Robinhood’s competitive edge—the real moat that makes it hard to disrupt—sits at the intersection of speed, design, engagement, and integration. It’s not just about offering free trades or a sleek mobile app. What sets Robinhood apart is how it’s reimagined the financial services experience from the ground up for a digitally native audience. That rearchitecture isn’t limited to trading—it now spans everything from banking and credit to retirement and crypto—and it’s being scaled rapidly across product lines in a way that traditional institutions struggle to match.

A big part of that advantage comes from Robinhood’s product velocity and unified platform design. In just the past year, the company has rolled out a range of new offerings—futures, prediction markets, a Gold-exclusive credit card, the Legend desktop platform, and integrated retirement accounts—at a pace that outstrips most legacy players by a wide margin. But it’s not just the volume of launches; it’s how tightly everything fits together. Whether a user is trading options, saving for retirement, or buying crypto, it all happens within a single, cohesive app experience.

That level of integration is tough for incumbents to replicate. Robinhood, by contrast, benefits from a modular backend, engineering-led culture, and mobile-first foundation—giving it the agility to ship faster and connect features more seamlessly. That speed, combined with a frictionless user experience, forms a durable moat rooted in both technology and execution. Let’s break it down.

Unlocking Global and Institutional Growth

Robinhood is shaping its future around becoming a full-spectrum, global financial platform that serves both seasoned traders and the next wave of investors. At the heart of this strategy are three major pillars that guide how the company is evolving.

First, Robinhood is zeroing in on becoming the top choice for active traders. They’ve been rolling out features that cater to high-frequency and sophisticated users. One standout is Robinhood Legend, a desktop platform packed with advanced tools like multi-leg options trading, in-depth charting, and live streaming, with futures trading on the way.

They’ve also introduced new asset classes—futures, index options, and prediction markets—that are already showing early momentum, each pulling in around $20 million in annual recurring revenue. And with 24-hour weekday trading now available, Robinhood’s aiming to expand that to 24/7 access across asset classes, something that could be especially attractive for international and crypto-focused users.

The second focus is on capturing more wallet share from the younger, digitally-native crowd. Robinhood wants to be their financial hub, not just their investing app. Robinhood Gold, the company’s premium subscription, has hit 3.3 million members. These users typically deposit more money, hold more assets, and use more of Robinhood’s products. Perks include access to exclusive investing tools, a higher-yield account, and now, a growing financial services arm.

Over 200,000 users already have the new Gold-exclusive credit card, and a digital banking product tied to Gold is slated to launch in Q3 2025. On top of that, Robinhood is making a real push into long-term financial planning. Its retirement products now manage $16 billion in assets, and its new advisory tools are designed to help users build passive, lasting wealth. The idea is simple: the more financial needs Robinhood can meet, the more valuable each user becomes over time.

Finally, the company is laying the groundwork for a truly global financial ecosystem. That includes reaching new geographies and serving more than just individual investors. Two big acquisitions are moving that forward. First is TradePMR, a platform for registered investment advisers, which brings in over $40 billion in assets and paves the way into B2B wealth management.

Then there’s Bitstamp, a crypto exchange with licenses and infrastructure that will give Robinhood instant access to global crypto markets when the deal closes in mid-2025. The international expansion is already underway, starting with a live UK brokerage, and Asian markets are on the horizon.

The Real Revenue Engines Driving Robinhood’s Growth

The segments truly moving the needle for Robinhood—those driving both top-line growth and bottom-line profitability—can be narrowed down to four key business engines. These areas aren’t just growing fast; they’re built for scale, deliver strong margins, and are increasingly central to Robinhood’s operating model and long-term strategy.

Options remain Robinhood’s most lucrative and resilient trading category. In the first quarter of 2025, options volumes reached record highs, contributing to a 50% year-over-year revenue increase. What sets options apart is their high monetization per transaction, generating more revenue than equities or crypto trades. This segment plays a major role in transaction-based revenue, while also driving higher engagement from power users with strong lifetime value.

Net interest income has become a foundational element of Robinhood’s margin profile. Despite a broader trend of rate normalization, Q1 saw continued growth in interest-earning assets. Margin balances doubled year-over-year to $8.4 billion, and sweep cash balances surpassed $20 billion. Robinhood generates NII from margin interest, securities lending, and idle customer cash—revenue streams that come with low funding costs and strong margin contribution.

Robinhood Gold has evolved into a high-margin, cross-selling engine that deepens customer relationships across the board. With 3.3 million subscribers—up roughly 1.5x from the previous year. These users are far more valuable: they deposit four times more money, hold five times more in assets, and are significantly more likely to adopt additional products like retirement accounts and advisory services.

Crypto continues to offer strong top-line momentum and evolving profitability. Robinhood generated $260 million in crypto revenue in Q1 2025—its second-highest quarter ever—despite broader market volatility. The company’s share of retail crypto trading has been steadily growing, but the real step-change will come with the integration of Bitstamp, which is expected to close mid-year. That acquisition brings global regulatory licenses, institutional trading infrastructure, and the potential to internalize order flow—improving unit economics and reducing third-party costs.

Several other areas are showing strong early momentum but haven’t yet reached scale. Futures and index options are each generating around $20 million in annual recurring revenue, with fast user adoption. Retirement accounts, now managing $16 billion in assets, are critical to wallet share but still early in monetization. Robinhood Strategies, the company’s advisory product, has grown to $100 million in assets under management. Meanwhile, prediction markets have crossed one billion contracts traded—an exciting sign of product-market fit, though monetization remains limited for now. These segments are important, but the four core engines above are currently the biggest contributors to Robinhood’s financial performance.

