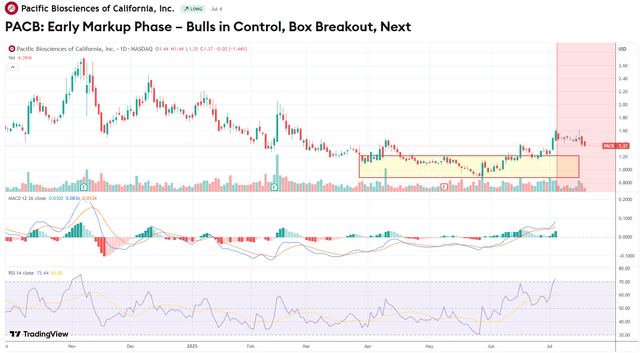

I have written about Pacific Biosciences (PACB) multiple times before. In my last analysis, I stated that the convertible debt the company issued would likely drag the stock. However, now that the company has broken through the $1 level that avoids Nasdaq delisting

for now, we can focus on what might be ahead: near near-term path to cash-flow breakeven.

PacBio is known for its long-read devices and for a long history of attempting to scale a business out of that technology. However, its biggest revenue driver these days isn’t even their systems—it’s the razor blades, I’m talking reagents, SMRT Cells, kits… basically consumables. In Q1 2025, they made around $20.1M from consumables alone, or about 26% more than last year and a record quarter for that segment. Those consumables now account for over half their revenue, 54%, up from 41% a year ago.

So why focus on this? Once a lab has a Revio, they’re pretty much locked into ordering consumables. You literally can’t run experiments without them. And here’s the thing—those consumables have way better margins than the hardware. So even if instrument sales slow, consumables will keep flowing. I believe that a shift in the company’s investment case will come from investors switching focus from devices to consumables.

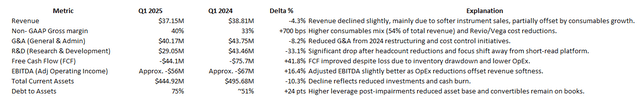

Margin Expansion and Cash-burn

So PacBio’s still burning cash, but they’re chipping away at it on a few fronts. Consumables pulled in about $20M in Q1 2025—that’s 26% more than last year. Pretty good. Plus, it was a record quarter for that line.

Vega’s helping too. It’s opening doors with smaller labs, and Revio’s starting to gain ground in rare disease and clinical markets, especially over in EMEA. And don’t forget, their ultra-high throughput platform is still coming—it might start showing up in revenue late 2026 or early 2027.

But here’s the thing—growing revenue isn’t the whole story. Margins matter too. Non-GAAP gross margin hit 40% in Q1 (up from 33% YoY). The goal’s to finish 2025 north of 40% and push further into 2026. Consumables carry higher margins than instruments, and now they’re already 54% of total revenue. So each extra dollar from that line basically drops more straight into cash flow.

Obviously, cost-cutting’s part of it too. Back in April they laid off around 14% of staff—headcount dropped from 575 to ~500. That cut OpEx down to $240M–$250M guidance for 2025, which is about 15–17% lower than last year. They’re saying the full benefit won’t hit until 2026, but cash burn this year should land around $115M (was $187M in 2024). Annualized savings are expected to end up in the $45M–$50M range.

PacBio Investment Theses

PacBio’s consumables revenue could be the single biggest shift in their business model right now. Q1 2025 pulled in $20.1 million from consumables. That’s a 26% bump over last year. More striking? Consumables now make up 54% of total revenue. A year ago it was just 41%. So this isn’t a blip — it’s a major change in how the company makes money.

Here’s why it matters. Once a lab gets a Revio or Vega system installed, switching away from PacBio’s reagents and SMRT Cells isn’t really an option. They’re locked in. Feels more like a subscription model than just selling hardware. And because consumables carry way better margins than instruments, this isn’t just about growth — it’s about steadier, higher-quality revenue.

Margins? Definitely improving. Non-GAAP gross margin hit 40% in Q1, up from 33% a year back. Solid improvement. Why? Mainly a better product mix — more high-margin consumables. Also, Revio’s production costs are down roughly 20% since launch. Vega should follow the same cost curve as it scales from pilot runs to full production. (Management hinted at this already.) Stick to this path and margins? They’ll probably keep trending upward.

And Vega? It’s doing something different here. Launched in Dec 2024. Lower price point. In Q1 2025, they shipped 28 units. Over half of those went to labs totally new to PacBio. Big deal. Shows Vega’s pulling in smaller labs and niche markets — microbial genomics, targeted sequencing — that were priced out before.

What’s more, Vega could be acting like a “starter kit.” These new customers might stick around. Some could eventually trade up to Revio as their needs grow. That’s more long-term revenue flowing back into the system.

Zoom out and you see the trend. PacBio’s moving away from hardware-heavy, lumpy revenue. Heading toward a stickier, recurring model. More consumables. Stronger margins. Wider reach. Still early days, but the setup is getting stronger.

