BigBear.ai (BBAI) has carved out a spot in one of the toughest corners of the tech world—national security AI. It’s not just dabbling; its work spans DHS contracts, airport facial recognition systems, AI for shipbuilding, and decision-support platforms for the DoD. That’s a serious portfolio in areas that are absolutely mission-critical. The key here? This is a niche most pure tech players can’t even touch.

Government work like this demands trust built over years, security clearances, and a track record of performing in high-stakes environments. With global tensions on the rise and supply chains getting reworked, demand for AI-powered solutions in defense and infrastructure is heating up fast. A case in point: BigBear.ai’s $13.2 million contract to deliver a force management platform for the DoD—a clear sign the Pentagon believes they can deliver at scale.

Then there’s the company’s backlog, which has jumped from $168 million to $385 million in just a year. That’s 2.5x growth and more than just a nice headline. It signals they’re landing bigger, longer-term deals rather than relying on small one-offs. This shift matters because it gives the company stronger revenue visibility—something investors in defense tech love as the chart tells.

The stock’s recent breakout isn’t random either. Multiple catalysts are lining up: the backlog surge proves customer confidence and a healthy pipeline; wins with the DoD and DHS boost credibility where it counts most; and geopolitical instability is fueling investor excitement around defense-focused AI. The price action matches what Trefis laid out: the run-up to $10 early in 2025 came on AI hype and contracts, the dip to $5 mirrored broader market nerves, and now the renewed surge is being powered by defense AI momentum and that growing backlog.

What Will Drive BigBear.ai’s Revenues?

BigBear.ai‘s revenue engine really boils down to two buckets: core markets where they’re already entrenched, and adjacent areas they’re trying to crack. Their bread and butter right now? Defense and Homeland Security. For the DoD, they’ve secured multiyear contracts—think the Orion Decision Support Platform—and they’re deep in mission-edge AI. That means fusing sensor data, running predictive models, and helping operational teams make calls in real time.

Over at Homeland Security, they’re in airports with tools like veriScan and Trueface, powering digital identity systems and AI-driven threat detection. LAX, DFW—you’ll find their systems there already. Critical infrastructure is another piece. With Austal USA, they’re bringing AI into shipbuilding and trying to modernize complex supply chains. The big question? Can they turn those pilots and contracts into large, recurring programs. Their $385M backlog (2.5x growth YoY) suggests they might be on the right track.

Then there’s the adjacencies. They’re pushing dual-use tech like veriScan and ConductorOS into commercial sectors—aviation, logistics, manufacturing. It’s a two-way street too: commercial innovations could end up feeding back into their federal playbook.

Their current portfolio is already pulling its weight. veriScan and Trueface handle biometric verification. ConductorOS and Shipyard.ai tackle supply chain modernization. Pangiam automates airport security by flagging prohibited items. And Orion? That’s their defense-focused decision-support system. All of these have “platform” potential—think SaaS or licensing models—but right now, much of the revenue is still coming from services and custom integrations.

Can the Business Model Scale?

Here’s where it gets trickier. On the plus side, BigBear’s pivoting away from services to become a solutions integrator with IP-backed platforms. If they pull that off, it opens doors for steady, recurring revenues—long-term government contracts, subscriptions, licensing. As products like veriScan and ConductorOS mature, deployments should get easier, require less customization, and deliver better margins. Partnerships (like Smiths Detection) could help them scale globally without having to build sales teams and infrastructure everywhere.

But the headwinds are real. A big slice of their revenue still relies on professional services. Scaling that model means more people, more overhead—not great for margins. Federal contract cycles are also lumpy, which creates volatile cash flows and makes linear growth hard to nail down. And while their platforms show promise, many are still in that awkward R&D-to-revenue stage.

Margin Expansion: Is It Coming?