A Look At Valuation

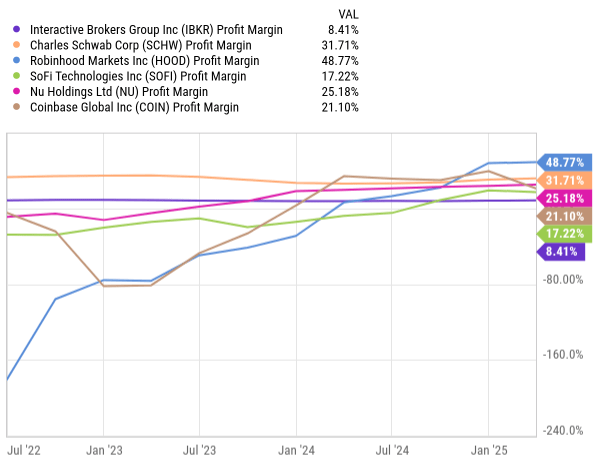

Source: YCharts

Robinhood has now emerged as the most profitable player in its peer group, with a profit margin of 48.77% as of early 2025. That puts it ahead of Schwab, which has long been considered the standard for operating efficiency, and far above fintech names like Nu Holdings (25.18%), Coinbase (21.10%), SoFi (17.22%), and Interactive Brokers (8.41%). What makes this even more notable is that Robinhood isn’t coasting on a mature business. It’s in the middle of expanding into banking, advisory, retirement, and international markets—all capital-intensive moves—yet it’s still outpacing its competitors in margin performance. That says a lot about how lean and scalable the company’s model really is.

So how is Robinhood pulling this off? A few things stand out. First, its entire platform runs on a single, modern tech stack—no legacy systems, no bloated infrastructure. That alone keeps costs down. Then there’s the way Robinhood grows: it doesn’t rely on expensive marketing to bring in users. Product-led growth and strong brand equity keep customer acquisition efficient. And on the revenue side, products like Robinhood Gold, crypto trading, and margin lending generate strong returns without much incremental cost. Looking across the board, the picture holds up.

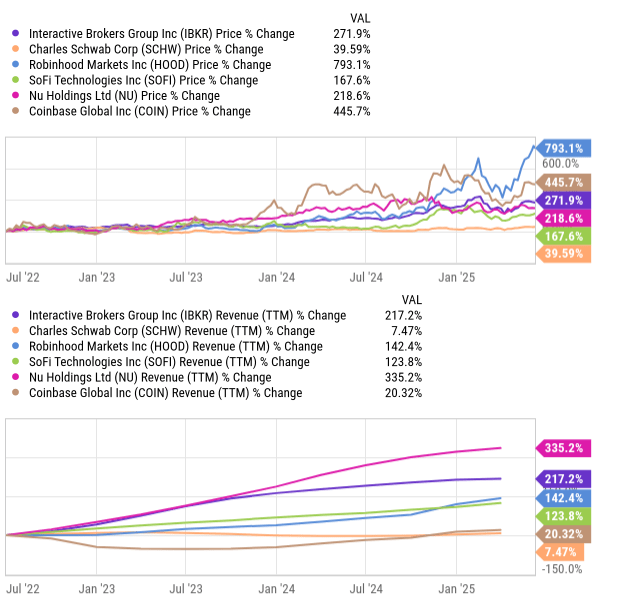

Source: YCharts

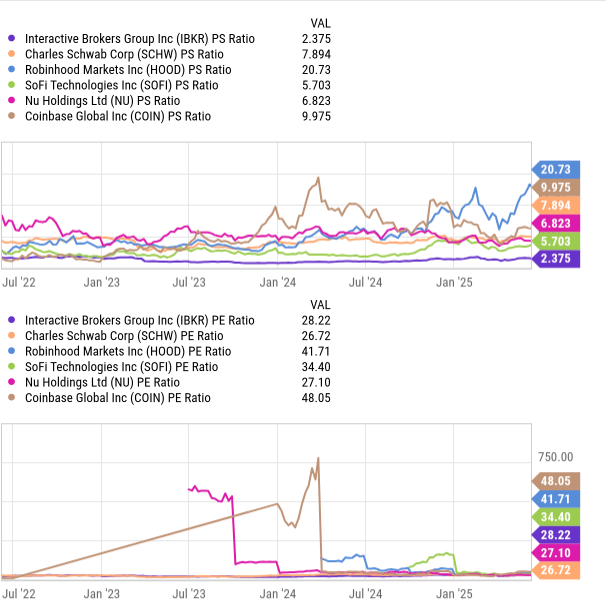

The company leads in stock price gains—up nearly 800%—and sits among the top in revenue growth over the last twelve months. Yes, its valuation multiples are rich (P/S at 20.73×, P/E at 41.71×), but those numbers look a lot more reasonable when you factor in the margins. Robinhood is showing that it doesn’t need Schwab’s scale to outperform—it just needs to keep doing what it’s already doing: building a faster, more integrated, and more efficient version of a financial services company.

Source: YCharts

Wrapping-up

Robinhood’s industry-best profit margins, paired with strong revenue growth and expanding product breadth, reinforce its position as a true fintech compounder. It’s not just disrupting legacy brokerages—it’s out-executing them.

With clear momentum in earnings, efficient scaling, and differentiated platform economics, Robinhood now deserves to trade at a premium multiple, as long as growth and cross-sell continue to hold, therefore, I am rating it a Buy.

Disclaimer: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Leave a comment