I have been keeping an eye on Roblox (RBLX) for a while now, the company is still perceived as a kid’s game, which I believe is too reductive. The reality seems to be much different with the platform becoming more like an infrastructure for social gaming and virtual economies. The most recent financial results seem to prove that a shift is underway. Let’s dissect this.

Booking growth and monetization optionality

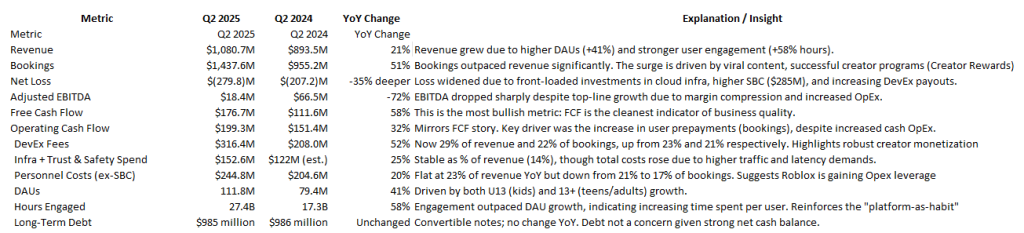

In 2Q25, the bookings were $1.44B, something not seen many times in companies this size, representing a massive year-over-year growth of 51%, while the DAU growth was 41%, this being the main indicator that the monetization is expanding. Bear in mind that the bookings are the true demand signal, representing the cash received for Robux and other subscriptions. The fact that bookings are growing faster than DAU means that this is a monetization unlock story.

The FCF metrics support our assertion that the monetization is being unlocked. We can dig deeper into a more granular level to unpack a couple of dynamics that are tailwinds to monetization. For starters, the virtual economy with in-app Robux purchases is increasing ARPPU. The ad-based monetization in rewarded video is integrated with Google’s ads and is scaling fast. On another note, creators can now license their IP, a bit like other creator-brand collaborations on YouTube. Finally, AI tools are now available, allowing for rapid goods creation, thus reducing time to market.

Global expansion as a growth engine

What most people aren’t paying attention to is how fast they are scaling on the international front, and the upside this can unleash in the next 2 to 3 years. The company’s business model is heavily dependent on getting people on the platform and keeping them engaged to eventually drive some form of monetization. Basically, international users are going through the same funnel as the US, just maybe 2 or 3 years behind.

A couple of recent improvements are having a huge impact on driving international growth. The burst of data centers capacity in Asia is helping to get lower latency, and auto translation is unlocking the potential in countries like Japan.

Monetization efficiency and creator flywheel

One of the most overlooked metrics is average bookings per daily user growth. This metric is growing at 20% year over year. Basically, this tells us that users are spending more. However, developers are also gaining more, with developers’ payouts now growing at 52%. That means that developers can make real money in the platform, which creates a virtuous cycle where better monetization attracts more creators, making better games, which should improve monetization.

Valuation

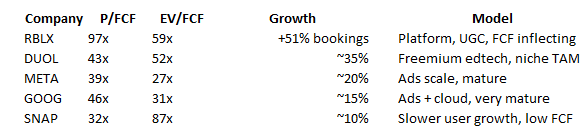

To give a proper look at valuation, we need to select a peer set that captures the many dimensions of the platform, and to be honest, there isn’t a completely direct comparable. In my opinion, the closest comparables are Unity, Duolingo, Snap, Meta, and YouTube (Google). Now, the problems begin because when you look at the valuation for Roblox and peers, we get the sense that it is insane.

If you look at the table, the company is trading at 97x price to FCF and 59x EV to FCF. I agree, this looks crazy. However, there are a few key reasons. First, FCF just inflected. The company went from burning cash to generating cash and its FCF margins are still expanding. Therefore, this is a work in progress. On the other hand, bookings growth is at 51% YoY, while FCF is lagging this metric because of deferred revenue accounting. Therefore, we can expect the valuation to re-anchor, if the company keeps hitting the high end of the guidance. And this is not far-fetched, since the company is now monetizing a very sticky user base.

Risks

One of the major risks the platform has been exposed to is predator concerns. As I keep following the company, these issues keep popping up periodically, making it almost feel like a time bomb. Even with a big effort in deploying trust and safety mechanisms, we are still hit with periodic media firestorms. And this is also likely to attract regulators’ attention. And make no mistake, more regulations will mean slower growth.

Another issue that I keep seeing mentioned by analysts is the over-reliance on a few big hits. To thrive, the whole ecosystem depends on having a mid-tier segment of games that is visible enough to keep the developers engaged in creating games. If only a couple of top hits end up getting most of the rewards, the ecosystem might dry up fast. On the other hand, one of the most interesting features that creates ecosystem momentum is user-generated content. The problem is that with UGC growth also comes the possibility of IP infringements. In the end, it is unlikely that lawsuits on this might destroy the company, but it is likely that it will divert resources and it might cool down the ecosystem momentum.

The ad monetization is still a big uncertainty. Yes, they already have ad initiatives like Rewarded Video, but these initiatives are still in beta. This is not yet a meaningful revenue stream. The market seems to be already baking in some of that optionality, and if the results disappoint, the stock price will likely take a hit.

Finally, the high valuation leaves no room for error, meaning that any miss on the metrics we have covered (DAU, ABPDAU, FCF) might lead to a painful re-rating.

Investment Action

The company is trading at very rich multiples and that makes it not for the faint of heart. However, if you zoom out, you can see that this is not a kids’ game anymore. We can distill the company’s ethos as a global platform for interactive entertainment. A kind of YouTube meets Fortnite.

The company is now reaping the benefits from developing a great discovery engine and creator tools that have unleashed a thriving economy and is now allowing the platform to break out organically. Yes, there are legitimate risks in terms of content moderation and high valuation, but at this pace, it is likely that the market will reward the company with even higher market cap.

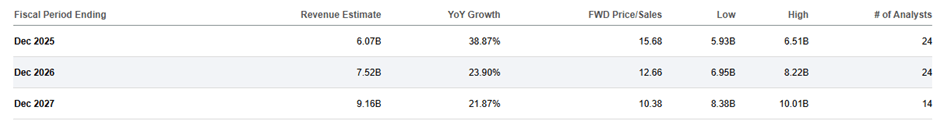

The revenue estimates show exactly that. This is a company with a lot baked in, but if the growth materializes, and the current platform performance seems to support this, then in a few years, the current valuation won’t look that expensive

Disclaimer: No position. This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based

Leave a comment