The rally in Opendoor (OPEN) comes on the heels of a long, grinding decline, and that backdrop really changes how this move should be viewed. After extended downtrends, sharp upside moves aren’t unusual—they can be either classic “dead-cat bounces” or the start of real trend reversals.

Over the last 3–5 sessions, we’ve seen large white Marubozu candles that signal heavy momentum, but the latest bar is starting to print upper wicks. That’s often the first hint that sellers are stepping in as price pushes higher. On the positive side, both volume and price action look constructive, yet this is also the zone where exhaustion rallies tend to show up.

Previously, the stock was boxed in a range between $0.40 and $1.00, which it has now cleared decisively. Price is currently testing the $2.50 area—a psychologically important round number and, more importantly, a prior supply zone from the April–May 2023 breakdown. A clean daily close above $2.50 with rising volume would go a long way toward clearing overhead resistance and opening the door for higher levels. But if price stalls here or we start to see heavy wicking into $2.50, it could signal a bull trap and a possible fade lower.

Let’s now see what is changing in the underlying business of the company that can justify breaking the $2.49 level and keep going higher.

Four Core Investment Theses for Opendoor (OPEN)

Opendoor has shifted gears in a big way. After years of chasing “growth at all costs,” it’s now running a much leaner, smarter operation. Instead of paying top dollar—or even above-market prices—for homes in hopes of riding appreciation, the company is buying properties at roughly a 10% discount and aiming to flip them faster. It’s also learning to play by more traditional real estate rules, like pricing with seasonal trends in mind, working with agents to build trust, and even staging homes to boost buyer appeal. On the marketing front, there’s been a clear pivot from expensive direct-to-consumer campaigns to agent partnerships and referrals—moves that have cut customer acquisition costs substantially. This first thesis relies on management’s ability to keep tightening operations and hitting milestones like EBITDA positivity, which they’ve guided for in Q2 2025.

The second thesis hinges on Opendoor’s huge operating leverage to a housing market rebound. Rising interest rates in 2022–2024 froze transaction volumes and that crushed results. But if mortgage rates ease in 2025–2026 as the Fed pivots (as Trump’s ongoing pressure seem to suggest will happen sooner or later), sales activity could bounce back. Faster resale cycles would lower holding costs, while higher turnover could drive revenue without a big increase in overhead. The company’s infrastructure is already in place—macro tailwinds could finally let it scale the way it was built to.

The third thesis is about optionality. Opendoor isn’t just an iBuyer anymore. Its model now blends flipping homes with earning referral fees from leads that don’t convert. Add in its partnership with Zillow, which acts like a national lead funnel, and you’ve got a business that can monetize more customer interactions than before. If they can execute both models well, Opendoor could evolve into a broader platform for residential transactions rather than staying stuck in the “house flipper” narrative.

Lastly, there’s the deep value angle—and a possible short squeeze catalyst. At a Price-to-Sales ratio near 0.3, OPEN trades at a massive discount to peers like Carvana (~5x) or even Zillow. The market clearly fears continued losses or bankruptcy, yet Opendoor’s $2.36 billion in real estate inventory plus cash exceed its current liabilities, suggesting downside support near liquidation value. On top of that, high short interest and a tight float create the setup for a squeeze, especially with events like the Russell 2000 rebalancing catching attention on retail forums.

How Opendoor Could Turn Its Changes Into Higher Sales and Fatter Margins

Opendoor’s path to growth and profitability depends on whether its revamped strategy can actually drive higher sales and expand margins. The company’s playbook now focuses on three levers to grow revenue.

First, agent partnerships—both with Zillow and local real estate agents—are replacing the old model of costly direct-to-consumer marketing, which used to burn through about $14,000 per home. By working with agents, Opendoor not only lowers customer acquisition costs but also improves seller trust since homeowners are far more likely to listen to a familiar local agent than a faceless tech company. Zillow funnels a steady stream of leads, while agents earn commissions that keep them engaged. This dynamic broadens Opendoor’s reach and improves lead conversion.

