-

Continue reading →: Macro Review: the “Chokepoint” did its job

Continue reading →: Macro Review: the “Chokepoint” did its jobThe tape screamed tight plumbing and risk-off: This is consistent with our framework: mechanical liquidity constriction (TGA hoarding + QT + bill-heavy issuance) tightens collateral, pushes SOFR higher vs EFFR, nudges SRF usage up, and sells the most liquid stuff first (crypto/mega-duration). It’s pipes, not fundamentals. Where we are in…

-

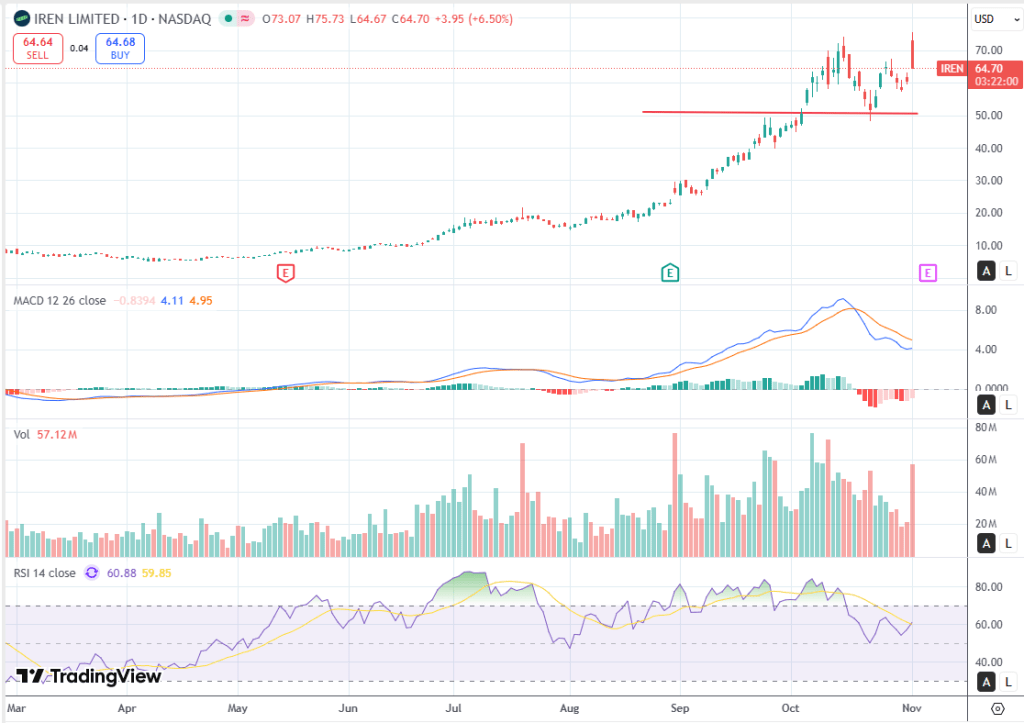

Continue reading →: IREN: MSFT pop fades – watch $56–58 support, $76 breakout line

Continue reading →: IREN: MSFT pop fades – watch $56–58 support, $76 breakout lineBig picture: the Microsoft $9.7B/5-yr GPU cloud contract is a real validator, but the tape is still sorting through funding/margin math. Intraday we’re +6–7% around $64–65, well off the $75.7 high printed on the headline. That long upper wick says “sold-the-news / price discovery.” Chart tells: Macro tape: BTC is…

-

Continue reading →: IREN × Microsoft: Contract big enough to reset the model

Continue reading →: IREN × Microsoft: Contract big enough to reset the modelI have been working on a one-pager for IREN’s valuation. My goal is to simplify the metrics used, so that retail investors can have a rough measure for the company that they can keep track of without much trouble. This will also allow me to keep regular updates at investmentgems.net.…

