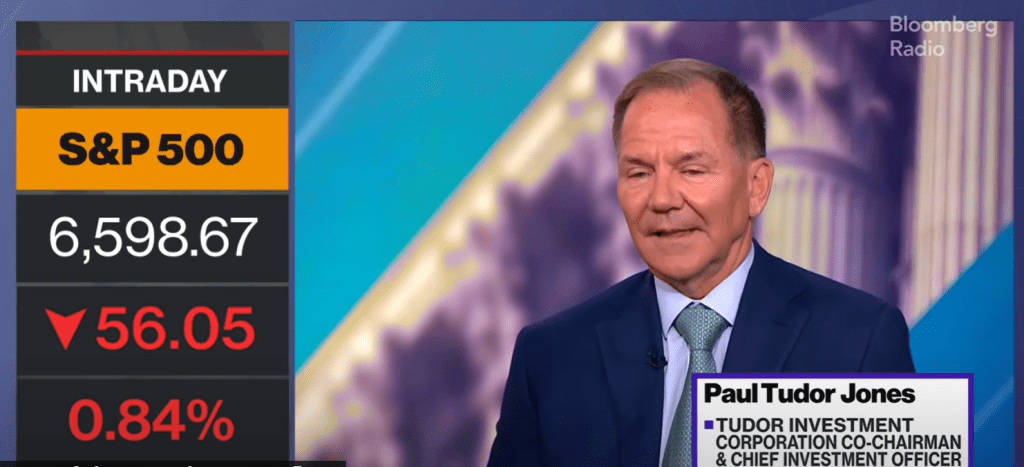

Paul Tudor Jones basically handed us a cheat code for how this tape can play out, and it slots perfectly into the framework I’ve been building here. The vibe right now is late ’99, not because valuations are identical, but because the setup is. Big fiscal (a ~6% deficit), policy that wants to ease, and megacaps actually making money. If the late-Oct/early-Nov gauntlet (mega-cap earnings + Fed + US-China headlines) doesn’t blow up, the path of least resistance is an end-of-year ramp. That last leg of a bull market is always the most delicious and the most dangerous.

The fragility isn’t sitting on corporate balance sheets this time, it’s in the equity plumbing. Margin debt stats are a fossil. The real leverage is options, 0DTE flow, and a Cambrian explosion of leveraged ETFs. Retail equity allocations are at records, the Mag-7 is a third of the S&P, and everyone’s swinging derivatives like nunchucks. That cocktail is great for melt-ups… and for air pockets when market makers lose their grip.

Now zoom out 6–18 months. PTJ thinks we’re heading for Fed funds ~2–2.75% once the political pressure finishes arm-twisting the committee. Pair that with structural deficits and you get the classic reflation broth: lower carry, easier financial conditions, and a second-wave inflation risk. Remember there’s ~$370T of global financial assets out there, even a tiny re-weight into hard stuff moves prices a lot. You can’t “print” copper or rare earths. You also can’t fake trust, so the debasement hedge expresses first in gold, then in crypto, then in cyclicals/commodities once the policy pivot is obvious.

One spicy PTJ observation: since ETF “liberation day,” flows into BTC/ETH and gold/silver were roughly similar, but on a vol-adjusted basis gold has outperformed Bitcoin. Retail picked the right narrative, wrong horse (for now). He still likes both as currency-debasement trades; he just thinks near-term momentum favors gold/silver, with crypto’s time coming back as the easing cycle matures.

Thread this through the “financial plumbing” lens I use here. With RRP basically empty and SOFR trading above IOR, the system is shouting “cash is tight.” QT is running on fumes, which is exactly how you force the Fed from “QT to stop to tweak funding to cuts,” and if something actually breaks, back to “QE.” In scarce-collateral phases the USD rips and front-end bills look like gold. In ample-collateral phases, the debasement basket (gold -> crypto → cyclicals) leads. That’s our two-step: dollar wrecking ball first, then the hard-asset party.

Overlay the Fourth Turning arc and it all rhymes. Populist fiscal, financial repression (low real rates), periodic sovereign wobbles. PTJ basically says a Truss-style episode in some sovereign bond market is a “when,” not an “if.” Bond vigilantes aren’t dead; they just express in metals and crypto until the day they run the bond table again.

What am I watching to separate melt-up from mayday? Cleanly, it’s vibes plus plumbing. If the Nasdaq sits above its 200-day with breadth not collapsing, VIX chill, dealers long gamma, and megacap prints fine, the path to a holiday ramp is open. If leveraged-ETF AUM keeps exploding, 0DTE call skew goes manic, single-stock options notional dwarfs cash volume, and breadth rolls while SOFR-IOR stays sticky positive, the tinder is piling up. Toss in a sloppy UST auction or two and you’ve got your air-pocket recipe.

Portfolio-wise, I’m thinking in phases. Into November/December, a quality growth/Nasdaq sleeve makes sense, but with crash insurance or a bit of duration short as the hedge, because the elevator down is always one headline away. Gold/silver stay overweight versus BTC near-term purely on trend; I’d flip that when funding stress cools and the easing is explicit. On confirmation of cuts, I start adding commodities/cyclicals and then increase crypto beta as the debasement trade broadens. Always leave room for a sovereign-stress window where USD and front-end bills rip and everything else inhales, use that to reload.

TL;DR the PTJ read plugs straight into our map: we could get a melt-up now because policy and positioning say “go,” but the destination is debasement, with a sovereign scare along the way. Respect the momentum, price the fragility, and keep one eye on the plumbing. Not advice, just the playbook I’m running until the tape tells me I’m wrong.

Leave a comment