Second, the company has found a way to monetize leads that don’t convert. Instead of letting rejected cash offers slip through the cracks, Opendoor now earns referral fees by sending those homeowners to agents. This effectively turns previously wasted leads into incremental revenue without carrying any inventory risk.

Finally, there’s the scale factor. Management has openly said they’re holding back on purchases in today’s weak housing market. But they’ve built the capacity to ramp up when conditions improve, with $559 million in cash earmarked for acquisitions.

On the margin side, the turnaround story is just as critical. Margins were crushed between 2022 and 2024, thanks to overpaying for homes as prices fell, high holding costs from unsold inventory, and ineffective marketing spend. The new strategy directly addresses these pain points. Opendoor is now buying homes at about a 10% discount to fair value and timing purchases to avoid peak-season pricing. This cuts hold times and carrying costs. By shifting to agent-driven lead generation, customer acquisition costs are down sharply. Plus, the referral model adds revenue without tying up capital in inventory. On top of that, aggressive cost cuts—including layoffs of 300 employees in Q4 2024 and another 110 in Q1 2025—are saving roughly $20 million per quarter.

If housing activity picks up, the model’s operating leverage should become obvious. With fixed costs spread over more transactions, margins have room to expand.

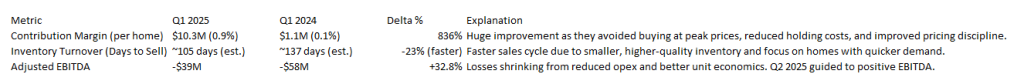

Two key metrics will show whether Opendoor is delivering. Contribution margin—gross profit minus direct selling, holding, and interest costs per home—will indicate how profitable each sale is before overhead. This metric, which was historically negative when Opendoor overpaid for inventory and prices dropped, should trend positive if they buy deeper discounts, cut hold times, and lower carrying costs.

The second is inventory turnover, measured as days to sell. Long hold times during 2022–2024 chewed up margins because of rising interest expenses and price depreciation. Faster turnover means less capital tied up, reduced price risk, and lower holding costs. Opendoor’s new seasonal strategy—buying in Winter/Spring and selling into stronger Summer demand—should help here.

A third, broader metric is total adjusted EBITDA. While less granular, this will capture overall margin trends across operations. Management has guided to $5–20 million in EBITDA profit for Q2 2025—its first positive print in years. Sustained improvement here would be strong evidence that margins are heading in the right direction.

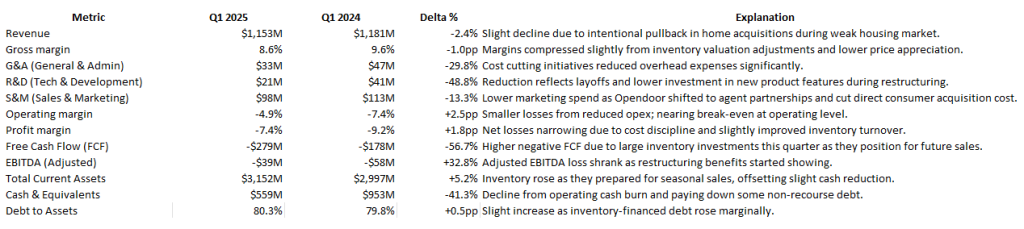

So what does success look like? Over the next three to four quarters, the focus will be on these targets: contribution margin turning positive on a per-home basis, inventory turnover improving from today’s estimated 90–120 days to 60–90 days, and adjusted EBITDA not just positive but scaling with sales. If Opendoor can hit these milestones, it won’t just prove the turnaround—it will start to look like a very different business. At the moment it stands like this:

Wrapping-up

The run-up in the stock price has been nothing short of incredible, especially for the public just looking at the surface. Without prior research, one is inclined to think this is just a dead cat bounce on a troubled company. But, a more focused look reveals a troubled company giving signs of recovery. The underlying business is recovering and the macro is about to turn favorable. This might be one of those cases where the stock climbs the wall of worries.

Disclaimer: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Leave a comment