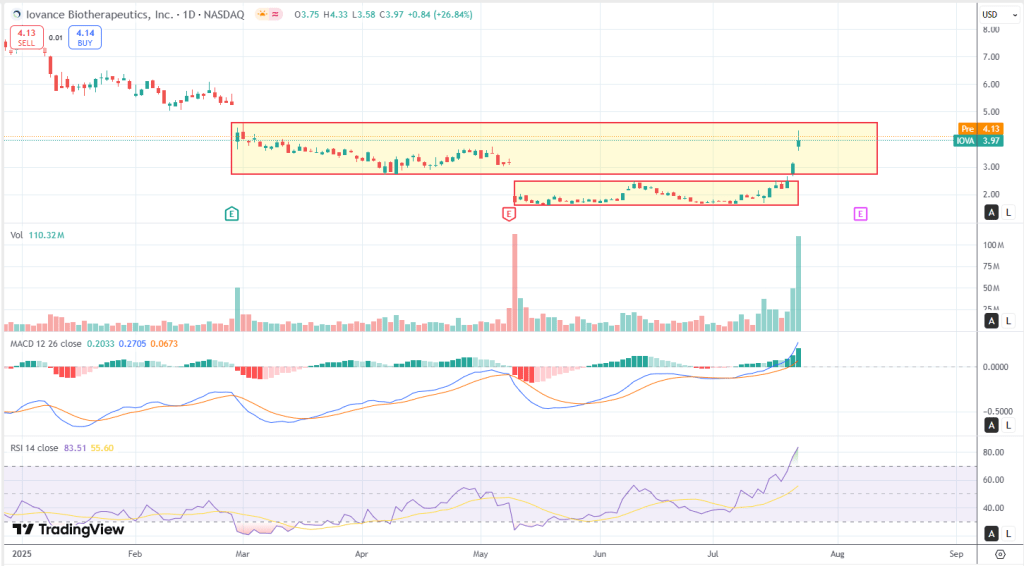

IOVA is breaking out hard—and it’s not just noise. This move is coming off a multi-month base with serious volume behind it. The most recent candle? A textbook marubozu, meaning it closed strong near the highs. That came right after a clean upside range expansion, and the previous session wasn’t quiet either—another high-volume thrust bar. Put together, this forms a classic bullish continuation pattern coming out of consolidation.

Momentum confirms it. RSI is sitting at 83.51, which is deep in overbought territory—this isn’t subtle buying, it’s emotional. But importantly, there’s no sign of a topping pattern yet. This looks more like trend continuation than exhaustion. MACD just crossed cleanly above zero, and the histogram is picking up—another ignition signal. Volume has surged across multiple sessions, which either points to institutional buying or news-driven demand. Either way, this isn’t retail noise. That RSI >80 tells us we’re in the emotional phase—still bullish, but things could get jumpy short-term. It smells like funds that sat through the whole base are finally getting involved.

Looking at box structure: the prior range was $1.70–$2.50, and the breakout started three sessions ago. Price is now flirting with a new upper box edge around $4.15–$4.30. There’s a clear support zone down at $3.20–$3.50—volume memory, prior gap, and plenty of churn. Resistance is tight at $4.30, so if price hovers below that level for a few sessions, it could set up a launchpad for the next move.

Fibonacci levels give more context. Using the swing low at ~$1.60 and today’s high at $4.33, key retracements land at $3.70 (23.6%), $3.25 (38.2%), $2.96 (50%), and $2.68 (61.8%). If this trend continues, extensions come into play: $5.08 at the 127.2% level, and $5.72 at 161.8%.

What’s the move? For long-biased traders, there’s a chance to trail stops under $3.70 or wait for a flag near $4.15 for another add. Dip buyers should watch the $3.25–$3.50 zone for any controlled pullbacks. As for shorts—no clean setup yet. Only makes sense if we see a rejection at $4.30 or a wick-heavy push with volume fading.

Three possible playbook paths from here? First, continuation—if the volume holds, a move toward $5.08+ looks realistic. Second, a pullback and flag—price chops around $3.50–$4.30 for a couple of days, resets RSI, then breaks higher. Third, a bull trap—price breaks down through $3.20 and closes under $3.00. That would flip the script fast. For now, though, the trend is alive and very much in motion.

Do the fundamentals support the move?

The Q1 2025 report offered a more grounded—and in some ways more realistic—snapshot of where IOVA stands in its transition from clinical promise to commercial reality. It didn’t blow the doors off, but it reshapes the thesis in ways that long-term investors need to pay attention to. The topline number was $49.3 million in revenue, with $43.6 million coming from Amtagvi. That’s real growth, but well below earlier expectations. Management revised full-year guidance down to $250–300 million, citing a significant—but now resolved—capacity reduction at their manufacturing facility. It’s not catastrophic, but it’s a reminder that biotech launches, especially with complex therapies, rarely go smoothly.

Still, there are solid signals that Amtagvi is gaining traction. Over 275 patients have been treated in the first year since launch, generating more than $210 million in cumulative revenue. The onboarding footprint is expanding—80+ authorized treatment centers (ATCs) and 11 centers that have treated 10 or more patients. Community oncology practices are starting to join the mix, which is key to scaling beyond academic hospitals. Manufacturing turnaround time is around 34 days now, with expectations for that to shorten during 2025. So, the product is being used, reimbursed, and accepted, but it’s still a heavy lift—logistically and operationally. It’s working, just slower than a traditional drug launch.

On the financial side, IOVA still has breathing room. The company ended Q1 with $366 million in cash and expects to burn less than $300 million for the full year, with no debt on the books. They’ve already started tightening costs across SG&A and R&D. The Q1 net loss was $116 million, mainly due to early-stage cost of goods and the natural inefficiencies of scaling up cell therapy manufacturing. Notably, cost of sales exceeded Amtagvi revenue for the quarter ($49.7M vs. $43.6M), which isn’t surprising at this stage—but reinforces the importance of ramping volume fast. The balance sheet is still a strength, but by 2026, IOVA needs to be running far more efficiently or a capital raise becomes likely.

Looking ahead, there are legitimate near-term catalysts that could shift sentiment. European, Canadian, and UK approvals are expected in 2025, with EMA inspections already completed—a good sign. The company’s targeting 15 treatment centers outside the U.S. by year-end, with early revenue possible through named-patient programs. More importantly, Phase 2 data from IOV-LUN-202 (NSCLC) is expected in the second half of 2025. If the data are solid, that unlocks a huge market and a major re-rating opportunity. Frontline melanoma combo trials are also underway, and could further expand TAM if successful. But as always in biotech, timelines need to be tracked closely—slips can hurt confidence quickly.

Conclusion

The current fundamentals aren’t a thesis-breaker, more like a gut-check. This is a company with a real product, expanding footprint, and pipeline upside—but the road to commercial scale is slower, messier, and more operationally intense than many expected. Don’t expect a straight line up.

Leave a comment