Just did a deep dive on Roblox’s Q2 2025 numbers and thought I’d break down the business model for anyone trying to understand this company. It’s a full-on creator economy ecosystem built around immersive experiences.

At the center of it all is Robux, their virtual currency. Users buy Robux with real money, which Roblox counts as bookings (not revenue—more on that in a second). People spend Robux on things like in-game items, avatar upgrades, and premium experiences (built by creators). Since nearly all of this content is user-generated, creators get a cut via the Developer Exchange (DevEx) program. In Q2 alone, Roblox paid out over $316 million to developers, which was 29% of revenue and 22% of bookings. That’s up big YoY, and it shows how central creators are to the model.

Here’s where it gets a bit wonky—Roblox recognizes revenue over time, not all at once. So if someone drops $30 on Robux, that revenue gets spread out over about 27 months (the average lifecycle of a paying user). That means the bookings number is a better signal for short-term momentum than revenue. In Q2, bookings hit $1.44B, up 51% YoY, while revenue was $1.08B (+21%). The difference is purely timing. What’s more impressive? Free cash flow was $177M, up 58%, and they’ve started to generate real operating leverage even though they still report GAAP net losses.

Engagement is also trending up in a big way. In Q2 2025, Roblox had 111.8 million DAUs (+41% YoY), 27.4 billion hours engaged (+58%), and 23.4 million monthly payers (+42%). The average payer spent $20.48, which was up 6%. That kind of growth fuels the whole ecosystem: more users → more Robux spend → more creator revenue → more content → more discovery → more users. It’s a self-reinforcing flywheel.

On the discovery front, Roblox is leveraging AI to personalize experience recommendations. Viral hits like Grow a Garden. Their discovery engine (curated lists, Today’s Picks, etc.) helped push it to tens of millions of users. Over 75% of users who played Grow a Garden also jumped into another experience the same day.

Monetization is also evolving fast. Native ads (like sponsored tiles) and rewarded video ads (in beta with Google) are opening up new revenue streams. There are even early real-world commerce integrations through Shopify APIs and merch programs, hinting at a virtual-physical hybrid economy.

The System At Work

The user base is exploding—daily active users are up 41%, and monthly unique payers (MUPs) are up 42%. That’s not just a traffic story, it’s a conversion story. More users are turning into payers, which is driving a 51% increase in bookings. And since Roblox uses a deferred revenue model, that surge in bookings won’t show up in revenue right away. But this creates a kind of built-in “revenue pipeline,” so even if growth slows, GAAP revenue will likely accelerate over the next 4–6 quarters as past bookings convert into recognized revenue.

Meanwhile, content on the platform is going viral faster and retaining users better. Hits like Grow a Garden drive cross-experience engagement. Roblox’s discovery engine is doing heavy lifting here, funneling users into other games, keeping them on-platform longer, and increasing spend per user. That’s what fuels network effects and gives creators more reach, which in turn attracts more creators, it’s the flywheel in action.

On the ops side, Roblox has built a scalable infrastructure that handles tens of millions of concurrent players, custom game servers, and real-time multiplayer, all without ballooning costs. That means margin expansion is happening without sacrificing innovation.

Then you’ve got the monetization mechanics evolving in real time. They’re moving past “spend Robux on hats” and into platform-level monetization: smarter in-game pricing tools, regional pricing, new ad formats, and real-world commerce integrations. This is leading to higher ARPPU (average revenue per paying user) and a big jump in free cash flow, which was up 58% in Q2.

Roblox is turning into the YouTube of 3D. Just like YouTube monetized an endless stream of user content through ads, memberships, and merch, Roblox is doing the same thing—but with fully interactive, 3D social environments. They’ve got the full stack: their own currency (Robux), a thriving paid creator economy (DevEx + Rewards), an AI-powered discovery layer, and a global infrastructure backbone. Content and user scale drive revenue, while system-level improvements—on infra and monetization—drive margins.

Core Investment Thesis for Roblox (Next 18 Months)

Here’s the core investment thesis for Roblox over the next 18 months, laid out simply. As bookings growth from the past few quarters starts to flow through the deferred revenue model, revenue CAGR could realistically accelerate into the 25–30% range. The business has already proven it can generate real free cash flow, as FCF margins are stabilizing in the mid-to-high teens, and if that trend continues, GAAP profitability by FY26 looks totally achievable.

What gets really interesting is the monetization roadmap. Roblox isn’t just relying on Robux anymore—they’re building out ads, IP-linked commerce, and subscription layers, which could unlock entirely new revenue streams. This is starting to look more like a platform monetization story than a one-dimensional virtual currency model.

If that narrative shift continues to play out, the stock has room to re-rate more like a SaaS platform with optionality baked in—think AI asset tools, virtual storefronts, even media licensing down the line. Roblox is evolving from a game-centric ecosystem into a full-scale platform with multiple levers for upside.

