Tesla’s Q2 2025 results weren’t just about missed deliveries or shrinking margins, they signaled a turning point in the company’s entire identity. The real story isn’t in the factories of Shanghai, Austin, or Berlin anymore. It’s in Texas cleanrooms, custom AI silicon, and robotic assembly lines. With Dojo officially scrapped and a $16.5B chip partnership with Samsung, Tesla is pivoting hard—from being “just” a car company to becoming a real-world AI platform that pushes intelligence to the edge.

The key idea here is simple but massive: the car itself is no longer the product. Every Tesla is now a node in a vertically integrated AI network, gathering real-world data, running inference on the fly, and monetizing that intelligence across autonomy, energy, robotics, and eventually infrastructure.

For investors, this completely changes the lens. You don’t value Tesla by units sold anymore, you value it by AI economics: per mile, per robot, per task, per watt-hour. That brings massive optionality if it works, but it also ramps up the complexity, capital needs, and execution risks Tesla has to navigate.

Tesla’s Strategic Reset: Dojo Is Out, AI6 Is In

Tesla just pulled the plug on one of its most ambitious bets, Project Dojo. In August 2025, Musk called the in-house AI supercomputer an “evolutionary dead end,” and the project was shut down. The reason? Tesla’s new AI6 chip made the whole approach obsolete. That meant walking away from more than $1B already sunk, disbanding the Dojo team (including chip lead Peter Bannon), and watching several engineers spin out to launch DensityAI, a startup that could one day become a competitor. Most companies would double down to save face, but Tesla did what Tesla always does: fail fast, pivot hard, and double down on what works.

Now, all eyes are on AI6, which has become the heart of Tesla’s strategy. This chip is designed to collapse the AI stack into one architecture, capable of both training massive neural nets and running inference in real time across cars, Optimus robots, and industrial systems. To lock this in, Tesla signed a $16.5B chip fab deal with Samsung to build AI6 in Texas, cutting reliance on Asia and reducing geopolitical risk.

AI6 matters because it gives Tesla full vertical integration of the AI pipeline, from raw driving data → training → custom hardware → deployment at the edge. It’s optimized for latency-sensitive use cases like autonomy and robotics, and it reduces Tesla’s dependence on Nvidia. Long term, it even opens the door for Tesla to sell “AI-as-a-Service” to external clients. This is no longer about EVs, it’s about building an AI moat that stretches across the physical world.

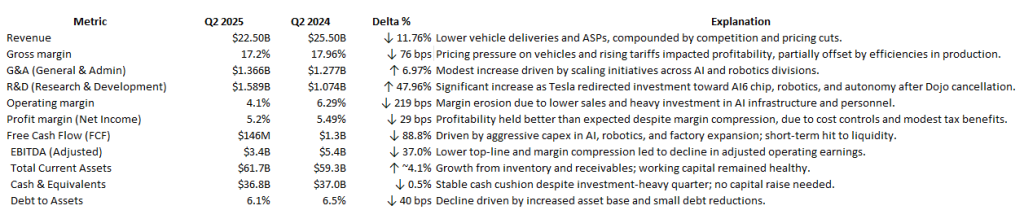

Q2 2025: The First Signs of the Platform Emerging

Tesla’s Q2 2025 earnings feel like a turning point. The numbers themselves don’t look great on the surface, revenue came in at $22.5B (-12% YoY), automotive revenue dropped to $16.7B (-16%), energy & storage slid to $2.8B (-7%), GAAP net income was $1.17B (-16%), adjusted EBITDA hit $3.4B (-7%), and free cash flow fell off a cliff to just $146M (-89%). Not exactly the kind of growth Wall Street loves.

But here’s where it gets interesting: management basically said this quarter isn’t about cars anymore. It’s about turning Tesla into a platform for AI, autonomy, and real-world automation. In other words, the financial pain now is the cost of building the infrastructure for potentially much higher-margin businesses later. The story isn’t just “can Tesla sell more cars?”, it’s “can Tesla execute on becoming the backbone of an AI-driven mobility and automation ecosystem?” That’s a much bigger swing, but also a much riskier one.

Tesla’s Multi-Layered AI Flywheel

Tesla isn’t treating the car like a product anymore, it’s treating every vehicle as a node. With over 4M connected cars constantly streaming real-world driving data, the fleet itself has become the backbone of Tesla’s AI network. That data feeds into shadow mode learning and real-time training, accelerating FSD Version 13 adoption (+25% QoQ) and powering the first robotaxi deployments, now live in Austin with expansion planned for San Francisco, Florida, and Nevada. In this framing, a Tesla isn’t something you buy, it’s a distribution channel for autonomy, AI, and monetizable services.

Then there’s Optimus. Version 2.5 is already in internal factory trials, and Version 3 is slated for low-rate production in early 2026. The long-term target is massive: 1M units a year, positioned not just in Tesla factories but in logistics, warehousing, and even service industries like hospitality. The model here is “Labor-as-a-Service,” and if humanoid robots can be scaled like cars, the margin potential is huge, software-defined labor with recurring revenue streams.

Finally, the AI6 chip sets the stage for something bigger: a potential Tesla AI Cloud. Dojo-as-a-Service is gone, but AI6’s architecture makes external monetization possible, offering inference for drones, industrial robotics, or shared training workloads across industries. Edge + cloud convergence is the endgame. If Tesla pulls it off, it won’t just be competing with automakers—it could look more like a vertically integrated AWS for real-world AI.