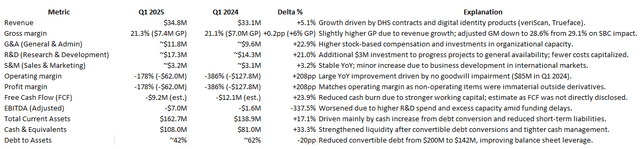

Right now, margins are tight. In Q1 2025, gross margin was 21.3%. Adjusted gross margin (ex-stock comp) was 28.6%. Adjusted EBITDA? Still negative at -20%. The drag comes from high R&D spending, stock-based comp, and government funding delays that left teams underutilized.

For margins to improve, they’ll need to convert that $385M backlog into steady cash flows. Scaling platforms like veriScan and ConductorOS with minimal tweaking is key. Shifting the revenue mix toward software and IP will also help.

If they can thread this needle, the business could look very different. What’s now a services-heavy, low-margin model could evolve into something anchored in SaaS and licensing, with gross margins in the 40–50% range and real platform scale.

Financials

BigBear.ai‘s revenue grew 5% year over year. It’s not exactly a blowout number, but given the tough backdrop, it’s still a positive step. DHS contracts and sales of their digital identity products were the main drivers here, showing some traction in key segments.

The bigger headline, though, is the backlog. That jumped to $385 million, giving the company clearer revenue visibility going into future quarters—a rare comfort in this space.

On the balance sheet side, there are signs of progress too. Cash climbed to $108 million, that boost gives them more flexibility to navigate what’s still a challenging phase. They’ve also chipped away at debt, with convertible notes dropping from $200 million to $142 million, largely thanks to equity conversions.

That said, the path to profitability remains rocky. Adjusted EBITDA fell further into the red, landing at -$7 million versus -$1.6 million a year ago. Two things drove that decline: an extra $3 million in R&D spend and delays in government funding, which left parts of the team underutilized.

Margins are still soft as well. Adjusted gross margin ticked down slightly to 28.6%, compared to 29.1% last year. And while net losses narrowed to $62 million from $127.8 million, most of that improvement came from the absence of last year’s goodwill write-down—not because of any real operational turnaround.

So, where does that leave them? BigBear.ai is showing some early signs of stabilization. The growing backlog and stronger balance sheet buy them a bit of runway to execute. But the core challenge hasn’t changed: they need to scale their platforms and start converting backlog into recurring, high-margin revenues. Until that happens, the story here is still more about potential than performance.

Valuation

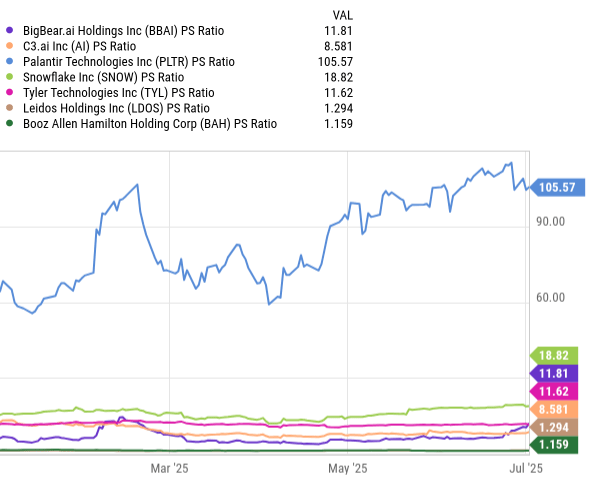

Here’s how I’d think about building a peer set for valuing BigBear.ai—and why each group matters. The first bucket includes players that, like BigBear.ai, are focused on delivering AI/ML-driven solutions for defense, national security, and critical infrastructure. Palantir (PLTR) stands out as the dominant mission-driven AI integrator in this space. Then there’s C3.ai (AI), a smaller peer leaning into enterprise and defense AI applications but with a higher SaaS revenue mix.

