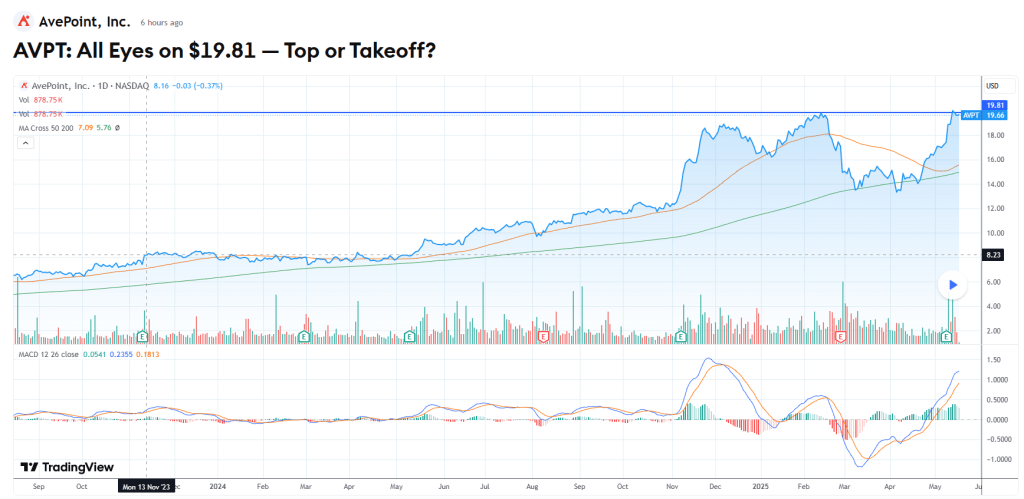

AvePoint is nearing all time highs and that has caught my attention. If it breaks the $20 line, we might be facing a breakout on the stock. However, it is important to consider the fundamentals around this less known name.

What AvePoint Actually Does

Look, if your company runs on Microsoft 365, Google Workspace, or Salesforce—and whose doesn’t these days—you’re probably dealing with a growing mess of files, permissions, and compliance headaches. AvePoint makes tools to help clean that up. Not in a flashy, magic-button way. They just give IT teams the stuff they need to get control of cloud data before things break—or worse, before auditors show up.

Their main offering is called the Confidence Platform. It’s less of a single product and more of a toolkit. You get backups, access controls, migration tools, policy enforcement—you know, all the “unsexy but critical” stuff that keeps systems running and data protected. It works across a bunch of platforms: Microsoft, Salesforce, AWS, Dropbox, Box, etc. You don’t have to rip and replace your stack—just plug it in and start fixing what’s broken.

What the Platform Actually Covers

The product lineup is grouped into three broad buckets. First, there’s governance—which is really just about knowing who has access to what and making sure you’re not accidentally violating five different data privacy laws. Then there’s protection and recovery: backups, ransomware response, disaster recovery, that kind of thing. If someone deletes a file they shouldn’t have, or a system goes down, you’re covered.

The last piece is modernization, and this is where things get interesting. A lot of companies are still sitting on ancient file servers or half-migrated cloud setups. AvePoint helps move that data, clean it up, and get it ready for modern workloads—especially if you’re trying to do something AI-related down the line.

Sure, compliance is a big driver—especially in finance, government, and healthcare. But honestly, a lot of teams just need help cleaning up after years of bad habits: oversharing folders, duplicate files everywhere, zero visibility into who has access. AvePoint gives them a reset button.

It’s also popular with orgs prepping for AI or analytics work. If your data is a mess, AI’s going to give you garbage. Cleaning things up first is non-negotiable. They’ve got a huge customer base—25,000+ orgs in 100+ countries—and Microsoft seems to love them (they’ve won Partner of the Year more than once).

How They Make Money

Most of the revenue comes from good old SaaS subscriptions. You pay per user, usually annually, and maybe extra if you’re using a ton of storage or doing a complex migration. This part of the business made up 74% of revenue last quarter, and it’s growing fast. Gross margins? Around 75%, which is solid.

They still offer traditional licenses for companies that need it—think big banks, global orgs with strict internal infrastructure, that kind of thing. And they also do some services work (less than 12% of revenue), mostly to help get deployments running smoothly.

One of the smart plays here is how much business AvePoint runs through partners—MSPs, resellers, integrators. Over half their ARR comes this way. That’s huge for scaling, especially in the SMB space where direct sales don’t really make sense.

Smaller customers (under 500 users) go entirely through the channel. Mid-size (500 to 5,000) are a mix. Large enterprises (5,000+ users) are handled directly—and they’re the biggest piece of the pie right now, at about 53% of ARR.

Q1 2025: The Numbers

Here’s how they’re doing:

ARR hit $345.5M, up 26% YoY

Net new ARR was $18.5M (that’s a 57% increase YoY)

Gross margin came in at 75%

Non-GAAP operating margin: 14.4%

Recurring revenue mix: 88% — highest it’s ever been

They’re not burning cash to grow, and the recurring part keeps climbing, which is exactly what you want to see from a SaaS company at this stage.

Where AvePoint Fits and What’s Next

They’re not trying to be the flashiest name in tech. What they are is reliable—and getting more strategic. They’re solving a boring but massive problem: cloud data sprawl. And they’re doing it in a way that scales across both small teams and global enterprises.

With AI now pushing companies to rethink how they store and structure data, AvePoint’s positioned well. Their tools aren’t built for hype—they’re built to keep data clean, compliant, and recoverable.

They’ve set a long-term goal: $1B in ARR by 2029. It’s not guaranteed, but between channel growth, product expansion, and growing demand for cloud governance, it’s not far-fetched either. They just need to keep shipping—and stay focused.

Leave a comment