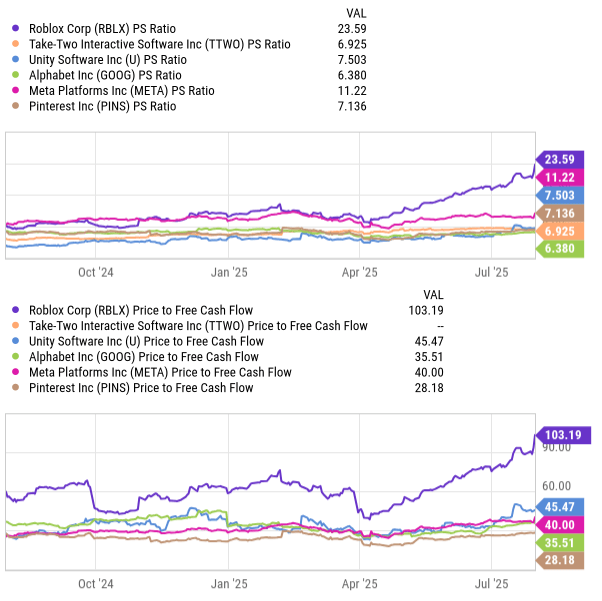

(Source: YCharts)

Let’s take a look at valuation, and see how these comparables help in framing the stock. Start with Take-Two (TTWO). It’s a classic AAA publisher with a hit-driven model—think GTA, RDR, big tentpole IP. That makes it a decent comp in terms of gaming monetization and long-tail user engagement, but Roblox isn’t pumping out sequels—it’s hosting a living library of user-generated content that evolves in real time.

Then there’s Unity (U), which is probably the closest from a tooling and infrastructure standpoint. Roblox gives creators a full-stack dev environment and backend to launch their own 3D experiences. Like Unity, it’s enabling creation, but Roblox owns both the tool and the distribution, which changes the economics completely. It’s a closed loop.

Now layer in Alphabet (GOOG) and Meta (META). YouTube is the blueprint for monetizing user-generated content at scale through engagement, subscriptions, and ads. Meta, meanwhile, brings the social graph, immersive ambitions (like Horizon), and a fine-tuned ad monetization engine. Roblox shares elements of both—especially the emphasis on creator economy and network effects—but in a 3D, interactive context rather than passive content. Add Pinterest (PINS) to the mix for its discovery-driven, interest-based UGC dynamic, and you can start to see how Roblox is this weird hybrid of game engine, content platform, and social network.

That complexity is showing up in the numbers too. Look at the Price-to-Sales (P/S) ratio—Roblox trades at 23.6x, while the rest of the peer group ranges from ~6x to 11x. Even Unity, its closest structural comp, sits at 7.5x. The market is clearly pricing in aggressive forward growth, and with 51% YoY bookings growth and a fast-expanding DAU base, there’s a case for it. But it also raises the bar. This kind of multiple assumes Roblox will keep layering on monetization tools, improve margins, and avoid any serious engagement slowdown.

The Price-to-Free Cash Flow (P/FCF) story tells a similar tale. Roblox is sitting at 103.2x, which is more than double Unity, triple Google, and nearly 4x Pinterest. That’s not because Roblox is printing insane cash right now, it’s because the market expects it to. Their FCF is just starting to stabilize, and as deferred revenue starts converting and OpEx scales better, that number could move fast. But again, the execution risk is real—one bad quarter, a DAU plateau, or slower-than-expected monetization, and the valuation could compress hard.

So what does all this tell us? Roblox trades at a premium for a reason. It has a unique business model built around a self-contained virtual economy, an engaged creator base, and its own development infrastructure. The tailwinds—UGC gaming, immersive digital spaces, AI-assisted creation—are all real.

Risks

Let’s talk about the bear case for Roblox, because as much as the upside story is compelling, there are definitely some valid risks that could derail the long-term thesis. First off, a big part of Roblox’s current momentum has been driven by viral hits and breakout creator content, but that kind of virality is hard to sustain. The absence of a recurring base of growth underneath could expose just how dependent the model is on fresh, attention-grabbing content. Without that constant influx of viral experiences the bookings narrative might lose steam.

Then there’s the infrastructure challenge. Roblox runs on a pretty custom backend to handle multiplayer, real-time interaction, and dynamic scaling across millions of concurrent users. That’s great when growth is steady, but during usage surges (like major game launches or seasonal spikes), infrastructure costs can balloon, compressing margins hard, especially if the company isn’t getting efficient cost leverage from its infra investment.

