaler infrastructure and networking silicon, which overlaps with parts of AMD’s strategy.

Broadcom (AVGO): A good read-through on what a diversified, high-margin semiconductor business can look like, especially one that touches AI and infrastructure.

This group gives a more grounded view of where AMD stands between legacy compute and next-gen AI, while also highlighting the valuation gap between AMD and the current AI market leader.

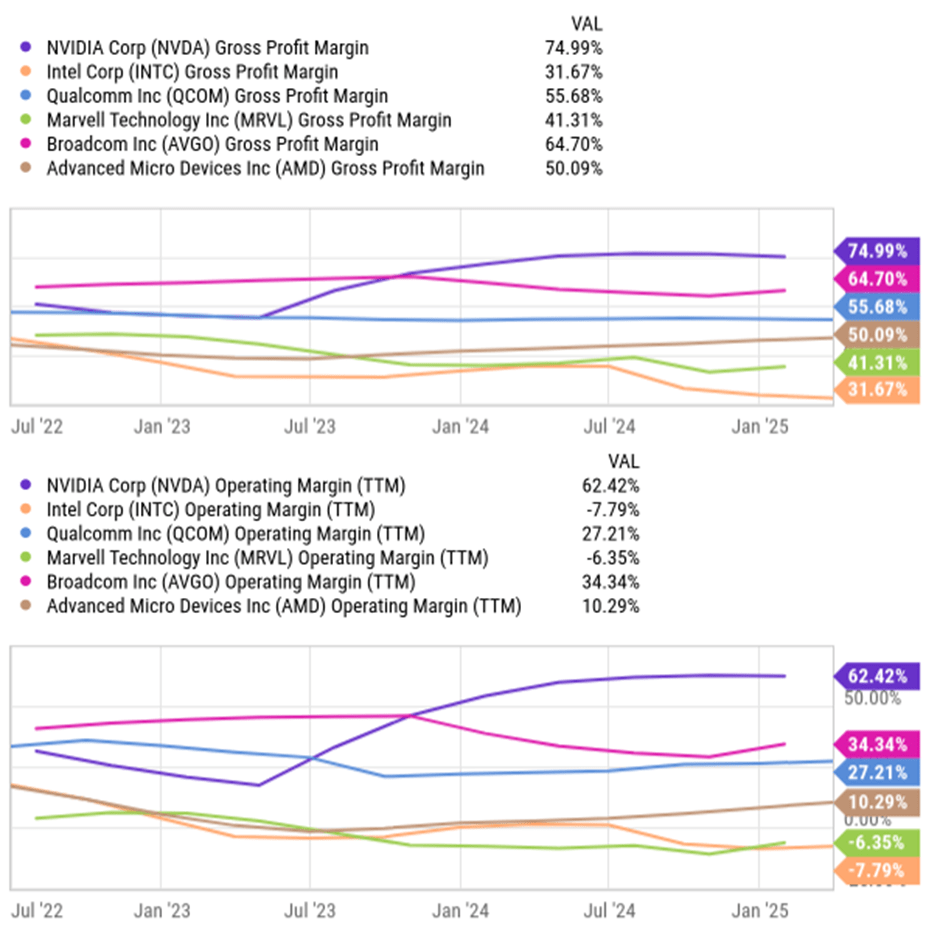

(Source: YCharts)

When it comes to margins, AMD sits in the middle of the pack, profitable and improving, but still far behind the category leaders. Gross margin has climbed to 50.1%, a strong step up over the past two years, though it remains well below Nvidia’s 75% and Broadcom’s 65%. That said, AMD is ahead of Intel (31.7%) and Marvell (41.3%), and only trails Qualcomm slightly (55.7%), suggesting a trajectory toward the higher end if mix shifts continue.

On operating margin, the gap is wider. AMD’s trailing twelve-month figure sits at 10.3%, materially below NVIDIA’s 62.4%, Broadcom’s 34.3%, and Qualcomm’s 27.2%. While it does outperform Intel and Marvell, both of which are currently operating in the red, this reflects AMD’s earlier stage in scaling AI-related revenue. There’s meaningful room for expansion here if its data center GPU and premium CPU businesses ramp as expected.

