I have been working on a one-pager for IREN’s valuation. My goal is to simplify the metrics used, so that retail investors can have a rough measure for the company that they can keep track of without much trouble. This will also allow me to keep regular updates at investmentgems.net.

With the new Microsoft deal, this sheet becomes even more important in order to track the potential re-rating of the stock without losing perspective. I intended to put this on a Gumroad bonus track with limited distribution, but given the importance of this event, I am keeping it at the blog, visible for all.

What’s new

- Multi-year GPU cloud contract with Microsoft: $9.7B TCV / 5 years (≈ $1.9B/yr revenue cadence if straight-line).

- 20% prepay: ≈ $1.94B cash in, materially de-risking capex/working capital.

- Capex: $5.8B purchase agreement with Dell for NVIDIA GB300 systems + ancillaries.

- Where/when: Deployed in phases through 2026, at IREN’s Childress, TX (750MW) campus, supporting ~200MW IT load across Horizon 1–4 (liquid-cooled).

Why it matters

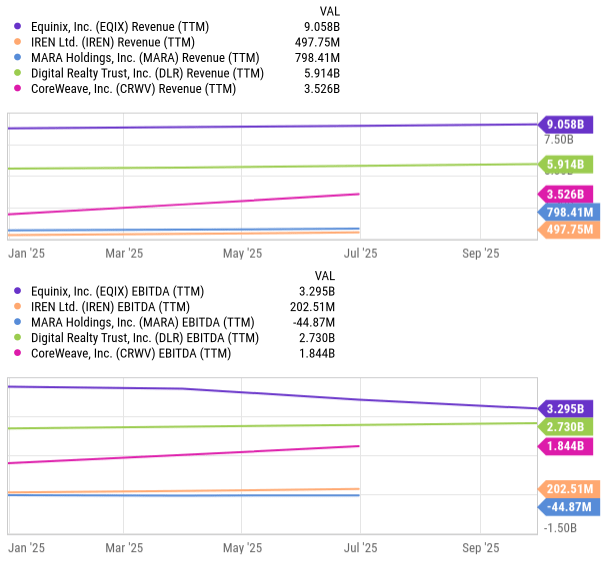

- Revenue step-function: This single logo implies a revenue base that exceeds our $1B “Base” AI scenario.

- Funding de-risked: The ~$1.94B prepay plus operating cash flow and structured financing bridges a large chunk of the $5.8B hardware outlay; lowers equity-raise anxiety.

