Source: Philip Taylor

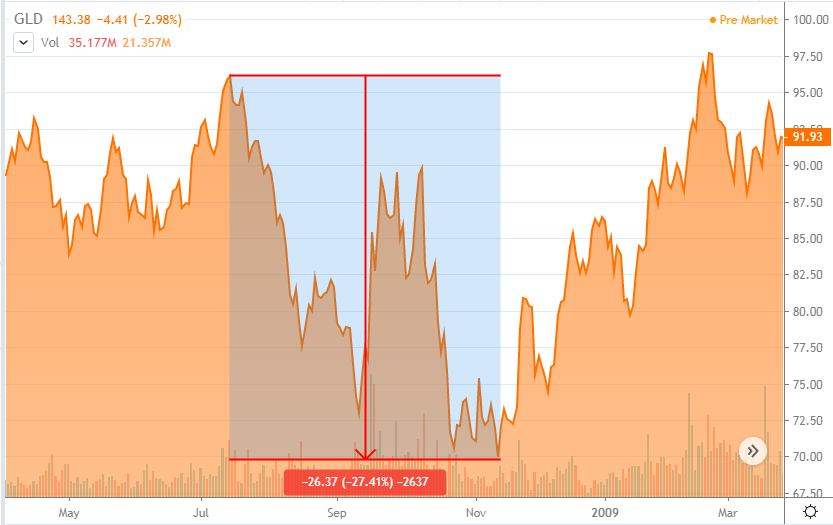

Gold underperformance during periods of panic is not new. If you look at the great financial crisis, you’ll see that the same happened then. The gold price peaked in July and then went on to lose 27% of its value.

Source: Seeking Alpha

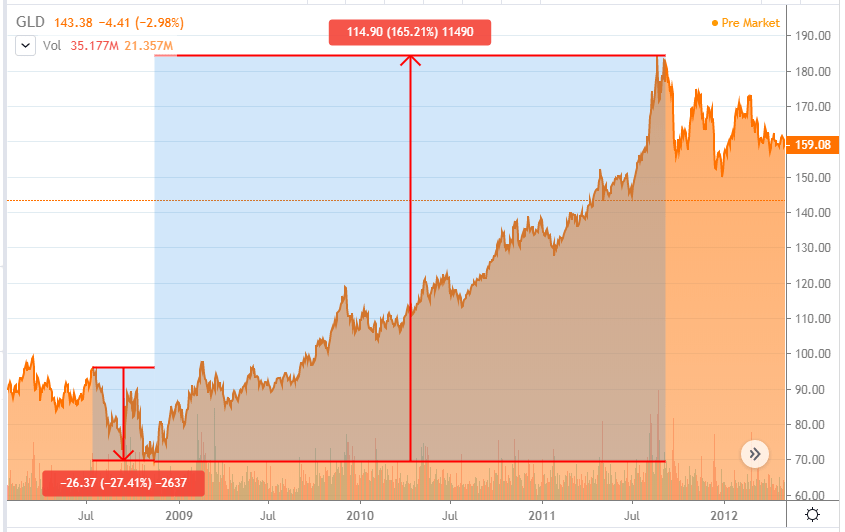

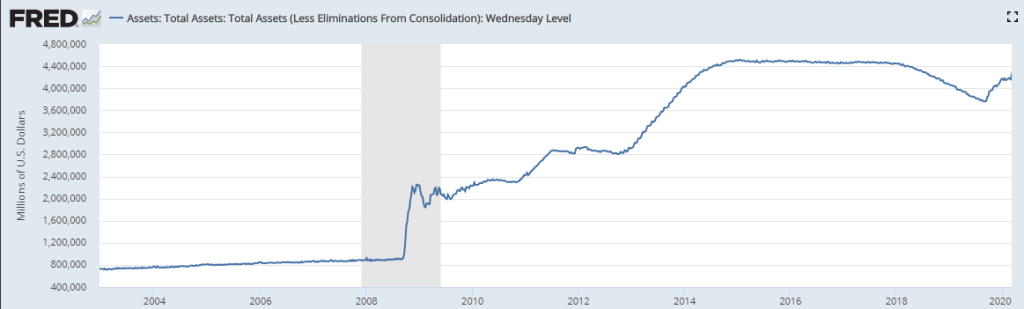

More interestingly, gold then started a rally until 2011. I have since theorized that the most likely cause for that rally was the beginning of the Quantitative easing (QE) program. QE1 started at the end of 2008, and the gold price followed suit.

Source: Seeking Alpha

Source: FRED

Curiously, with the Fed announcing a massive rate cut and a new QE program, the circumstances are now very similar to those in late 2008. However, this time gold might lag for a while longer. Market participants are still in panic mode, and investors are liquidating what they have to cover their losses. I believe that a couple of trading days will be necessary to understand how the new QE round will affect the gold market.

Leave a reply to FoxSr Cancel reply