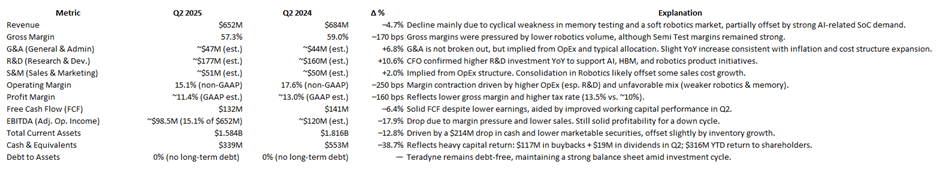

Just went through Teradyne’s Q2 2025 numbers and figured I’d share a breakdown for anyone tracking the name. Not a blockbuster quarter, but definitely some interesting signals under the hood, especially if you’re following the AI test space.

Revenue came in at $652M, down about 4.7% YoY. Not great, but mostly expected. The memory test business is still soft (cyclical dip + digestion of HBM4 capacity from last year), and robotics also showed weakness. That said, AI-related SoC demand showed up in a big way and helped to partially offset the whole thing.

Gross margin took a hit, down 170 bps to 57.3%. The pressure mostly came from lower volumes in robotics, not surprising given that segment’s ongoing struggles. On the bright side, Semi Test margins stayed strong thanks to higher ASPs and product mix from AI workloads.

On the cost side, OpEx continues to rise—but it’s deliberate. G&A is estimated at $47M (up ~7%), which lines up with inflation and some cost structure expansion. R&D jumped ~11% YoY, now around $177M. Management already said they’re leaning in here to support AI, HBM, and robotics initiatives, so this increase isn’t a surprise. Sales & Marketing was mostly flat, with a slight increase (~2%), probably helped by the robotics consolidation they mentioned last quarter.

Operating margin dropped to 15.1% (non-GAAP), down 250 bps from a year ago. Not ideal, but again, they’re in investment mode, and the revenue mix (more robotics + less memory) dragged things down a bit. Profit margin (GAAP) was ~11.4%, versus 13.0% last year, with the added headwind of a higher tax rate (13.5% vs. ~10%).

Free cash flow was $132M, down 6.4% YoY, but still respectable given the margin compression. Working capital efficiency helped here. EBITDA came in around $98.5M, a ~17.9% drop, but they’re still putting up decent profitability in what’s arguably a transitional quarter.

Balance sheet’s still clean. Cash & equivalents fell to $339M from $553M, largely due to heavy capital return activity—$117M in buybacks and $19M in dividends this quarter alone, totaling $316M returned YTD. That’s 138% of FCF, which shows how aggressive they’ve been in rewarding shareholders. Zero debt on the books, which gives them flexibility as AI-related programs ramp and memory starts to recover.

Revenue Growth Drivers

Now I want to share some thoughts after digging into what’s really driving Teradyne’s business right now, especially coming out of Q2 2025. The numbers were fine, but the real story is in the setup for the second half and beyond. If you’re following the AI hardware and test ecosystem, there’s a lot to like here—especially around mix shift, margin setup, and longer-term optionality.

AI compute and networking are becoming core drivers. Let’s start with the obvious: AI compute is no longer a “nice-to-have” growth angle for Teradyne, it’s becoming foundational. Compute-related revenue made up about 20% of the SoC segment this quarter, so north of $80M, and they’re guiding for significant growth in Q3 and Q4. You’ve got major hyperscalers and merchant GPU/AI ASIC customers ramping test volumes, and the company is clearly seeing an inflection coming in the back half.

Networking demand is also outperforming. It’s flying under the radar, but a big chunk of that is tied to buildouts of AI data center infrastructure. Every test socket and interconnect matters when these hyperscalers are rolling out next-gen AI clusters. CEO Greg Smith even said directly: “The majority of Semi Test revenue in the second half will be AI-driven.” That’s a strong directional signal.

Memory was the weakest spot in Q2 (only $61M), but that could change quickly. What’s happening is that HBM4 capacity buildouts are finally starting to see test demand—specifically, post-stack testing is picking up due to yield losses in final AI accelerator packaging. That could create incremental volume and expand TAM over the next few quarters.

Still a drag in 2025, but there’s a clear pivot happening here. Teradyne has a “plan-of-record” win with a large industrial customer that starts contributing in 2026, and that could be a big needle-mover for Universal Robots. They’re refocusing robotics on scalable, high-volume industrial applications, and they’ve already consolidated sales and service to get leaner. Add in the new U.S. manufacturing facility (for redundancy and customer proximity), and you’ve got the pieces for real structural improvement—just not this year.

Now, On to Margins—This Is Where Things Get Interesting

AI mix is lifting gross margin. AI SoC testing isn’t just growing—it’s more profitable. Higher ASPs and better test throughput make it a margin enhancer. SoC is now over 60% of Semi Test revenue and skewing increasingly toward AI workloads. Meanwhile, memory and robotics are still lower-margin, so the mix shift is doing a lot of the heavy lifting on margins right now.

Volume leverage is starting to kick in. The guidance for Q3 shows this clearly. Gross margins are projected to rise to 56.5–57.5%, with operating margins pushing back toward ~19.5%. That’s all volume-based leverage—better absorption of fixed costs, especially in Semi Test engineering and infrastructure. Basically, they’re getting paid for the capacity they already invested in.