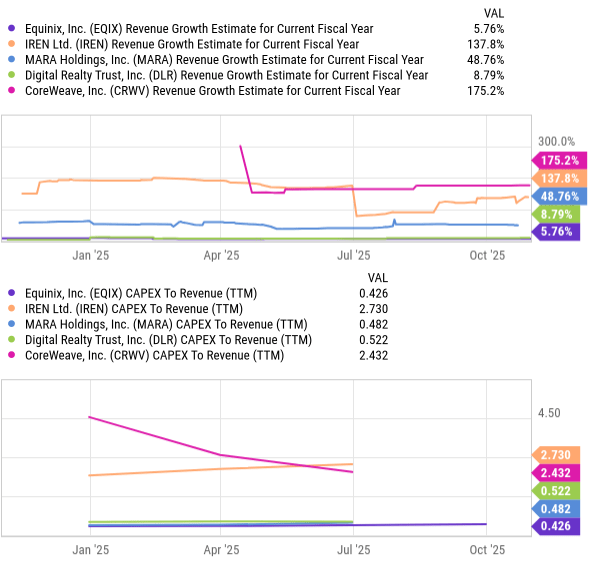

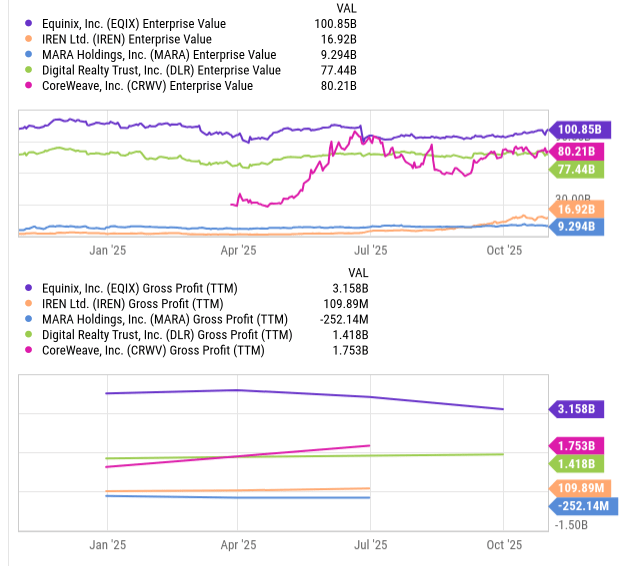

- Validation premium: A hyperscaler choosing IREN for 200MW IT liquid-cooled capacity is contract/ops validation; expect the market to tighten IREN’s discount vs CRWV-style multiples.

Quick valuation bridge (SOTP)

AI Cloud (CRWV-anchored multiple):

- Contract suggests ~$1.9B/yr revenue once fully ramped.

- At 16× P/S (CRWV band) ⇒ $30–31B value for the AI segment (vs. our prior Base case $1.0B × 16× = $16B).

Power/Campus (DLR/EQIX yardstick):

- Childress phase here is ~200MW IT; portfolio is larger, but keep our conservative program: $2.5–3.5M/MW equity value for stabilized IT.

- Using 2.0–2.3GW long-term controllable capacity ⇒ $5–8B (unchanged range).

Updated SOTP EV (illustrative):

- AI Cloud $30–31B + Power $5–8B = $35–39B EV.

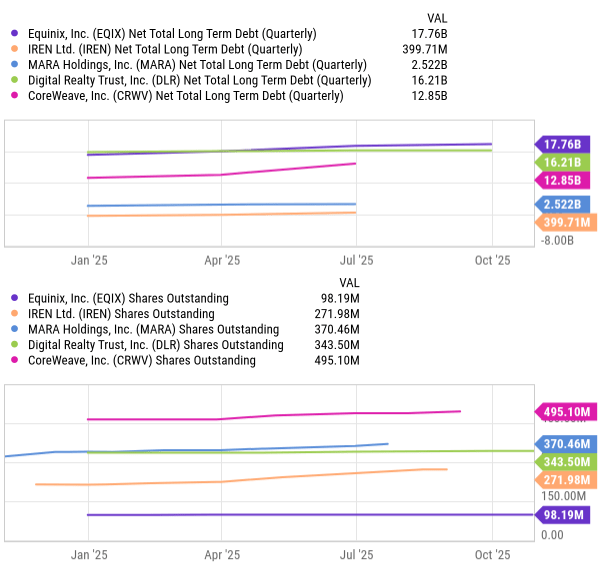

- Less net debt (prepay reduces needs; last print was ~$0.4B net LT debt) ⇒ Equity ~$34–38B.

- Per share (≈272M shrs): $125–$140.

(Assumes CRWV-like multiple; timing/recognition ramp through 2026.)

P&L shape (back-of-the-envelope)

- Revenue recognition ramps with GPU deliveries/commencements; don’t straight-line GAAP.

- COGS will include depreciation on $5.8B hardware, power, cooling, and ops.

- Bare-metal at this scale typically supports high-30s to 40s EBITDA margins once stabilized; hyperscaler precommits should support utilization.

What to watch next

- Commencement cadence: signed → delivered → live MW (DLR-style “booked to live”).

- Cash flow/financing mix: how the 20% prepay is sequenced against Dell milestones; residual financing terms (convertible, ABS, vendor, etc.).

- Unit economics: disclosed pricing/MW, PUE/uptime SLAs; margin disclosure as clusters light up.

- Follow-on logos: second hyperscaler or large AI lab would cement CRWV-like visibility.

- Capacity roadmap: Childress (200MW) is only ~27% of the 750MW campus; the remaining headroom is strategic.

Risk checks

- Delivery risk (GB300 timing, liquid-cooling integration, construction schedule).

- Recognition phasing (TCV ≠ near-term revenue; expect 2H26 step-ups).

- Concentration (single-logo exposure early in ramp).

- Power policy (Texas grid conditions remain constructive, but always monitor).

Bottom line: This is the kind of contract that moves IREN from “story” to “underwritten capacity.” On our framework, the print pulls forward the High-case AI Cloud value, pushes SOTP to $35–39B EV, and justifies CRWV-like multiples as utilization lands. Execution now is about commencements and margins, not demand.

Annex

Leave a comment