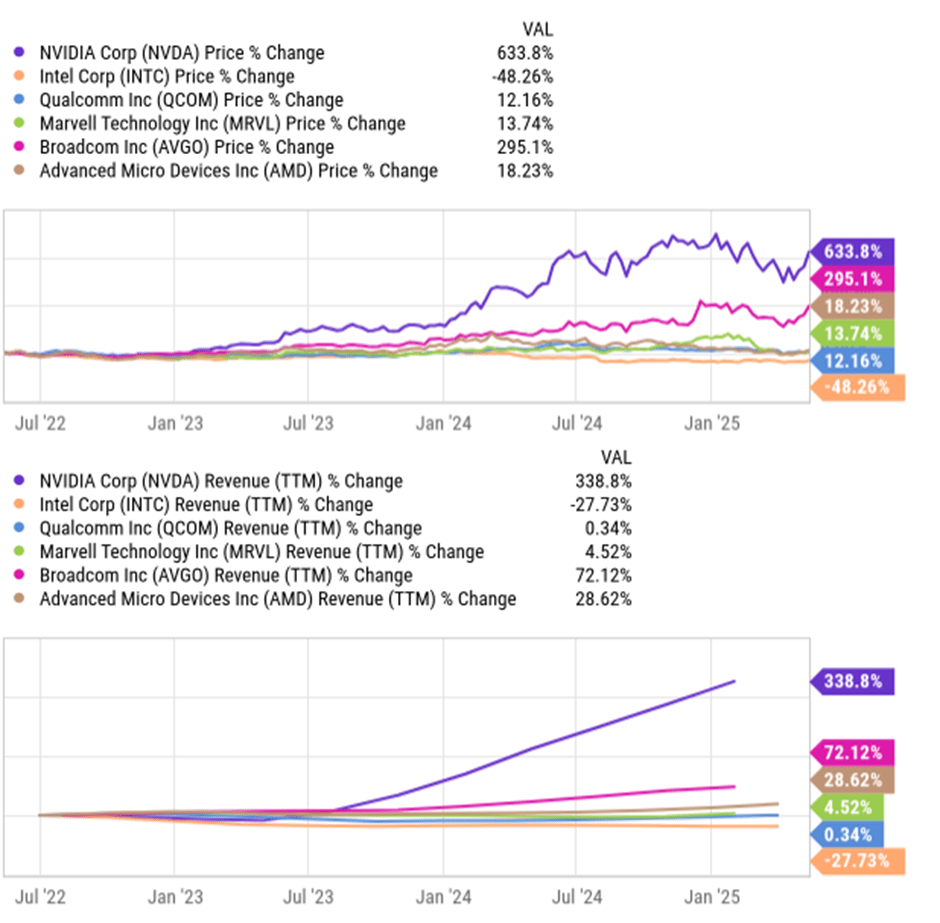

(Source: YCharts)

Revenue growth tells a similar story. Since mid-2022, AMD’s top line has grown by 28.6% healthy but modest compared to Nvidia’s explosive 338.8% surge, which was driven by runaway demand for AI GPUs. Broadcom also posted strong growth at 72.1%, buoyed by exposure to networking, cloud, and infrastructure build-outs. Other peers, including Intel, Marvell, and Qualcomm, have seen flat or negative revenue trends over the same period.

The real disconnect, however, lies in equity performance. AMD shares are up just 18.2% over that stretchdespite solid execution and growing data center traction. By contrast, Nvidia has rallied over 630%, and Broadcom is up nearly 300%, as investors piled into names perceived to be pure AI plays. The market clearly hasn’t rewarded AMD in the same way, likely due to a few key factors: thinner historical margins and lingering skepticism around its ROCm software stack compared to NVIDIA’s CUDA ecosystem.

That disconnect may be where the opportunity lies. AMD is very much in transition, not at peak. Margins are improving, revenue is accelerating, and the company is gaining product credibility across its AI GPU, EPYC CPU, and Ryzen AI lines. Yet the stock still trades like a legacy semiconductor name, not a platform that could scale with AI infrastructure.

Structurally, AMD has a lot going for it. MI300 began ramping in late 2023, and the upcoming MI350 and MI400 launches in 2025 and 2026 could help close the valuation gap with Nvidia if the company executes. Right now, Nvidia deserves the premium, with superior margins, software moats, and vertical integration. But if AMD delivers on its roadmap and deepens traction with customers like Oracle and Meta, that spread could narrow quickly.

Source: YCharts

Bottom line: AMD isn’t priced like an AI leader but it may be building into one. It’s showing improving leverage, a credible path to gross margin expansion, and access to growing AI budgets. The market’s caution feels rooted in timing and sentiment, not fundamentals. If execution stays on track, especially in the back half of 2025, this could be one of the more underappreciated AI infrastructure stories in the space.

Disclaimer: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Leave a comment