The headline isn’t “a car company quarter.” It’s a capital allocation quarter.

The most important line from this whole update is that Tesla is explicitly telling you 2026 is a “huge investment year” with CapEx expected to be in excess of $20B . And they didn’t describe it vaguely, they basically rattled off an industrial roadmap:

- paying for six factories: refinery, LFP factories, Cybercab, Semi, new Megafactory, Optimus factory

- plus AI compute infrastructure investment

- plus expanding the robotaxi and Optimus fleets

That’s Tesla leaning into the thing the market constantly misprices: they are a capital-intensive business that behaves like a compounding software platform, because each dollar of capital isn’t just “one more unit of capacity.” It’s capacity + data + distribution + iteration loops.

And the reason that matters: Tesla ended Q4 with $44.1B of cash, cash equivalents and investments, so this isn’t a “we have to” CapEx year. It’s a “we’re choosing to” CapEx year.

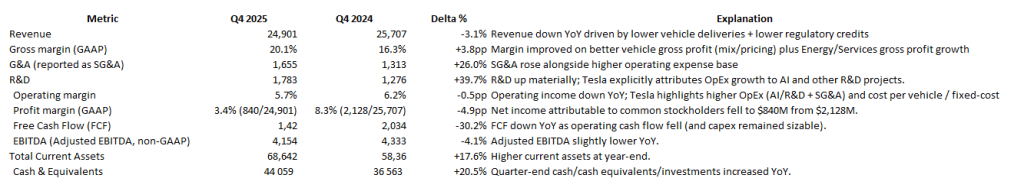

What the financials say (and what they don’t say)

The scorecard

- Q4 revenue: $24.9B (down 3% YoY)

- Q4 operating income: $1.4B, 5.7% operating margin

- Q4 free cash flow: $1.42B

- Q4 total gross margin: 20.1% first time above 20% in “over the last 2 years” per management

- They call out tariffs > $500M in Q4 embedded in the margin story

And on the year:

- 2025 total revenue: $94.827B

- Energy generation & storage revenue: $12.771B (+27% YoY)

- Automotive revenue: $69.526B (-10% YoY)

- 2025 operating margin: 4.6%

The interpretation

This was not a “clean margin expansion” story. This was a “we stabilized the machine while eating headwinds” story.

- Deliveries were down (they cite lower deliveries and lower fixed-cost absorption)

- They still got back to ~20% gross margin while absorbing tariffs

- Operating expenses were up (AI + R&D + SG&A, SBC, restructuring) and operating income fell YoY

So if someone is trying to value this quarter as “peak auto margin rebound,” they’re missing the point. Tesla is basically saying: “We’re going to trade some near-term cleanliness for long-term platform scale.”

Autonomy: this is the quarter Tesla tried to make “robotaxi” non-theoretical

Two callouts matter because they are operational, not vibes:

- Paid rides in Austin with no safety monitor in the car.

- And then: no chase car either, “cars with no people in them and no one’s following the car in Austin.”

That’s Tesla trying to cross a credibility threshold: moving from “supervised driver assist” to “unsupervised operations,” even if narrowly scoped.

Now marry that to how they describe Cybercab:

- They explicitly frame Cybercab design as a different optimization problem: not “best car,” but minimum cost per mile and high duty cycle

- They talk about Cybercab being used 50–60 hours per week versus ~10–11 hours for a personally driven car

That’s the platform logic: utilization transforms unit economics. A robotaxi network is basically a factory that sells miles.

Also buried in there is an underrated monetization hint:

- Elon analogizes customers adding cars to the autonomous fleet like Airbnb

- And claims the value of that option is underweighted because there are “millions of cars” with the needed hardware generation

Whether or not that plays out fast, strategically it matters: Tesla’s path to scale is not “buy 100k robotaxis.” It’s convert a fleet into supply, then add dedicated purpose-built supply (Cybercab).

FSD: the business model just flipped

This is one of those “small sounding” changes that can rewrite the income statement over time:

- Tesla says FSD paid customers reached ~1.1M globally

- Then: they’re transitioning fully to a subscription-based model beginning this quarter

- Management explicitly warns: in the short term, this shift will impact automotive margins

Translation: they’re choosing recurring revenue quality over upfront margin optics.

And the sneaky synergy: Tesla is saying some customers can offset subscription cost through insurance discounts tied to FSD usage . That’s not just product bundling, it’s Tesla turning “safer driving behavior + telemetry” into pricing power.

Optimus: this is Tesla converting auto manufacturing real estate into robotics capacity

This is one of the most consequential operational statements on the call:

- Tesla plans to take the Model S/X production space in Fremont and convert it into an Optimus factory, targeting 1M units/year in that footprint

- And they basically say it’s time to end S/X production to shift to an autonomous future

In the update deck, they add: “First generation production lines for Optimus are being installed in anticipation of volume production.”

