-

Continue reading →: Crypto Blunders: SEC Showdown and the UK’s Rise

Continue reading →: Crypto Blunders: SEC Showdown and the UK’s RiseIn a world where cryptocurrencies and digital assets are in turmoil, the US Securities and Exchange Commission (SEC) is locked in an internal battle. It’s the Wild West of crypto, where disagreements within the Commission tear at the very fabric of regulation. The Coinbase blog post reveals the twisted plot…

-

Continue reading →: Tesla Demand Problems: Quick Takes

Continue reading →: Tesla Demand Problems: Quick TakesSeveral analysts have pointed out that Tesla has a demand issue. However Musk downplayed the problems in the earnings call. The company is seeing strong demand for its products and has seen the highest orders year-to-date in its history. Orders are currently almost twice the rate of production. Despite a…

-

Continue reading →: Navigating the Market in Tough Times: Why Crypto and Stocks Will Behave Differently

Continue reading →: Navigating the Market in Tough Times: Why Crypto and Stocks Will Behave DifferentlyIn my opinion, the crypto market and the stock market will behave differently in the coming economic recession. While the Federal Reserve’s monetary policy will have an impact on both markets, crypto will be highly sensitive to it, while stocks will be more affected by the economic cycle. The crypto…

-

Continue reading →: Solana: Overcoming Challenges

I’ve gone through a couple of Twitter threads on Solana, and it changed my perception of the chain. Solana’s all about scalability without sacrificing decentralization or security. It’s the sixth biggest Layer 1 by market cap, and it’s got a unique consensus algorithm called Proof of History that helps it…

-

Continue reading →: Is inflation going to crash the stock market?

Continue reading →: Is inflation going to crash the stock market?(Photo credit: Ehud Neuhaus) I don’t think so. Why? Inflation has several causes, and different factors have different weights at different times. Production capacity, production utilization, energy costs, productivity, and monetary cycle play a big role. Some of these are interdependent, and sometimes they work reflexively. In some ways, the…

-

Continue reading →: The Brave New Genomic World

Continue reading →: The Brave New Genomic WorldSummary Illumina and its short reading technology pushed the sequencing costs down during the last decade. Long reads and artificial intelligence are improving the sequencing and will likely keep driving the costs lower. Several companies are building business models around these technological improvements. The past decades brought us the foundational…

-

Continue reading →: The WSB storm opened the door to mainstream decentralized finance (DeFi)

Continue reading →: The WSB storm opened the door to mainstream decentralized finance (DeFi)(Photo credit: BTC Keychain) The Gamestop debacle showed us a couple of things. First, intermediaries in our centralized financial system might have been cheating. The number of short positions in Gamestop suggests that funds and brokers have been practicing naked short-selling. Meaning that they haven’t been selling loaned shares, instead,…

-

Continue reading →: Quick thoughts on the GameStop debacle

Continue reading →: Quick thoughts on the GameStop debaclePhoto credit: Mike Mozart The GameStop episode is not about valuation. It is about supply and demand. With 130% short interest and what seems to be a volume of puts issued way bigger than the available float, it seems like a bad case of an overcrowded trade that got squeezed.…

-

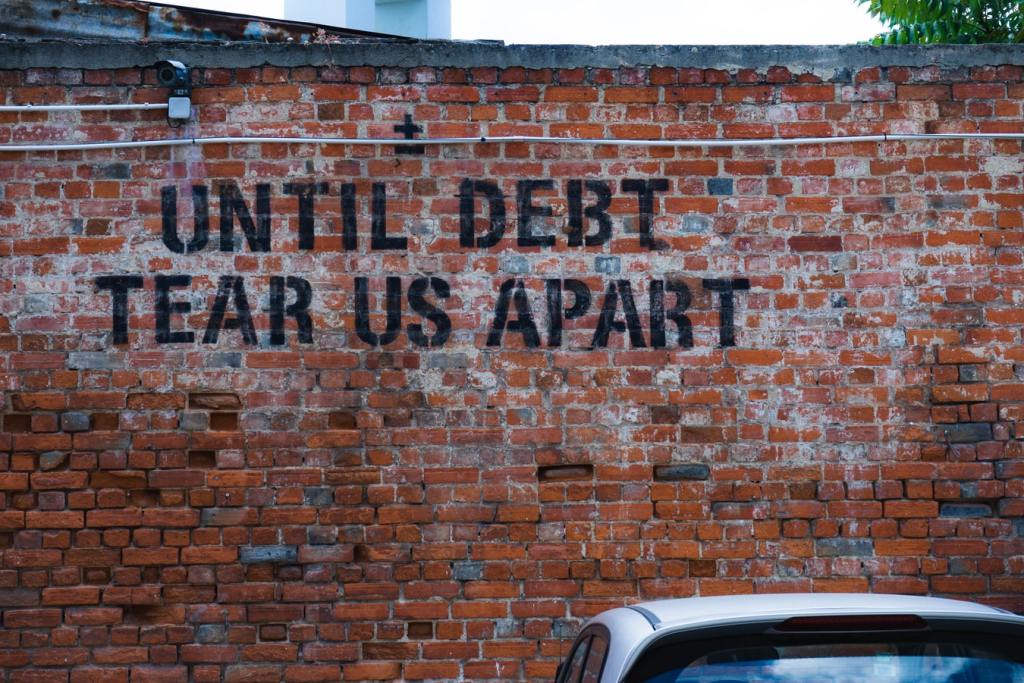

Continue reading →: Bitcoin is a threat to the US dominance

Continue reading →: Bitcoin is a threat to the US dominanceThe monetary architecture that rules the world is one of the most important pillars of US dominance. And the US dollar is one of its most important tools. The reserve currency of the world has allowed the use of policies not permitted to other countries. The privilege of issuing currency…

-

Continue reading →: Tesla: Learning from experience

Continue reading →: Tesla: Learning from experiencePhoto Credit: Open Grid Scheduler Prelude There are two sides to the Tesla story. The first is the stock price, and the second is the underlying business. They seldom seem to reconcile. For a while, it seemed like Tesla’s stock price was in a bubble. To my best knowledge, both…

Hi Fren,

Pepe Maltese

I used to trade inside the machine. Now I just raid it.

I publish two high-conviction setups daily — one momentum, one turnaround — filtered through tape structure, volume shifts, and misaligned narratives.

Some of these turn into full trades. A few evolve into deeper stories. The rest get cut.

This isn’t education. This is intelligence.

I don’t run ads. I don’t sell dreams. I track price, watch structure, and call bullshit when the story breaks.

Follow the setups. Fade the noise. Stick it to the man.

Let’s connect

Join!

Stay updated with our latest ideas by joining our newsletter.