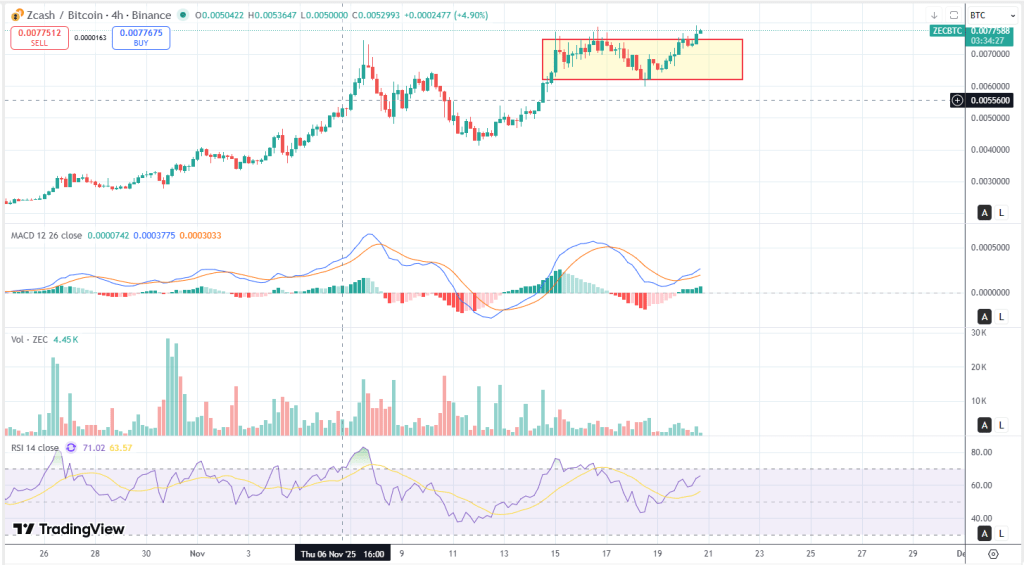

I have been all over ZCash for the past two months. I have been surprised of the strenght of this particular cross and how uncorrelated to broader crypto ZEC has been. It’s time for a technical analysis update.

So far it has been pretty simple, big mark-up followed by stall stall, and then range (box), in essence it looks like a classic re-accumulation. Inside the box we saw multiple secondary tests near the bottom, contracting volatility, then a Sign of Strength (SOS) attempt into/through the box top. The 0.00556 is the prior “creek” from the first impulse; it held on every dip, demand dominant. If we now close and hold above the box, the next phase is a BUEC (retest of the box top that turns resistance to support) before continuation.

On a candles perspective: At range lows we printed long lower shadows and a bullish engulfing follow-through; at the recent push higher we’ve got wide real-body green closes (near-high closes, small upper wicks) = bullish marubozu behavior. Watch for shooting stars/evening stars at the box top, failure there would just mean more rotation inside the range.

Momentum/volume: MACD turned up with a positive cross and rising histogram; RSI is back through 60–70 (bull zone). Volume contracted through the range and expanded on the up-legs, textbook for absorption before a break.

Fibonacci map & targets

Use the swing low at the range bottom as the Fib “0” and the pre-range high as the Fib “1.0”. That gives:

- Retracements (buy-the-dip zones on a successful breakout):

38.2% (shallow trend pullback), 50%, 61.8% (strongest support inside a healthy trend).

Confluence with the box top = high-probability BUEC. - Extensions (targets): measure the box height (H) and project from the breakout:

T1 = breakout + H (measured move)

T2 = 1.272 × H, T3 = 1.618 × H (trend acceleration).

My game plan

Base case (continuation):

- Break-and-BUEC: Wait for a close above the box high on volume > 20-period avg.

- Buy the retest of the box top (BUEC).

- Invalidation: close back inside the box mid (or below 61.8% of the breakout leg).

- Targets: measured move (H), then Fib 1.272 / 1.618. Trail below higher lows or the 20-EMA.

Alternate (range rotation):

- If we print a false break (bearish engulfing back into the box with rising red volume), fade the move and re-accumulate at the box low on a springy candle (long lower shadow + RSI bullish divergence). Stop just under the box.

Bear-switch (trend break):

- Close below 0.00556 (creek) + follow-through = distribution risk. Shift to defense: target Fib 61.8–78.6% of the whole up-leg and wait for a fresh spring before re-risking.

Risk notes: RSI in the low-70s can flag a brief pause; that’s fine if pullbacks hold the box top/38.2–50% area. Don’t chase wide candles; let the BUEC come to you.

TL;DR: Structure says re-accumulation, momentum agrees, and we’re attempting an SOS over the box. I’m bullish into a break -> BUEC → measured move sequence, with a hard line in the sand at 0.00556.

Not Financial Advice

Leave a comment