That’s the tell: Tesla is treating humanoid robots like a manufacturing product line, not an R&D demo. The market can argue about timelines, but the capex + factory allocation choices are real.

Energy: the “quiet winner” keeps getting louder

Two clean facts:

- Management says energy ended the year with nearly $12.8B in revenue, up 26.6% YoY

- They expect increasing deployments with Megapack 3 and Megablock, while flagging potential margin compression from competition, policy uncertainty, and tariffs

This matters in the thesis because Energy is increasingly the “non-auto ballast” that can fund the autonomy/robotics buildout, especially when auto is cyclical or demand-sensitive.

Capital strategy: “we’re writing a new book”

Tesla literally says: “We’re starting not the next chapter, but a new book.”

And they lay out the intended profit transition: hardware-related profits increasingly accompanied by AI, software and fleet-based profits .

Then they reinforce the AI stack direction with the $2B xAI investment and an AI collaboration framework intended to “enhance Tesla’s ability to develop and deploy AI products and services into the physical world at scale.”

Whether you like that deal or not, it’s consistent with a thesis: Tesla wants control over real-world AI, not just buy chips and rent models.

Updated investment thesis (post Q4/FY25)

The old Tesla framing breaks

If you model Tesla as “units × margin,” you will keep getting whipsawed.

Management is explicitly telling you to stop applying a pure car-sales framework when autonomy is the growth driver .

The updated thesis: Tesla is building a vertically integrated autonomy + robotics industrial platform

Core claim: Tesla’s moat is an end-to-end deployment loop: product → data → training → inference → manufacturing scale — and the company is now allocating capital as if autonomy and robotics are the primary outputs.

Pillar 1 — Autonomy becomes a fleet business (not a feature)

- Early proof points: paid driverless operations in Austin without safety monitor or chase car

- Cybercab designed around utilization and cost-per-mile economics

- Potential supply expansion via owner fleet participation (“Airbnb” analogy)

What changed this quarter: the narrative shifted from “someday robotaxi” to “we are already running real rides,” and the product strategy is explicitly built for miles, not sales.

Pillar 2 — FSD monetization shifts to recurring revenue

- ~1.1M paid customers

- Subscription-only transition (short-term margin headwind, long-term quality upgrade)

What this does: it de-lumpifies revenue and, if adoption continues, creates a cleaner bridge from “driver assist” economics to “fleet” economics.

Pillar 3 — Optimus moves from concept to factory allocation

- Fremont S/X space repurposed to Optimus, 1M units/year target

- First-gen Optimus lines being installed

What changed this quarter: Tesla is treating robots like a real manufacturing ramp competing for scarce factory space against legacy products.

Pillar 4 — Energy scales as the cash-flow stabilizer

- ~$12.8B FY energy revenue, strong demand and deployments

- New products (Megapack 3, Megablock) and continued backlog strength

Role in thesis: energy becomes a structural contributor that can reduce reliance on auto cyclicality.

Pillar 5 — Capital intensity becomes a weapon if execution holds

- 2026 CapEx > $20B targeting factories + compute + fleet expansion

- Strong liquidity base ($44.1B) to fund that roadmap

This is the bet: Tesla believes it can spend heavily while remaining “capital-efficient” — meaning output per dollar remains high.

Thesis scoreboard

1) Autonomy proof, not promises

- expansion pace beyond Austin

- evidence of improving autonomy “every month” as claimed

2) Subscription economics

- FSD subscription attach rate vs prior upfront mix

- churn / retention signals

- impact on reported auto margins (they already warned it’ll hit short term)

3) Capex-to-output conversion

They’re about to run a $20B+ capex year . The market will forgive spending only if:

- factories come online when promised

- unit economics improve (cost per mile, cost per robot, cost per MWh)

- operating leverage shows up later in the model

4) Energy margin durability

They warned about margin compression from low-cost competition, policy uncertainty, and tariffs . Watch whether product iteration (Megapack 3 / Megablock) offsets that.

The bottom line

This quarter is Tesla saying, plainly: “Stop valuing us like a car OEM. We’re redeploying capital into autonomy, robots, and energy at industrial scale.”

Financially, 2025 showed pressure on operating margin and profits, but strategically, they’re spending into a platform transition: driverless fleet operations, subscription software, and robotics manufacturing capacity.

If you believe autonomy + robotics monetization is real, this is the setup year.

If you don’t, then all you see is a company voluntarily choosing a high-capex, lower-near-term-clarity path.

Either way, the thesis has updated: Tesla is telling you the product is no longer “cars.” The product is miles, robots, and megawatt-hours, delivered through an integrated AI and manufacturing stack .

Leave a comment