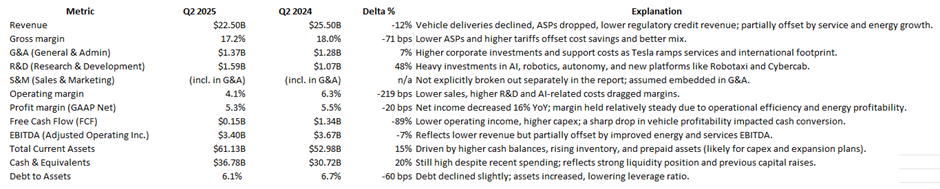

Revenue slid 12% from a year ago to $22.5 billion. Not a surprise, considering the drop in vehicle deliveries and softer selling prices across the board. Gross margin came in at 17.2%—down 71 basis points. There were some cost savings from materials and model mix, but they couldn’t fully counter lower prices and those climbing tariffs.

Operating margin took a bigger hit, down to 4.1% from 6.3%. That’s largely due to weaker sales and a noticeable ramp-up in R&D, especially around AI. But the real gut punch? Free cash flow—down a staggering 89% year-over-year, landing at just $146 million. Higher capex played a major role there.

Cash and equivalents stayed fairly flat at $36.8 billion, dipping only $200 million from the last quarter. Nothing dramatic—just regular investment and financing flow. As for leverage, the debt-to-assets ratio ticked down to 6.1%, helped by a slight debt trim and a bump in total assets.

Impact on Tesla’s Investment Thesis

Tesla’s Q2 2025 results offer a mixed bag. We got fresh momentum in long-term growth bets, especially with Elon back, but also a few red flags that warrant caution in the near term. Together, these updates don’t break the investment thesis, but they do reshape it in meaningful ways.

Starting with the big picture: the core structural growth drivers are still intact. On autonomy, Tesla confirmed it’s rolling out an unsupervised Robotaxi pilot in Austin by mid-2025, with plans to scale later in the year. Most existing vehicles can be upgraded for autonomous use, which means Tesla could expand its addressable market significantly—without having to pour in fresh capex. Progress on AI, fleet learning, and the Dojo training supercomputer all seem to be tracking well. That’s a strong tailwind for the long-term software-as-a-service vision, and it helps justify some of the optionality priced into the stock.

Then there’s Optimus—the humanoid robot project. Still early days, but management says thousands of units could be deployed by year-end. If this pans out, it’s not just a science experiment—it could be a transformative productivity tool. Speculative? Definitely. But the progress and clearer timelines lend more credibility than we’ve seen in past updates.

Energy storage, meanwhile, is already hitting its stride. Megapack deployments grew 60% year-over-year in Q2, and margins are strong. It’s a part of the business that doesn’t get much spotlight but offers real diversification and insulation from the ups and downs of vehicle demand.

Now for the caution flags. Automotive fundamentals are under pressure. Revenue and deliveries declined year-over-year, average selling prices are down, and brand strength is still being questioned. Margins dropped to 17.2% despite cost-cutting efforts—suggesting pricing power is slipping. Free cash flow cratered, down 89% from last year to just $146 million. That’s a steep drop and puts near-term earnings power under strain.

Execution is another concern. Tesla’s new low-cost EV platform is moving slowly. Management is focused on reusing existing manufacturing lines, which may help longer-term efficiency but introduces short-term delays. The new “unboxed” manufacturing process is still in test mode, and likely won’t materially impact margins or production scale until late 2025 or beyond. That’s a real risk, especially in an increasingly price-sensitive EV market where speed matters. On the plus side, Tesla’s financial cushion is still solid.

The Silver Lining from Tesla’s results

Tesla has definitely abandoned its EV company tag, reinventing itself as a real-world AI platform. The core idea here is simple but bold: Tesla owns the full AI stack for real worl applications. It’s designing custom chips, training massive neural networks on real-world data from its fleet, and deploying that intelligence at scale through vehicles, and robots.

The first pillar of that shift is Tesla’s push into custom AI hardware. Its upcoming AI5 chip, targeted for 2025–2026, is internally designed and apparently powerful enough that it may brush up against U.S. export restrictions. The focus is on high intelligence-per-byte—beating out Nvidia’s H100 and Google’s TPUs in compute density. These chips are meant to run everywhere: inside Optimus robots, in vehicles, and at data center scale.

