(Photo credit: Mike Mozart)

For investors used to follow this stock, it might seem unbelievable, but the share price of the home company for the Coach brand is nearing its decade lows.

Graph 1 – Tapestry stock price (2009 to present)

(source: Yahoo Finance)

For those keeping track of the company’s affairs, it seems both tempting and scary. It is tempting because the operating and marketing problems that the company faced, in the past, are being overcome. On the other hand, the recent price action brings that someone-knows-something feel.

What might someone know about Tapestry that we don’t?

Three main possibilities come to mind:

- Trade war

- Amazon disrupting retail

- Write-offs

These seem to be the most plausible drivers for the negative price action. Obviously, other could be included, like key personnel leaving the company, or accounting fraud, but, so far nothing seems to suggest even the slightest hint of any of that. Therefore, let’s review those three main negative drivers.

Trade war impacting Tapestry

That is probably the main threatening event threatening in the short-term. Tapestry has a significant portion of its sales derived from China.

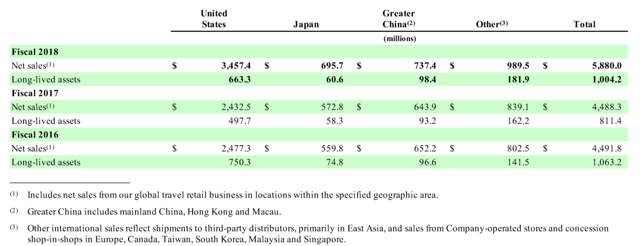

(Source: Tapestry FY2018 10-K)

As we can see in table 1, sales from China represent around 12.5%. Obviously, the Chinese market is one of the fastest growing markets for Tapestry, but even if the trade negotiations fail, it won’t be life-threatening.

More troubling is the fact that a very significant part of the company’s production, and sourcing, is located in China. Obviously, a full-blown trade war will increase the costs and negatively affect profitability. However, in the company’s FY2018 10-K, they have already expressed the desire to diversify its supply-chain to other countries.

Amazon disrupting luxury retail

Amazon has been disrupting all types of retail. From toy makers to third-party vendors trying to make a living by selling on Amazon, many have been disrupted and got their lunch stolen. Therefore, it shouldn’t come as a surprise that luxury retail analysts worry about their traditional brands being disrupted, by Amazon. So far, luxury retailers have been wary of selling online. The main reason lies in the fact that the main reasons to buy online, convenience and promptness, are not attributes that the traditional luxury customer valued, in the past. Buying at luxury stores is not just about getting the products. There is a different feel into it. Going into a store, and getting to feel like a high-end customer, exposed to impeccable service, is part of the whole experience.

However, millennials and generation Z are changing the trends. Millennial high-earners are more inclined to buy online, and that means luxury brands will have to adapt. One way might be to keep the brick-and-mortar stores but allow for a less transactional role. Luxury retailers have been trying that. They have improved their online channel and allowed their stores to also serve as a showroom for the type of customer who likes to buy online.

Most likely, Echo and Alexa (Amazon voice assistants) will bring a new shockwave of disruption to the marketplace, in the years ahead. However, for the time being, traditional luxury retailers seem to be doing the right moves to fend-off the online threat.

Write-offs looming over Tapestry

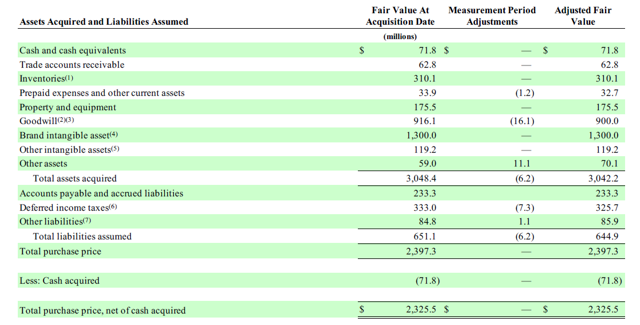

For luxury retailers, like Tapestry, the risk of a write-down stems mostly from paying high premiums to acquire other brands. Later, the company might be called to recognize part of the goodwill as a loss.

Another issue might be an accumulation of inventory that is not sold and becomes obsolete. There was an increase in Tapestry’s inventory, caused by the Kate Spade acquisition, but so far, nothing seems to be indicating problems of that kind.

Performing a simple exercise, we can see that the goodwill is acceptable. The company’s equity book-value is around $3.2 billion, while the 3-year net profit average was $480 million, which offers an ROE of around 15%. The ROE seems high enough to back up the goodwill figures. Even if a more significant goodwill write-down is necessary, the company has enough equity to cushion it.

(Source: Tapestry FY2018 10-K)

Tapestry’s investment case

The company seems like a classic value investment case. Right now, the market sees it as a value trap, that will be disrupted by online retailers while sailing through trade war headwinds.

In my view, the company has a strong brand and a good retailing strategy. Its logistics will adapt to the trade war, and its marketing will adapt to the Amazon threat, at least in the mid-term. In the end, you’ll get a strong brand, paying a 4.37% dividend, with perspective to grow at a moderate pace.

Disclosure: I am long TPR