Valuation: From Multiples on Cars to Multiples on Intelligence

The way you frame Tesla’s story has completely flipped. The old thesis was all about EV volumes, margins, and regulatory credits. The new thesis is about monetization per inference, per mile, or per robot-hour. That means the revenue streams of the future look very different: FSD subscriptions at $99/month with adoption still climbing as more geographies come online, robotaxi platform cuts in the ~$0.25–$0.50 per mile range, Optimus billing on a task-based model in factories and logistics, energy automation through AI-driven grid optimization with Megapacks, and eventually even selling inference cycles directly to AI and robotics clients.

If Tesla executes on this, it stops looking like a car company altogether. The model becomes something closer to Nvidia + Uber + Boston Dynamics + AWS rolled into one.

Risks: Execution, Regulation, and Capital Intensity

Tesla’s biggest risks now aren’t just about selling fewer cars, they’re about stretching itself too thin across multiple high-stakes bets. Execution overload is real, with the company trying to ramp FSD, Robotaxi, Optimus, and the AI6 chip all at once. Regulatory friction is another wild card, autonomous vehicle approvals are still patchy across U.S. states and international markets, which could slow deployment. On the hardware side, HW3 retrofits may drag out FSD adoption timelines. Then there’s the capital intensity, AI, chip manufacturing, and robotics scale-ups all demand years of heavy burn before they turn cash-positive. And let’s not forget the talent risk: with Dojo shut down, some of Tesla’s top engineers spun out to launch DensityAI, which could become a competitor in the next wave of AI chips.

Investment Conclusion: Tesla Is a Platform Now, Not a Car Company

Tesla’s story has officially flipped. It’s no longer about how many Model Ys roll off the line or how the Cybertruck ramp is going in Texas. The real game now is how many inferences Tesla can monetize, how much labor Optimus can replace, and how much intelligence the company can deploy at the edge. That puts Tesla in the same conversation as Nvidia (silicon), AWS (infrastructure), Uber (mobility-as-a-service), ABB/Siemens (automation), and Boston Dynamics (robotics). If it executes on even half of these fronts, the valuation ceiling moves way beyond “car company” territory.

Investment Outlook:

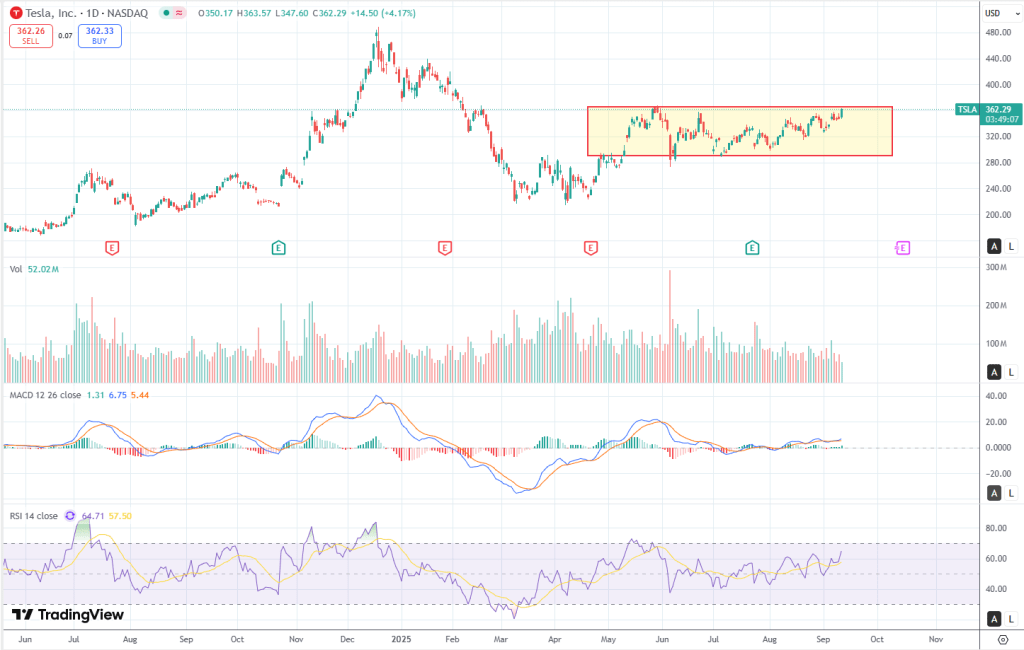

- Near term (6–12 months): Expect plenty of volatility, EV demand is soft, margins are compressed, but Tesla’s $36.8B cash pile and platform optionality should cushion the downside.

- Medium term (12–24 months): Key things to watch are Robotaxi scaling, FSD adoption rates, and the AI6 production ramp. The Samsung deal makes chip supply less of a risk.

- Long term (2027+): If Tesla pulls it off, it evolves into a dominant AI + robotics + energy platform. That would justify a re-rating from auto-like multiples to something closer to SaaS or infrastructure valuations.

Final Thought: Ignore the Deliveries—Follow the Intelligence

Tesla isn’t really in the car business anymore, it’s in the intelligence business. The vehicles are just carriers, Optimus is the workforce, AI6 is the nervous system, and autonomy is the monetization engine tying it all together. The market’s still trying to price this shift, which means plenty of volatility in the near term. But for long-term investors, the real question isn’t “how many cars does Tesla ship next quarter?” It’s “what’s the value of a company that installs intelligence into the physical world at scale?” And that’s a way bigger conversation than auto deliveries.

It also explains why the stock is breaking out on no news.

Disclaimer: LONG TSLA. This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based

Leave a comment