On the training side, Tesla is betting on Dojo. Dojo 2, expected around 2026, is projected to reach the compute equivalent of 100,000 H100s. It’s optimized for vision-based AI training, the kind needed for autonomy, robotics, and simulating complex real-world environments. Tesla is already exploring ways to merge its chip and server architecture across devices—laying the foundation for both internal scale and external offerings. Dojo 3 and the next-gen AI6 chip are already in the concept stage.

Why does that matter? Because it gives Tesla full vertical control over the AI stack. No reliance on Nvidia. No off-the-shelf compromises. And if Dojo becomes viable at scale, Tesla could eventually sell training capacity to other companies—offering “Dojo as a Service” to the growing ecosystem of robotics, autonomy, and edge AI players. That’s a massive unlock in terms of margin profile and business model expansion.

The second pillar is the real-world neural network—trained not in simulation, but on actual roads and factory floors. Tesla’s fleet of 4 million+ vehicles is constantly collecting driving data, creating the largest video dataset of real-world driving behavior in existence. This data trains its FSD network daily, enabling a tight feedback loop between the edge and the cloud. FSD version 12 has already shown major improvements—usage is rising, and Tesla reports a 10x lower accident rate compared to human driving.

Meanwhile, robotaxi deployment has begun in Austin. The Cybercab is designed for full autonomy and aims to bring costs down to around $0.25 per mile—well below Uber or Lyft. The plan to eventually let owners add their personal vehicles to the network, much like an Airbnb or Uber model, could turn idle cars into revenue-generating assets, and Tesla into the platform that powers it all.

Then there’s Optimus, Tesla’s humanoid robot. Version 2.5 prototypes are already working inside factories, and v3 is slated for production in 2026. The robot is designed from scratch, using Tesla’s in-house AI hardware and software. Long-term, the company says it can scale to a million units per year. If that happens, Optimus could create an entirely new labor-as-a-service market—handling repetitive physical tasks at lower cost than human labor. It’s early, but the roadmap is getting clearer.

This brings us to monetization—Tesla’s third major pillar. The $99/month FSD subscription is gaining traction, offering drivers a “personal chauffeur” experience. It’s early days, but only about half of eligible Tesla owners have tried it—meaning there’s a large addressable market even within Tesla’s existing user base. Combine that with the robotaxi platform (where Tesla takes a cut of every mile driven) and Optimus’ potential role in industrial services, and the recurring revenue opportunities start to stack up.

Finally, as Dojo scales, Tesla could offer compute power to outside clients. Think robotics startups, drone companies, industrial automation firms—even governments managing logistics or energy grids. If that happens, Tesla won’t just be building smart cars and robots—it’ll be the cloud infrastructure for anyone working on real-world AI. That’s a competitive lane occupied today by Nvidia, AWS, and Google Cloud. But none of them have the same real-world training data—or the full-stack vertical control—that Tesla is building.

Key Risks

A cautious note is important here, as there are still plenty of risks that could slow Tesla’s AI-driven roadmap. First, scaling up hardware isn’t a given—ramping production of custom chips like AI5 and deploying Dojo 2 at full capacity will test Tesla’s manufacturing muscle. The complexity of the whole task will likely create bottlenecks.

Regulatory hurdles are another wildcard. Even with the Austin robotaxi pilot underway, approvals for broader autonomous deployments will very likely face delays especially in major markets with tougher safety standards. high-profile incident involving autonomous driving could trigger the debate about public trust in the technology.

Then there’s the hardware already on the road. While Tesla says most of its current fleet is upgradeable, getting every HW3 car fully capable of autonomy might require costly retrofits or even full replacements hitting margins and rate of adoption.

Execution risk also looms large. Tesla is attempting to scale vehicles, launch a robotaxi network, mass-produce humanoid robots, and build out a cloud-scale supercomputer, at the same time. That kind of parallel ramp creates will unleash organizational chaos.

Finally there is capital: scaling compute infrastructure and robotics production is expensive. Even with $36.8 billion in cash, the long-term path to profitability depends on keeping unit costs in check and avoiding delays that stretch payback periods. The massive investments from the hyperscalers should be a warning of what might be needed.

Wrapping-up

At this point, this isn’t just an auto story anymore. Tesla’s AI ambitions are now the thesis. And if the pieces come together—chip, data, network, robot, and cloud—it could end up being one of the most valuable AI platforms on the planet. After this earings call it is likely that the price dips, and that’s a good thing.

After this, all the negativity will be baked in the stock price and the following months will allow for a silent repositioning around the stock. In other words, we might just see the stock slowly climbing the wall of worry. That is why at this juncture, I am bullish and will start to add to my positions in the following weeks.

Disclaimer: This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Leave a comment