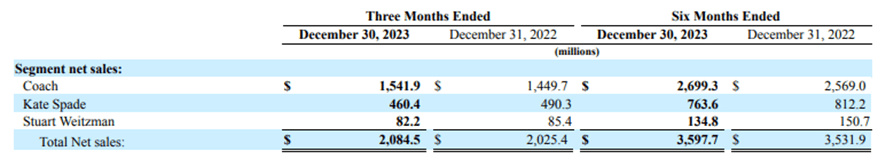

I’ve talked about $TPR before, and I’m sticking to my guns here. They tried to pull off a Louis Vuitton $LVMUY, but let’s be real: it’s not hitting the mark. They brought Stuart Weitzman in 2015 and Kate Spade in 2018 into the fold, thinking they could sprinkle some of that Coach magic on them. But here’s the hard truth: despite all that effort and the years that have passed, Stuart Weitzman and Kate Spade haven’t really stepped up their game. Coach remains the lone star in what looks more and more like a dark sky.

Acquisitions

The company is now closing the Capri acquisition, and it seems optimistic about the acquisition outlook, highlighting the potential of the involved brands to unlock value through leveraging the Tapestry platform. But let’s keep it real: optimism is one thing, execution is another.

The leadership’s been painting a picture of building this powerhouse of iconic global brands. They hammer on about these brands being legendary and present on growing markets. And there’s always the spin about diversifying the portfolio to boost value. They’ve got this blueprint for making investment choices, talking up strategic alignment, financial gains, and how ease of execution. But a cold hard look reveals that it’s a whole different ball game compared to how Louis Vuitton operates. LV picks its additions with precision—only those that are already shining and can seamlessly mesh with what they’ve got, aiming to instantly broaden the brand’s reach and up its visibility using LV’s platform. On the other hand, Tapestry’s approach feels like a lot of talk about the upside of diversity and potential synergies that, frankly, often don’t pan out as promised.

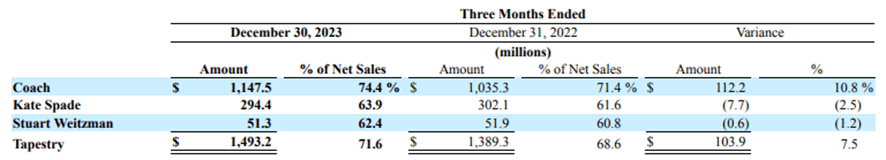

You can note the incongruences in the company strategy when they claim that one great step to improve the Kate Spade brand is to launch the outlet site. In my opinion, never has a luxury brand improved through outlets. If anything, outlets tend to do more harm than good. The gross margins below tell all.

To reiterate, Coach stands out as the lone success story in this mixed bag of brands. The Tabby collection is hitting the mark, showing promise for growth that could span years, thanks to a streak of design innovation. Coach is playing its cards right, setting sights on higher price tags from the get-go and dialing back on discounts.

Conclusion

From where I stand, Tapestry, as a conglomerate, still needs to show its worth. It’s supposed to be this launchpad that immediately boosts the distribution and visibility of its new brands. Yet, here we are, almost a decade into their strategy of accumulating brands under one roof, and we’re still squinting to see the real advantages they’ve managed to materialize.

The Capri chapter adds another layer to this unfolding story, and honestly, my skepticism is dialed up. But fair is fair—I’ll circle back and take a fresh look in a few quarters. Maybe they’ll surprise us, or maybe it’ll be more of the same. Time will tell.