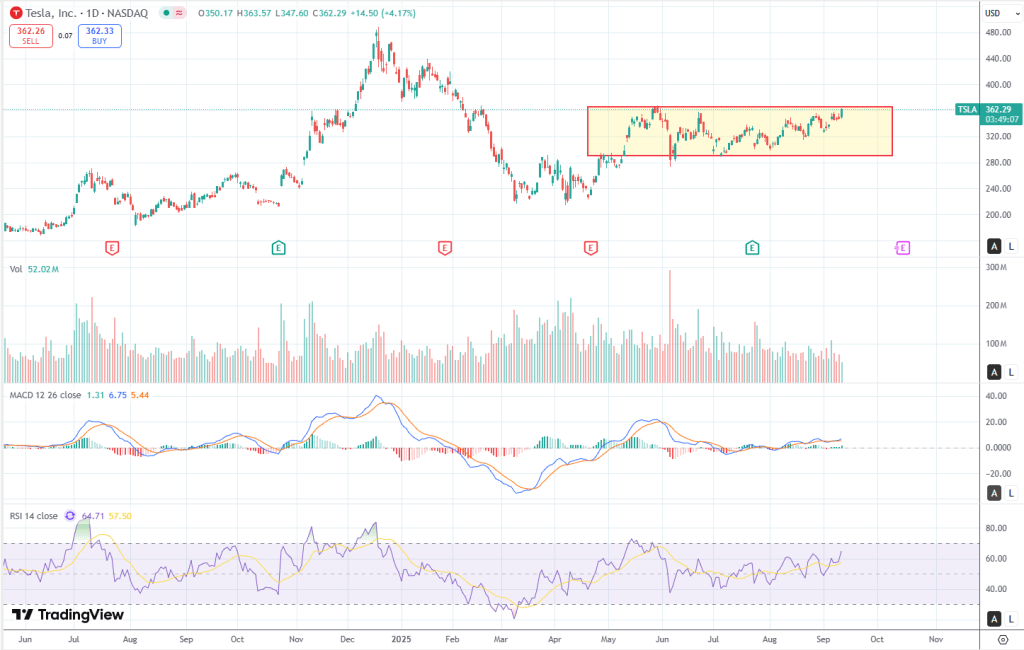

Tesla has been very volatile and range bound, however it is now making higher lows consecutively and it has popped again in my screens.

Tesla (TSLA) is presenting a high-conviction breakout opportunity following a sustained multi-month consolidation between $2910 and $360. Price action has been range-bound since May, forming a classic Darvas box structure. As of today’s close, TSLA is trading at $362.29, above the upper boundary, and positioning for a potential breakout. Momentum indicators are now confirming: the MACD has recently crossed bullish, and RSI has climbed to 64.7 with a strong slope, signaling building buying pressure. While volume has not yet expanded significantly, the compression of price near the top of the range combined with rising momentum suggests a volatility expansion is likely near.

The proposed trade is a breakout entry, contingent on a daily close above $360. If confirmed, the entry zone would be between $367 and $370 on the following trading session. The stop is placed at $352, just below the breakout zone, to protect against a failed breakout. Target 1 is set at $400, corresponding with the 127.2% Fibonacci extension of the prior swing, and Target 2 is set at $430, aligning with the 161.8% extension and prior supply zones.

Liquidity is robust, with TSLA trading over 50 million shares daily, making the setup suitable for both equity and options deployment. For optional convexity, traders may deploy 2–4 week call options (e.g., $370 or $380 strikes) after breakout confirmation, or structure debit spreads to manage premium exposure. Confirmation of breakout strength should be supported by volume exceeding the 20-day average (approximately 70M shares). If the breakout fails and price closes back below $352 after entry, the trade should be considered invalidated and exited.

There are no major catalysts on the near-term calendar, so this is a purely technical setup dependent on price and volume confirmation. The trade should not be front-run. If no breakout confirmation materializes by the end of this week (September 13), the setup should be re-evaluated as the risk of a failed breakout increases.

Disclaimer: LONG TSLA. This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based

Leave a comment