Valuation

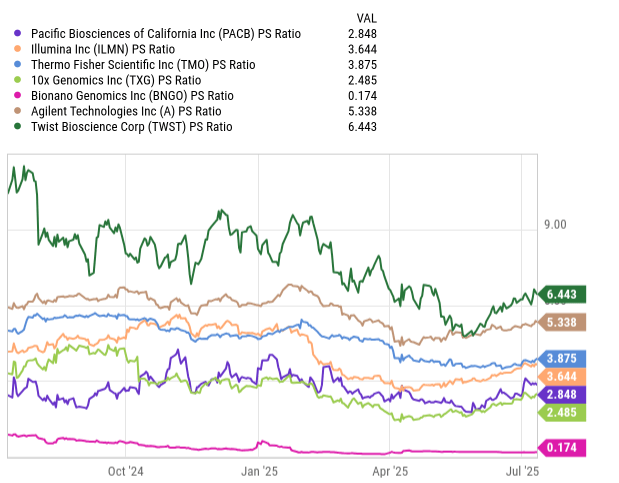

PacBio’s peerset needs to include companies across life science tools, sequencing, and genomics, with a common thread: strong consumables and reagents revenue. Illumina (ILMN) is the heavyweight in short-read NGS and, no surprise, PacBio’s top rival. Thermo Fisher (TMO) plays a broader game, offering instruments and reagents across multiple segments. A big chunk of its sales comes from repeat consumables purchases. Agilent (A) sits at the intersection of genomics and diagnostics. Its model ties hardware sales closely to a steady flow of reagents. Then there’s 10x Genomics (TXG), which focuses on single-cell workflows. That’s more niche, but it complements what PacBio does. Bionano Genomics (BNGO) is also working on genome mapping with an instruments-plus-consumables approach. Finally, Twist Bioscience (TWST) leans into synthetic DNA, also pulling in high recurring revenue from consumables.

On P/S ratios, PacBio’s right in the middle. At 2.85x, it’s cheaper than Illumina (3.64x) or Thermo Fisher (3.88x) but way above Bionano’s bargain-bin 0.17x. It’s also roughly aligned with 10x Genomics (2.49x), another high-growth name still bleeding cash.

Twist (6.44x) and Agilent (5.34x)? They’re playing in another league entirely. Twist’s 6.44x multiple is hard to miss. Investors still seem happy to pay up for synthetic DNA and fast growth expectations—even if profits aren’t in sight. PacBio, meanwhile, looks like a bargain if we consider the chances of hitting free cash flow by late 2027.

Gross margins hit 40% in Q1 2025. Consumables revenue jumped 26% YoY. Both are strong. If Vega/Revio adoption ramps up and system pull-through cracks $300K, this multiple could move higher. But let’s be real. Risks are still on the table—NIH funding issues, China tariffs. FY25 growth sits at ~4%. That won’t get PacBio trading like Twist or Agilent anytime soon.

At 2.85x, it’s a “show-me” stock. Management needs to execute—stronger adoption, higher pull-through, and breakeven by 2027. If they do, there’s room to re-rate toward TXG’s 3–4x or maybe even TWST’s 5–6x over the next 12–24 months.

Risks

PacBio’s path forward isn’t without risks over the next few years. One big question mark is NIH funding. Proposed cuts to U.S. government budgets could squeeze academic labs, a key customer group for PacBio.

Then there’s trade. Losing Chinese instrument sales—or seeing the cost of goods rise from supplier exposure—would be a major setback, and as of now, a major looming risk.

Vega’s off to a solid start—28 units shipped in Q1 2025. But scaling from pilot runs to full production later this year will really test PacBio’s manufacturing muscle. On top of that, Vega needs to convert enough new customers who’ll eventually adopt Revio systems. If Vega adoption slows or margins fall short, overall growth could lose momentum.

Even with cash burn down from ~$187M in 2024 to ~$115M in 2025 guidance, profitability isn’t locked. Breakeven by Q4 2027 isn’t a given. It hinges on revenue growth, getting margins past 40% by late FY25, and keeping a tight lid on OpEx. If any of these slip, the $343.1 million in cash and equivalents will evaporate even more quickly.

And has I stated in my last piece on the stock, the ~$641 million in convertibles might pose a problem if the stock price triggers a delisting from the Nasdaq

Competitive pressure adds to the challenge. Oxford Nanopore is making a hard push into long-read markets with lower pricing and fresh tech. Meanwhile, Illumina holds its ground in short-read sequencing and may lean harder into clinical applications.

Wrapping-up

PacBio’s April 2025 restructuring—cutting operating expenses and trimming headcount by about 14%—is already starting to pay off. For FY2025, the company expects non-GAAP OpEx to land between $240 million and $250 million, a drop of roughly 15–17% year over year. With this, the cash burn is projected to shrink sharply, down to ~$115 million from ~$187 million in 2024.

Looking ahead, PacBio is now aiming to hit free cash flow breakeven by Q4 2027. A big part of this improving picture comes from the consumables flywheel that is gaining momentum. Nevertheless, the stock has failed to break decisively into the $1.7 level, meaning that it is stuck at this resistance, while volume has been fading.

Although there are good early signs of a turnaround in the underlying business, I will need to see the market also share the enthusiasm before committing. If the stock pierces through the $1.7 level with volume, I will be a buyer; until then, I will watch.

Disclaimer: This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Leave a comment