If you’re looking at BigBear.ai (NYSE:BBAI) right now and thinking “the stock shouldn’t be ripping like this after that earnings mess,” you’re not alone. The tape is telling one story while the near-term fundamentals still tell another. This is one of those moments where price is potentially running ahead of the narrative, and the question is whether the narrative can catch up before the chart exhausts. In plain English: we got a classic post-dump base, a gap reclaim, and a momentum flip in a name that still has real execution questions. That can be powerful, and treacherous, depending on your time horizon and risk tolerance.

Quick backdrop: how we got here

Q2 was a gut punch. Management cut full-year revenue guidance to $125–$140 million, withdrew adjusted EBITDA guidance entirely, and flagged disruptions on U.S. Army programs as that customer consolidates and modernizes its data architecture. Reported Q2 revenue fell to $32.5 million (down ~18% year over year), gross margin slipped to about 25% (vs. ~27.8% a year ago), adjusted EBITDA deteriorated to -$8.5 million (from -$3.7 million), and the P&L was crushed by non-cash items: a ~$136 million derivative revaluation loss and a ~$71 million goodwill impairment tied in part to the lower outlook.

The only unequivocal “win” in the quarter was the balance sheet: the company raised roughly $293 million via its at-the-market facility (about 75 million shares sold at an average $3.90), finishing with ~$391 million of cash and, for the first time, a meaningful net cash position. If you’re a short-term trader, that quarter screamed “fundamentals deteriorating, valuation needs to compress.” If you’re a long-term strategist, you saw “fortress liquidity, optionality to play offense in the biggest funding wave defense AI has ever seen.”

Enter the technical set-up

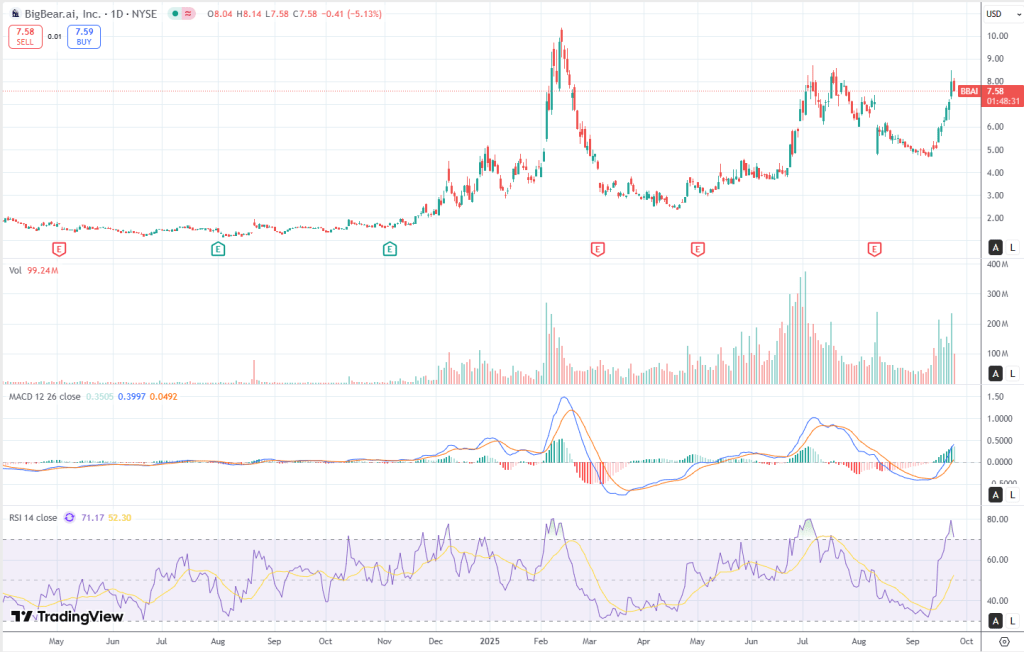

After the earnings gap-down, BBAI built a tight base in the $6s–$7s, then reclaimed the entire post-earnings gap zone (~$6.9–$7.8) and flipped it to support. That matters because old supply became new demand; every seller in that gap is now underwater and less willing to dump at former levels. Momentum confirms the change in character: RSI shifted from sub-40 to a strong 70–80 regime (that isn’t “just overbought” in a young uptrend; it’s gas), and MACD curled up through the zero line, the point where a lot of trend systems add exposure. Volume expanded on up days. Put it together and you have the textbook ingredients of short-covering + momentum funds pressing the long side after a flush. The market doesn’t need a press release for that; the chart is enough.

