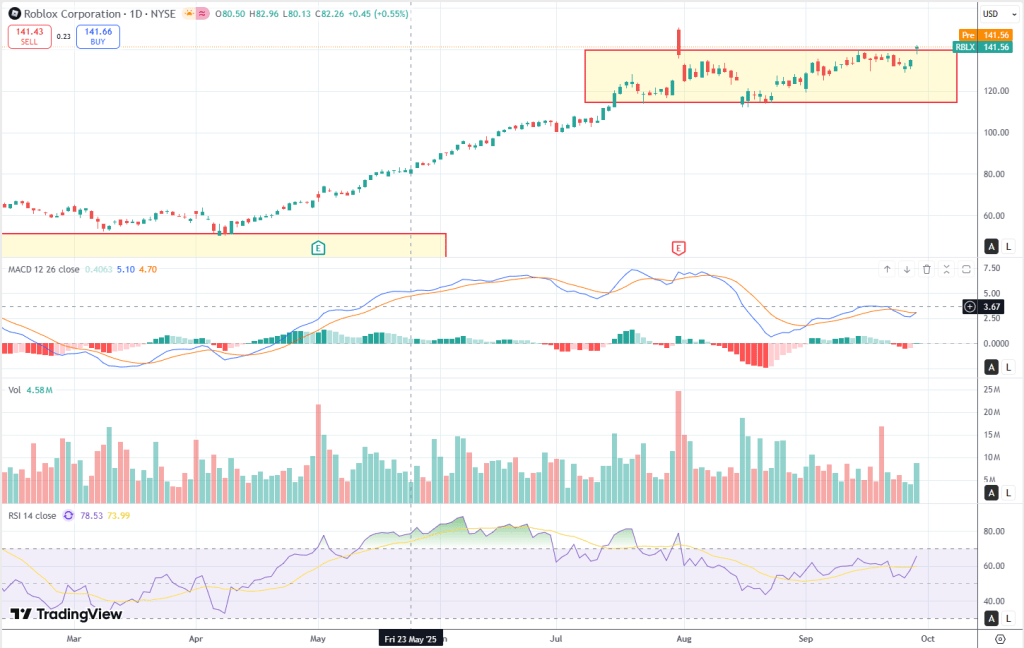

RBLX just printed a chunky green day and parked under the same ceiling it’s bumped into for two months. Price closed around 141.7 after pressing the 143 zone that has capped every pop since August. The whole last leg looks like a classic re-accumulation: big run April–July, then a sideways box between ~123 and ~143 while volume cooled and dips kept getting bought. This week the character shifted—momentum flipped up, the fast line crossed the slow on MACD, RSI is rising through the mid-60s without divergence, and the last few candles are real bodies with small upper wicks. In other words: buyers are finally showing intent, but they still need to finish the job with a proper range break.

If you map the recent swing from 123 to 150, the fibs frame both paths. On a clean push through 145 with expanding volume (think a full-bodied breakout candle that closes above prior highs), the next magnets line up at the 1.272 extension near 157, the 1.414 around 161, and the 1.618 up at ~167. That cluster also agrees with a simple measured move off the box height (20 points added to the 143 lid gives ~163), so there’s nice confluence in the high-150s to mid-160s if momentum really kicks.

If the breakout stumbles, the retracement rails are clear. First defense is the 38.2% at ~139.7; lose that and the work back into the box usually gravitates to the 50% at ~136.5 and the 61.8% at ~133.3, which also sits right on the mid-box memory from September. Deeper shakeouts can probe the 78.6% around ~128.8, with the last line of the whole structure down at the 123 base. Candle behavior matters at each step: a strong close back under 139.7 after poking highs would look like a failed breakout; a long-wick rejection near 145–150 with rising volume would scream “upthrust” and likely send it to those mid-box supports. Conversely, a breakout day that closes near the highs with volume 1.5x the recent average, followed by a shallow throwback that holds 143–145 and flips that level into support, is the textbook continuation look.

Tactically, this is one of those “trade the break, not the hope” setups. Confirmation above 145 with juice opens 150 quickly and then the 157 → 161 → 167 ladder as momentum builds; risk gets tucked below the most recent higher low or, for swing patience, beneath the 38.2% at ~139.7, with a hard invalidation if the structure caves through 133.3. If instead price can’t hold the 139–140 shelf, let it reset toward 136/133 and wait for a fresh reversal signal rather than forcing an entry in the middle of the box. Big picture: the range did its job, momentum has flipped, and the next few sessions should tell us whether this was just another poke at the ceiling or the start of the next markup leg.

Disclaimer: No position. This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based

Leave a comment