-

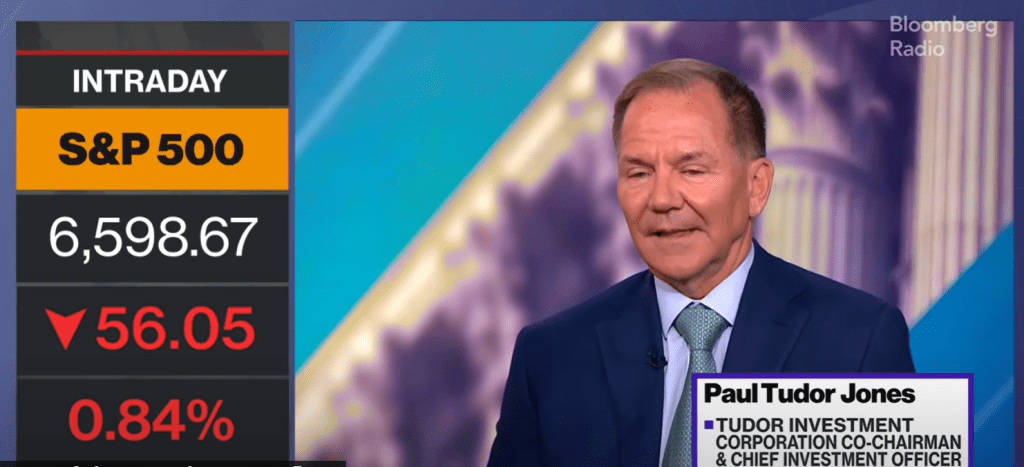

Continue reading →: PTJ Just Plugged Into My Macro Map: Melt-Up First, Debasement After

Continue reading →: PTJ Just Plugged Into My Macro Map: Melt-Up First, Debasement AfterPaul Tudor Jones basically handed us a cheat code for how this tape can play out, and it slots perfectly into the framework I’ve been building here. The vibe right now is late ’99, not because valuations are identical, but because the setup is. Big fiscal (a ~6% deficit), policy…

-

Continue reading →: AMD Lands OpenAI 6GW Deal: Platform Validation Now, Revenue From 2026

Continue reading →: AMD Lands OpenAI 6GW Deal: Platform Validation Now, Revenue From 2026AMD and OpenAI signed a multi-year anchor deal. OpenAI naming AMD a core compute partner for 6 gigawatts of AI infrastructure, starting with MI450 in H2’26, upgrades AMD’s AI story from “credible #2” to “platform supplier with contractual runway.” It doesn’t juice 2025, but it meaningfully raises both the floor…

-

Continue reading →: Security Tightening Could Be a Tailwind for Palantir: Zero-Trust & Auditability, as Competitive Moats

Continue reading →: Security Tightening Could Be a Tailwind for Palantir: Zero-Trust & Auditability, as Competitive MoatsReuters/Breaking Defense dropped a spicy one: an internal Army CTO memo flagged the NGC2 prototype (Anduril is prime; partners include Palantir, Microsoft, etc.) as “very high risk” with “fundamental security” issues. Think basic zero-trust fails: who sees what wasn’t locked down, user activity wasn’t logged, and third-party apps slipped in…

-

Continue reading →: RBLX: From Sideways to Send? Watch 145

Continue reading →: RBLX: From Sideways to Send? Watch 145RBLX just printed a chunky green day and parked under the same ceiling it’s bumped into for two months. Price closed around 141.7 after pressing the 143 zone that has capped every pop since August. The whole last leg looks like a classic re-accumulation: big run April–July, then a sideways…

Hi Fren,

Pepe Maltese

I used to trade inside the machine. Now I just raid it.

I publish two high-conviction setups daily — one momentum, one turnaround — filtered through tape structure, volume shifts, and misaligned narratives.

Some of these turn into full trades. A few evolve into deeper stories. The rest get cut.

This isn’t education. This is intelligence.

I don’t run ads. I don’t sell dreams. I track price, watch structure, and call bullshit when the story breaks.

Follow the setups. Fade the noise. Stick it to the man.

Let’s connect

Join!

Stay updated with our latest ideas by joining our newsletter.