The line in the sand is the prior swing high. In BBAI’s case the “boss level” sits around $9.2–$9.6. Why that zone? Because it’s the last swing high before the earning’s breakdown, the level that defines whether the stock is still in a damage-control range or transitioning back into an intermediate uptrend. Clearing it with authority (think 1.8–2.5× average daily volume and a daily close above the zone) does three mechanical things: it creates a supply vacuum (not many trapped longs above to sell), it triggers systematic trend/momentum flows that require new highs on volume, and it can add gamma fuel if there’s a concentration of calls around $9/$10 forcing dealers to hedge by buying shares. In other words, a clean break is a signal that price is leading the story, and that you might get a second leg higher even without a new fundamental catalyst in hand.

Why this “price first, narrative later” dynamic is plausible here. The long-term story, the one management is trying to sell, is legitimately massive: the so-called “OB3” supplemental funding wave that allocates ~$170B to DHS and ~$150B to DoD, with explicit buckets for border technology, biometric exit, AI autonomy, and shipbuilding — all lanes BBAI already plays in with veriScan/Trueface (biometrics), ConductorOS (autonomy enablement), and Shipyard.ai (industrial base, scheduling, and optimization). International partnerships (UAE’s IHC umbrella; Panama’s Narval cargo security) broaden the surface area further. The balance sheet is a weapon: ~$391M in cash means BBAI can fund capture campaigns, accelerate deployments, and even pursue transformational M&A without tapping expensive debt. On paper, if they convert even a sliver of those OB3-aligned opportunities into funded, multiyear awards that start soon, the revenue slope can steepen from low single-digit to something investors can actually model. The issue is timing — and that’s precisely why the chart can get ahead of the story in the interim.

But let’s be real about the near-term fundamentals

Management admitted the pipeline was narrow and reliant on a few large contracts; they’re working to broaden it, but that takes time. They also made it clear they’re going on offense: more spend on marketing, talent, product, and partnerships — and no EBITDA guide while they invest — which is code for lower earnings before they’re higher. The equity raise was dilutive in the here and now (that’s ~25%+ more shares), even if it unlocked the cash they needed. At the operating level, revenue contracted, gross margin compressed, and the Army program disruption will take time to re-compete or replace. None of that screams “imminent P&L inflection.”

So why entertain the breakout at all? Because the tape says buyers are willing to front-run the possibility that backlog and award flow improve before the Street believes it. This is where “leading indicators” matter. In a name like BBAI, revenue, margins, and EBITDA are lagging. The leading indicator is backlog (especially funded backlog) and how fast it converts. We’ve already seen backlog grow from the mid-$300Ms to over $400M earlier this year; if that metric inflects again with funded awards tied to OB3 buckets — think CBP biometric exit and primary processing, AI autonomy (ConductorOS and distributed systems), shipbuilding/digital thread — and if the period of performance starts in the next quarter or two, then the Street will rerate forward revenue growth and the chart will have been right to sprint. Until then, this is technicals doing the heavy lifting.

Valuation in context

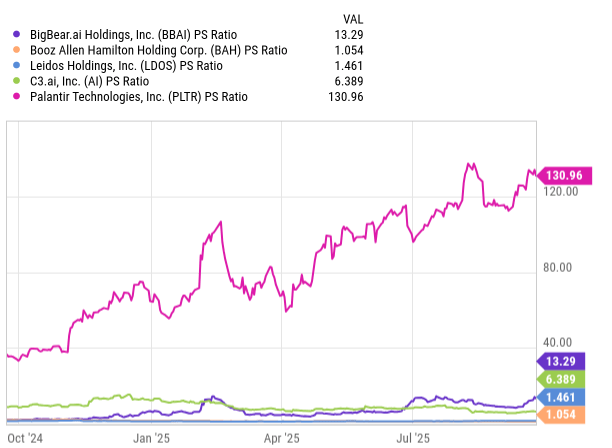

You can’t ignore the comp set. Compared with old-school federal integrators like Booz Allen (BAH) or Leidos (LDOS) that trade ~1–2× sales with mature cash flow, BBAI’s multiple has hovered well above that because it’s pitching platform-like upside in defense AI. Compared with “AI platform” peers like C3.ai (AI) or the mission-software behemoth Palantir (PLTR), BBAI is tiny, still negative on EBITDA, and far more contract-lumpy.

