The tape screamed tight plumbing and risk-off:

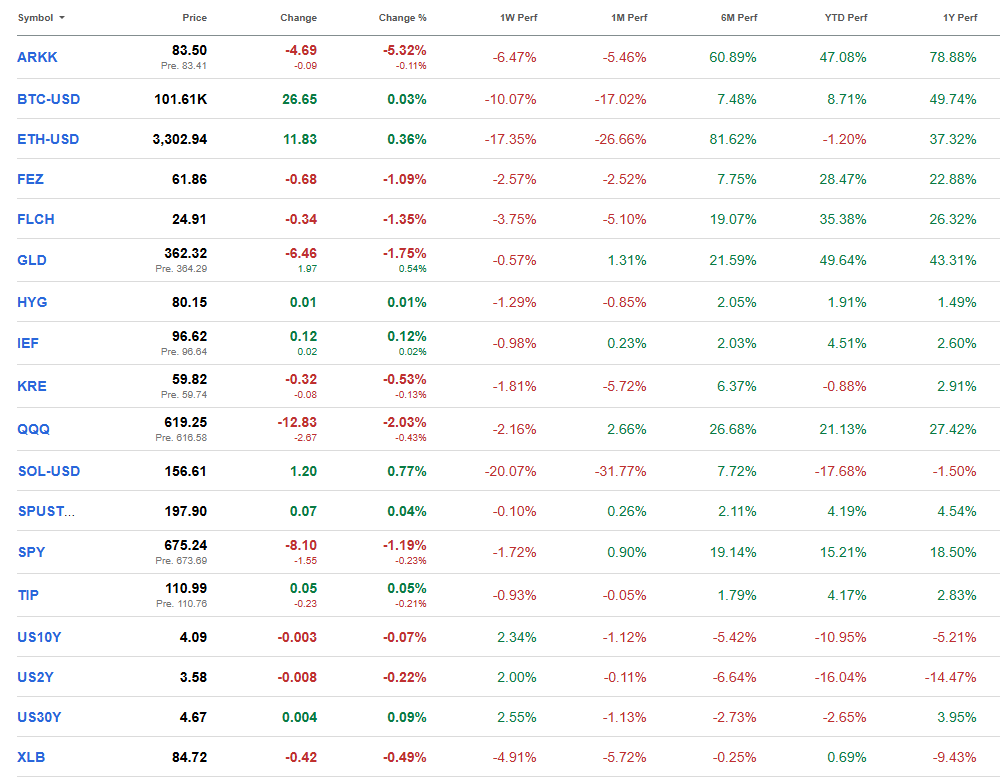

- Crypto led lower (BTC -10% w/w, ETH -17%, SOL -20%).

- Long-duration tech bled (QQQ -2.2%, ARKK -6.5%; XLK -2.7%).

- Rates up, prices down: IEF -1.0% w/w; 2s/10s/30s yields all higher.

- Defensives rotated: Staples (XLP +3.1%) and REITs (XLRE +2.0%) outperformed; Financials (XLF +1.1%) held up, regionals (KRE -1.8%).

- Gold essentially flat on the week (GLD -0.6%) after recent vol; still massive YTD gainer.

- Europe and China lagged (FEZ -2.6%, FLCH -3.8%).

This is consistent with our framework: mechanical liquidity constriction (TGA hoarding + QT + bill-heavy issuance) tightens collateral, pushes SOFR higher vs EFFR, nudges SRF usage up, and sells the most liquid stuff first (crypto/mega-duration). It’s pipes, not fundamentals.

Where we are in the cycle

Window of Pain to Liquidity Flood remains the base case:

- Plumbing stress: SRF taps spiked, repo prints jumped. That’s the market telling the Fed “reserves are scarce here,” not that the economy is dead.

- Policy sequencing next: gov’t re-opens means TGA spends ($250–350bn over a few months), QT halts/decels, SLR relief / bill-to-coupon mix shifts. That mechanically adds reserves, softens the DXY, and bull-steepens the curve.

- Election-year impulse + CLARITY-style crypto rails + Asian fiscal (China balance sheet, Japan) layer on top.

Pattern since 2009: equities rise first, credit tightens second, crypto multiplies last once liquidity actually expands. Drawdowns of ~-30% are how the regime shakes conviction pre-surge. We just had one across crypto/long duration.

Two near-term paths (probabilistic)

- Accident-first (40%): private credit/insurer PLR games recveal a couple of “cockroaches” (EquipmentShare-type stories, ABS haircuts, small bank funding) force an early policy tweak (repo facilities, QT stop). Quick risk-off then faster pivot.

- Orderly loosening (60%): no big break; the Fed lets the facilities do the work, TGA spend resumes, DXY rolls, yields drift down, and the rally broadens.

Either path takes us to more reserves, just on different timelines.

Structural backdrop we keep front-of-mind

- US vs. China re-industrialisation squeezes Europe (Pettis/Fardella): FEZ underperformance fits the “manufacturing share shrink” story.

- AI narrative vs. consumer reality: staples and consumer names have been wrecked YTD; this week’s bounce doesn’t change the bigger signal, credit-led consumption model is tired, narratives are doing more work than incomes.

- Private credit opacity: ratings inflation (PLRs) + insurer hunger for yield = undercapitalisation risk in a shock. Tail to watch.

- Scarcity premium rising: gold’s YTD and BTC’s ETF bid say the market is assigning value to non-printable, globally settleable collateral, especially when plumbing wobbles. ZEC price action also makes us consider including privacy narratives. Another tail to watch.

Positioning implications (tactical – 1–3 months)

- De-lever into vol; no hero trades until the liquidity flip is visible (TGA drawdown, SRF calm, SOFR-EFFR back inside the rails, DXY rolling).

- Barbell:

- Duration on DXY momentum break / QT stop (10–30y USTs, TIPS on dips).

- Scarcity: add on forced crypto/gold pukes; ETFs are persistent buyers once the pipes unfreeze.

- Own bottlenecks with cash flow: power grid/data-center capex, select industrials, copper/uranium. Those ride both fiscal and AI capex regardless of consumer softness.

- Financials: prefer quality money-center over regionals until deposit beta and commercial real estate marks are clearer.

What would change our mind

- SOFR pinned at ceiling + sustained SRF > $50–100bn/day with no TGA draw / QT unchanged → escalate crash-protection; that says “policy lagging the pipes.”

- Credit spreads (HYG/OAS) widen > 100–150 bps from here → de-risk cyclicals.

- BTC/GLD ETF outflows alongside stronger DXY → pare scarcity.

What to watch next week

- TGA: is spend starting?

- Treasury refunding mix (bills vs coupons) and any SLR chatter.

- SOFR-EFFR spread, SRF usage, and RRP floor.

- DXY momentum; curve shape (bull-steepening = go signal).

- HY spread and KRE price action.

- ETF flows (IBIT/GLD) for the scarcity bid.

Bottom line: Last week’s cross-asset selloff was the symptom of a funding choke, not the cause of a recession. The play remains: survive the choke, get paid in the flood, with duration and scarcity ready to add once the plumbing eases.

Leave a comment