Robotics margin expansion is a 2026 story. The cool part here is that UR and MiR are vertically integrated. That means once volumes ramp, the gross margin scale can be meaningful. Combine that with the cost-cutting they’ve done this year—especially around platform consolidation and unified sales/service—and they’re setting up for margin improvement when revenue returns. Just not in 2025.

SG&A is under control. Despite all the investment in AI, photonics, and robotics R&D, overall OpEx was flat YoY at $275M in Q2. They’re clearly keeping a tight lid on SG&A. R&D is where the spending is focused, and that’s strategic—it’s going into high-return areas, not bloated admin layers.

So yeah, not a blowout quarter, but the AI momentum is real, and they’re clearly investing for what they see coming in H2 and 2026. If you’re long, it’s all about watching how quickly AI ramps offset the lag in robotics and memory.

Price Action And Key Points

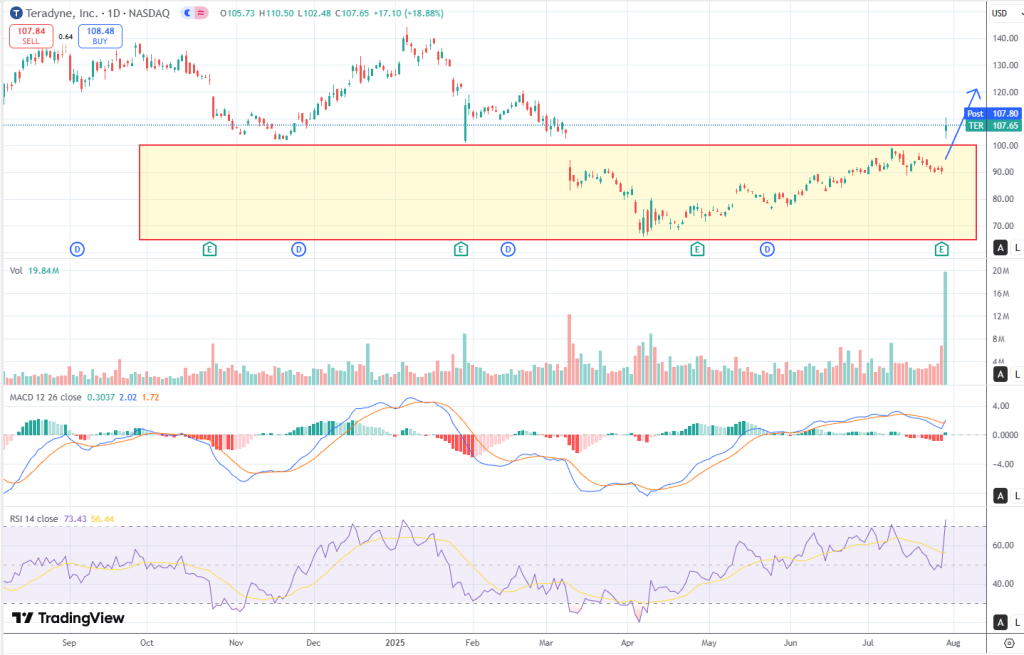

Alright, turning to the price action around the stock, Teradyne just went full beast mode today — stock ripped +18.88% and closed right near the high of the day. Absolute monster candle. No upper wick, all buying, straight up bullish marubozu type move. What makes it even more interesting is that this didn’t come out of nowhere — the chart had been coiling for weeks in a tight range around $85–$95, so today’s breakout looks like a legit momentum ignition, kicked off by earnings. You can check my full chart breakdown here, it has a play button where yo can keep tabs on the idea progress. Also, follow me on X (@pepe_maltese), I post small tidbits on the stocks I am following.

What’s wild is how clean the technicals are lining up. MACD flipped bullish from below zero a few sessions ago and is now widening — classic signal that momentum’s turning up. RSI is pushing into overbought territory (around 73), but it’s not divergent, so nothing to panic about. And the volume? Easily one of the biggest days in six months. Feels like the market finally woke up to this name. This doesn’t scream FOMO; it feels more like a sentiment shift or even a re-rating in real-time.

If you like trading breakouts, this is a textbook move. TER had been stuck between $85 and $95, and today it blasted through that range with force. New box forming somewhere around $95–$107, and if you use the measured move logic (add the height of the box to the breakout), you get a potential price target of $117. That lines up pretty well with the Fib extensions too — it already tagged the 100% extension intraday at $110.50, and the next upside levels look like $124.86 (127.2% Fib) and possibly $140+ if things really get cooking.

Smart money vibes are all over this. The base from April to July looked like slow accumulation — not much action, low volume — and then today boom: gap up, no fade, straight move to the highs with volume behind it. No upper wick means no real profit-taking yet. If this was distribution, you’d see some selling into strength. You’re not.

Bottom line: this is a clean breakout with serious momentum behind it, likely the earnings were the trigger. If you missed the move, keep an eye on any pullback into the $102–104 zone. Target-wise, $117–125 is reasonable in the short term if no reversal shows up, but also remember to keep a tight stop if you see a reversal candle or big-volume rejection. Honestly, this is one of those rare setups where technicals, volume, and macro (AI test tailwinds post-earnings) all come together. Worth watching closely.

Disclaimer: LONG TER. This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Leave a comment