ProKidney Corp just caught my attention with a massive green day. This action is backed by clinical results that the market took with huge enthusiasm. Let’s take a deep dive on the price action.

Technical read

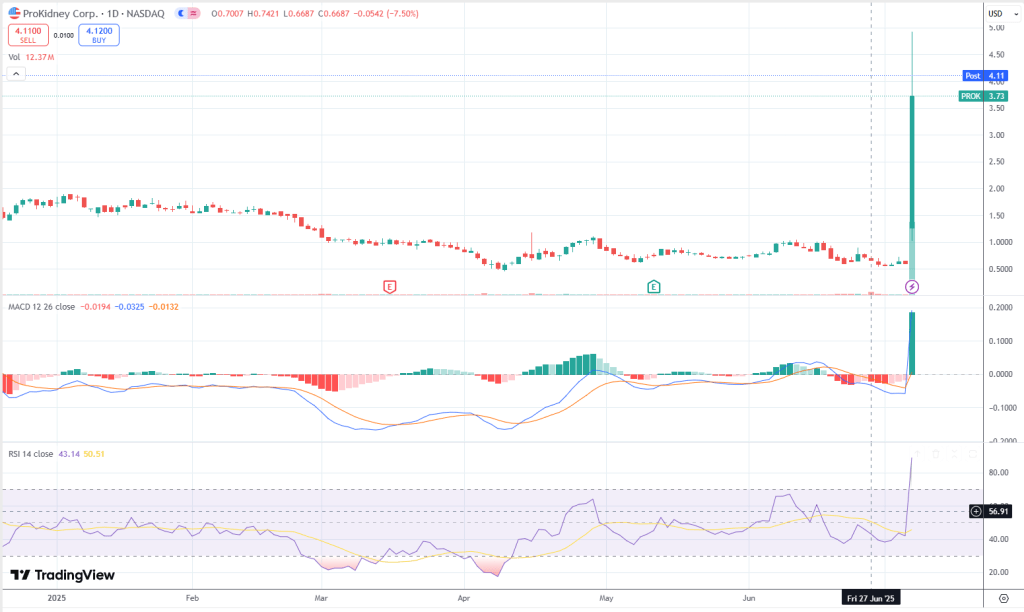

The latest price action shows a massive Marubozu candle—no upper or lower wicks, just pure emotional buying and complete dominance by the bulls. Coming off yesterday’s gap-up bullish engulfing pattern off a low base, the two candles together mark a powerful reversal and the ignition of a new trend. This isn’t just short covering—it’s fresh participation stepping in. In short, this looks like a momentum breakout from a base, not an exhaustion move. Buyers are moving in with real conviction.

The trend health is undeniable when viewed through a momentum lens. Price has surged from around $0.70 to nearly $5 in just two sessions, a parabolic move by any standard. The MACD flipped bullish and is accelerating sharply, while RSI has spiked from the 40s to nearly 80 in a single candle—textbook signs of an emotional momentum shift. From our perspective, the strongest trends often launch from low bases like this. As long as price holds above today’s open near $1.50, there’s room for this move to expand further.

Structurally, the chart shows a clean box between $0.50 and $0.90 that’s been broken decisively. Price is now entering discovery mode, with no historical resistance overhead. Volume tells the story too—12 million shares traded today on what’s otherwise a small float. This isn’t retail frenzy; it looks and feels like institutional-sized accumulation driving the breakout.

Fibonacci levels offer a map for potential pullbacks and extensions. A retracement into the 23.6% to 38.2% zone ($4.00–$3.61) would be constructive and could form a bull flag. A deeper pullback to the 50% level near $3.06 would raise the risk of a failed breakout. On the upside, a clean move through $4.92—the session high—would send price into uncharted territory, with Fibonacci extensions pointing to $6.03, $7.53, and even $9.17 as possible targets if momentum persists.

The Catalyst

For traders, the playbook from here is clear. Momentum players can watch for micro-flags or bull pennants forming above $3.50 as potential re-entry points. Swing traders might prefer to wait for one or two quieter red days with lighter volume, ideally pulling back into the $3.00–$3.50 zone, which could present a golden setup. For those chasing strength, it’s late to buy breakouts blindly here unless price consolidates intraday to reset.

The company is developing a drug, Rilparencel, that works by leveraging the patient’s own kidney tissue to trigger regeneration. The process begins with a biopsy of the patient’s kidney, from which ProKidney isolates and expands a proprietary mix of renal progenitor cells—early-stage kidney cells with the capacity to repair damaged tissue. These cells are then re-injected percutaneously into both kidneys, with one injection per kidney typically spaced about three months apart. Once delivered, the progenitor cells migrate to damaged areas of the kidney, where they stimulate the repair and regeneration of nephrons, the filtering units critical to kidney function. They also help reduce fibrosis and scarring, which are key drivers of chronic kidney disease (CKD) progression. The ultimate goal is to stabilize or even improve the eGFR slope, effectively slowing or halting the decline in kidney function. In essence, Rilparencel gives the kidney its own repair toolkit back.

What makes this significant is the current treatment landscape for CKD offers little beyond slowing decline. Standard therapies like ACE inhibitors or SGLT2 inhibitors can delay progression but do not restore function. Rilparencel, by contrast, aims to preserve or recover lost function, potentially delaying or avoiding dialysis or transplant altogether. Results from Phase 2 (REGEN-007) were compelling: patients in Group 1 saw a 78% slower decline in eGFR slope (from –5.8 to –1.3 mL/min/1.73m²), with a p-value under 0.001, and no serious adverse events reported.

The therapy also holds a unique position in the space. It has received RMAT designation from the FDA, fast-tracking it as a regenerative medicine treatment. Because it uses autologous cells, there is no risk of rejection or need for immunosuppression. And it specifically targets advanced CKD (Stages 3b and 4), a population with few options and enormous unmet need. In simple terms, Rilparencel gives patients with progressive CKD a shot at slowing, stopping, or even reversing kidney damage—using their own cells as the catalyst for repair.

The Warning

The market’s reaction comes down to a meaningful shift in perceived risk. The Phase 2 data sharply de-risked the upcoming Phase 3 program, with Group 1 showing a 78% improvement in eGFR slope (–5.8 to –1.3 mL/min/1.73m²) and a highly significant p-value below 0.001. Adding to that momentum, the FDA confirmed in Q4 2024 that accelerated approval is on the table if Phase 3 replicates these results. For investors, this changes the timeline from a distant, uncertain payoff to a clearer path: if all goes as planned, Rilparencel could see a commercial launch as early as late 2027 or early 2028—roughly two to three years from now.

Now, between the present moment and the moment the drug gets to bring revenues in, the market is certain to be optimistic for a while, then it becomes depressed, and finally it forgets the company exists. I have seen that happen time and again in this sector. For investors/traders chasing a thrill or a quick buck this is a good vehicle for those trying to sleep well this is likely a bad fit. That said, I remain on the sidelines on this one with a Hold rating.

Leave a comment