The second group pulls in companies building scalable platforms for both government and commercial clients. Snowflake (SNOW), while it’s not defense-first, its data platform has secured some federal contracts, showing how commercial-first firms can pivot into the public sector. Tyler Technologies (TYL) is a good proxy for understanding recurring revenue dynamics in public-sector software. This group is less about direct competition and more about understanding how dual-use, platform-heavy business models are valued when they successfully straddle federal and private markets.

Finally, it’s worth looking at traditional government contractors—not because they’re direct comps, but because they give us a floor for valuation multiples. Leidos (LDOS) is a major federal contractor. It’s lower growth but has massive contract scale and steady cash flow. Booz Allen Hamilton (BAH) offers another reference point.

BigBear.ai‘s current P/S ratio—about 11.8x—really jumps out when you line it up against peers. It’s almost identical to Tyler Technologies, which trades around 11.6x, and noticeably higher than C3.ai at 8.6x, even though C3 operates at a much larger scale. The difference is even starker when compared to traditional federal contractors like Leidos and Booz Allen, where P/S multiples hover closer to 1.2x.

Of course, there’s Palantir at the other extreme. Its P/S ratio of 105x almost doesn’t belong in the same conversation. That multiple reflects a huge momentum premium and investor hype—less a comp and more an outlier that skews the entire peer group.

When you stack it up against C3.ai, which trades at 8.6x, the contrast is sharp. C3 has a similar risk profile but operates at a larger scale. Tyler Tech, at 11.6x, earns its premium with high SaaS margins and a mature base of recurring revenue—two things BigBear doesn’t yet have. Right now, BigBear’s multiple looks more like a bet on what could be, rather than what’s already been achieved operationally.

Risks to thesis

There are some clear reasons to stay cautious with BigBear.ai right now. For one, execution hasn’t inspired confidence. Revenue has barely moved over the last three years—roughly 1% CAGR—and Q1 2025 didn’t help, with adjusted EBITDA swinging deeper into the red at -$7M, down from -$1.6M a year ago. A lot of that comes back to their dependence on federal contracts. Procurement cycles are long and often unpredictable, and funding delays can leave staff and resources sitting idle.

Valuation is another red flag. At ~11.8x P/S, BigBear trades at a premium you don’t often see outside high-growth SaaS. It’s even higher than C3.ai‘s 8.6x, despite C3 having more scale and a stronger SaaS revenue mix. Compared to legacy government players like Leidos or Booz Allen, which trade around 1–2x, the gap is massive. That kind of multiple assumes BigBear is about to flip a switch and start growing fast while expanding margins—but so far, the numbers don’t back it up.

And revenue consistency? It’s not there yet. The company’s top line still depends heavily on when contracts get awarded, leading to lumpy quarters. Free cash flow is negative, too. If they can’t convert that $385M backlog quickly enough, liquidity could start to feel tight.

Then there’s competition. They’re up against Palantir and Anduril, both of which are far larger, with more resources and stronger government relationships. BigBear will have to fight hard to carve out a niche in a field already dominated by these heavyweights.

In short, while there’s a story here about potential, the fundamentals are still shaky. Flat growth, widening losses, and an expensive multiple make this more of a high-risk bet than a proven business.

Conclusion

In my opinion, the main catalyst for BigBear.ai was the backlog jumping sharply, reaching $385 million—a 2.5x increase year over year. Behind the surge are multi-year program wins, which signal growing customer trust in their ability to deliver at scale. It’s also an important shift for the business model. Instead of relying on lumpy, transactional project work, BigBear is now better positioned to transition toward steadier, annuity-like revenue streams that provide more visibility and predictability over time.

Here, I get mixed feelings. On the one hand, it seems like we might be getting ahead of ourselves. The company still needs to show more. On the other hand, the robust backlog increase gives us a strong early indicator.

The stock seems poised to test the previous all-time high at $10, especially if it keeps getting perceived as a baby Palantir, but the downside is the stock coming back to the recent channel between $2.5 and $4. Given the untested nature of the company, I am remaining on the sidelines with a hold rating.

Disclaimer: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Leave a comment