On the monetization side, the company is betting big on new tools—ads, real-world commerce, subscription models, and creator-facing pricing tools. But those aren’t guaranteed to work out of the gate. If they miss, it could stall revenue growth and keep Roblox more dependent on Robux-based microtransactions. Creators are only going to adopt new monetization tools if they’re easy to use and don’t hurt their UX.

Finally, there’s the user demographic risk. While Roblox continues to grow its DAU count, a lot of that growth still comes from younger users. If they struggle to retain the over-13 crowd, or worse, if those users churn after aging out of the platform, it pokes a hole in the long-term engagement thesis. Roblox has talked about aging up the platform, but if that doesn’t stick, it risks becoming a “kids’ app” with limited appeal beyond that initial demo—limiting both user lifetime value and broader cultural relevance.

Wrapping-up

That 23.6x sales / 103x FCF multiple comes with strings attached. The market is giving Roblox credit not just for what it is today, but what it could become: a cross between YouTube and Unity, with monetization layers stacked on top—ads, IP licensing, digital commerce, maybe even media down the line. If that vision plays out and margins follow, the upside’s big. If not, there’s plenty of room to correct.

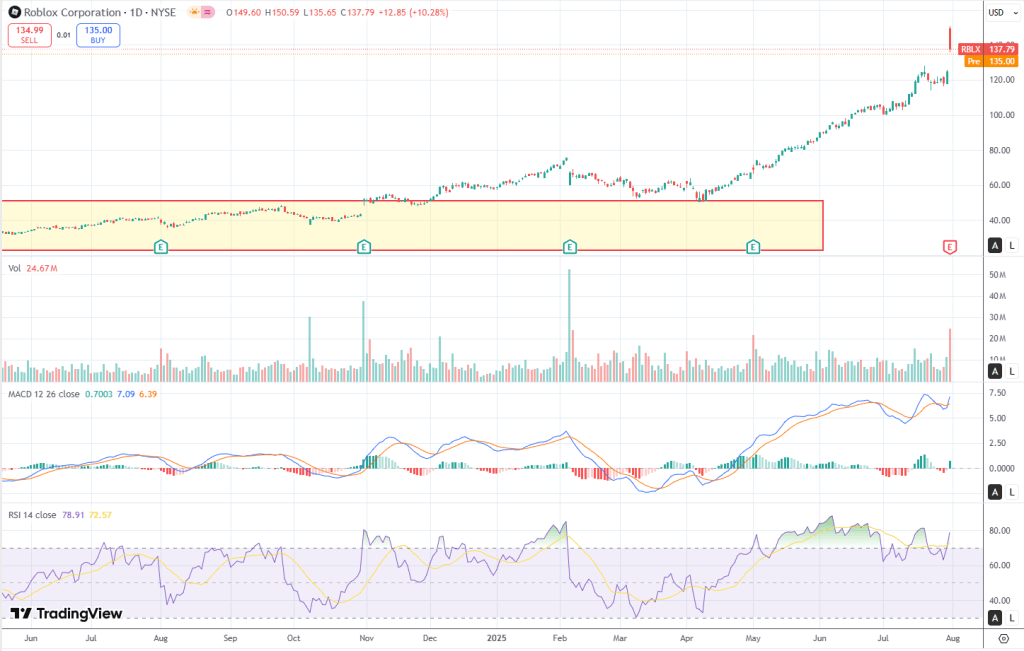

Mr. Market is telling us that he likes the stock. Since April, price was climbing steadily in higher highs/higher lows. Volume was gradually increasing. No vertical moves until the last few weeks which is healthy. Yesterday’s candle looks like a confirmation on good earnings.

This absolutely could be a continuation, not a blow-off top. The structure heading into earnings was clean—tight range, decent volume buildup—and the breakout itself was backed by real volume. This doesn’t feel like a meme-driven, parabolic pop. It looks more like money stepping in and validating Roblox’s broader platform story. The fundamentals (bookings growth, monetization roadmap, etc.) actually support the move, which gives it more credibility than your average earnings spike.

That said, we’re probably in the third inning of the breakout, not the first. Meaning? The “easy money” has already been made by the people who got in pre-earnings or during the early base. So this is not the time to start blindly chasing green candles and FOMO-ing in at highs.

The smart move now is to be patient. Ideally, you want to see a pullback to the $122–128 range—that’s where you can really test whether buyers are serious and if prior resistance becomes new support. Also, don’t just watch price—watch time. If the stock consolidates above $130 for a bit instead of retracing, that’s a bullish sign in itself and might justify an entry on strength.

But if we start seeing weakness and it breaks down below $110, something’s off. Maybe the story wasn’t as sticky as it looked, maybe earnings momentum fades fast, or maybe the market just re-rates. Either way, don’t try to rationalize it. If the structure breaks, be disciplined enough to step aside and reassess.

All-in-all, I am bullish on Roblox.

Disclaimer: LONG RBLX. This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Leave a comment