The board and the market both “priced in” optionality earlier this year; the guidance cut forced a reset. For this break to stick, the company must show the path from cash → capture → funded backlog → revenue conversion → margin stabilization. Without that, any multiple expansion from a breakout risks being temporary, the kind algos sell into when headlines go quiet.

Risk management (for traders and investors)

So, what to do with BBAI here? If you’re here for the trade, you have a clean heuristic: above $9.6 on volume and holds → the path of least resistance is up; below $7.6 on rising down-volume → the move’s probably a head-fake and the base needs more time. If you’re here for the investment, your DPIs are backlog composition (funded multiyear wins), conversion pace, gross margin trajectory, and any verified OB3-aligned awards with near-term start dates. The balance sheet gives them time; the pipeline needs breadth; the execution needs to show up in numbers. Yes, this can be price leading the story for a stretch — that’s how big winners start — but the story still has to show up.

If you’re trading the chart, the playbook is straightforward: you want a daily close above $9.6 on 1.8–2.5× average volume, a short flag/pause just above that zone, and then a retest of $9.2–$9.6 that holds. That’s your “price is leading the story” confirmation. Stops belong just below the breakout shelf (call it $8.95–$9.10), or under an anchored VWAP from the breakout day, with a measured move toward $10.0–$10.4 based on the height of the $6–$8 base. If the stock fails to hold that shelf twice on expanding down-volume, respect the failed breakout and step aside; probability shifts to a longer base between $8.0–$8.6 or even a retest of the $7.6 gap shelf. If you’re investing, position sizing needs to reflect that this is still a speculative, contract-driven story. The time horizon mismatch is real: technicals play out over days–weeks, while the fundamental payoff (OB3 capture, international deployments, M&A integration) is quarters.

What would make the move “fundamentally real.” There are three things that would validate price leading the story. First, funded backlog acceleration with start dates inside the next two quarters, this tells you not just that they “won” something, but that revenue recognition is imminent. Second, proof of international monetization, i.e., announcements that UAE-linked deployments are live and paying, or that the Panama cargo security solution is scaling to big shipping lines. Third, stable to rising gross margin back toward the high-20s/low-30s as software/IP-heavy projects mix up — confirmation they’re not simply growing services headcount to chase revenue. Any combination of those three, while the chart is above $9.2–$9.6, is the recipe for a sustained rerate.

What could break it. Two things will kill this breakout fast: a return to heavy ATM usage without related contract wins (share count up, narrative flat), and another guide-down or evidence that government award/obligation timing is pushing conversion further right. Also, keep an eye on Army re-competes; losing a high-profile one could reset expectations again, even if the broader OB3 wave is still out there.

A word on M&A because cash is burning a hole in their pocket. Management said the quiet part out loud: they are “actively pursuing strategic transformational acquisitions.” That can accelerate scale… or blow up value if they overpay or mis-integrate. The “right” deal would add immediate revenue scale, complementary IP, and distribution in federal or Tier-1 international channels, with clear line of sight to margins. The “wrong” deal would be a headcount-heavy services roll-up with thin gross profit and integration debt. If they announce an acquisition while the stock is breaking out, read what they bought before you assume it’s bullish — the mix matters.

Bottom line. BBAI is a classic asymmetric optionality case right now. The technicals argue for a legitimate momentum turn — gap reclaim, rising volume, RSI regime shift, MACD above zero, and a very clear breakout level — while the fundamentals argue patience: guidance reset, EBITDA uncertainty, dilution, and a multi-quarter capture/conversion slog. Those two realities aren’t mutually exclusive. They intersect if (and only if) management converts the OB3 opportunity, diversifies the pipeline, and turns that $391M cash pile into revenue scale with margin. Until then, trade the tape with discipline and size the investment like a speculative sleeve. If they start printing funded awards and backlog inflects while the stock holds above $9.2–$9.6, the tape will have been right to front-run; if not, respect your levels and don’t marry the ticker.

Disclaimer: No position. This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based

Leave a comment