- A crisis will come, and when that day arrives, you better have some gold in your holdings.

- However, that is just part of the problem. Crisis brings great opportunities, but you’ll need to know where to look.

- We will use demographics to clarify our prospects for investments in the next ten years.

Originally posted on Seeking Alpha

Photo credit: Dave – resting

During the last twelve months, I have formulated some thesis explaining why the yields are so low, and why that will end in a crisis. We are in an era of investment glut, and at the same time, the Fed is getting it all wrong. Summing the two will get us into a crisis, that’s how this cycle will end. I have also explained that, for the next two or three years, gold (GLD) will be a good addition to the portfolio.

Now that we’ve sorted that out, it is time to look beyond a possible recession and try to identify the places where we have the best chances to deploy our capital in the coming decades. It is not easy to try to forecast the next twenty years. But, if one is trying to do it, the best way should be to look at demographic trends. Right now, many pundits point to the demographic pyramids of the advanced world to justify the Japanification of Europe. And, they might not be wrong.

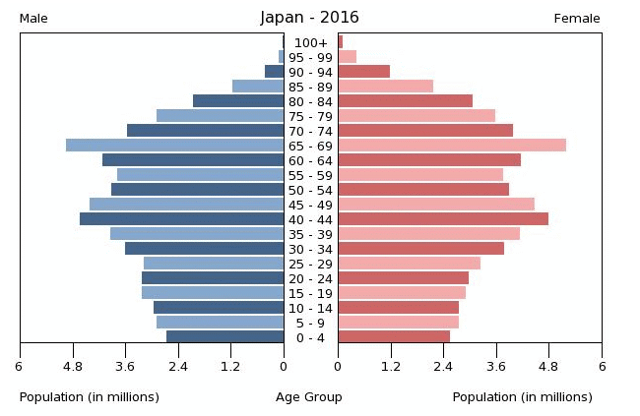

Japan age pyramid 2016

(Source: Indexmundi)

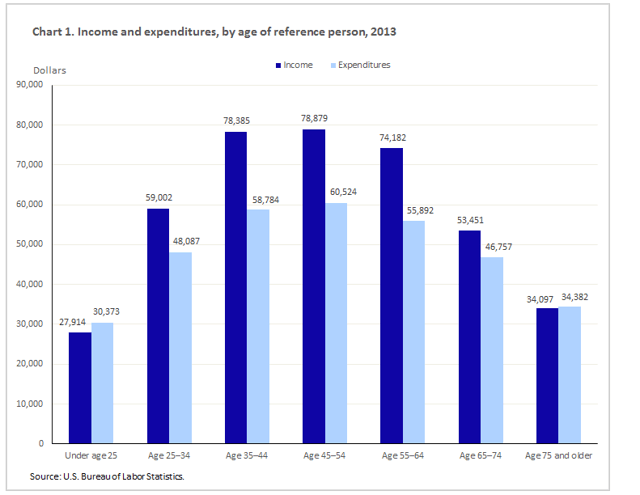

The problem in Japan is that a significant part of the population is in the 65-plus years bracket. And, if we take the US consumer data by age group as an example for the advanced economies, we have to conclude that the consumption starts dropping after the age of 55.

US Income and Expenditures by age (2013)

(Source: BLS)

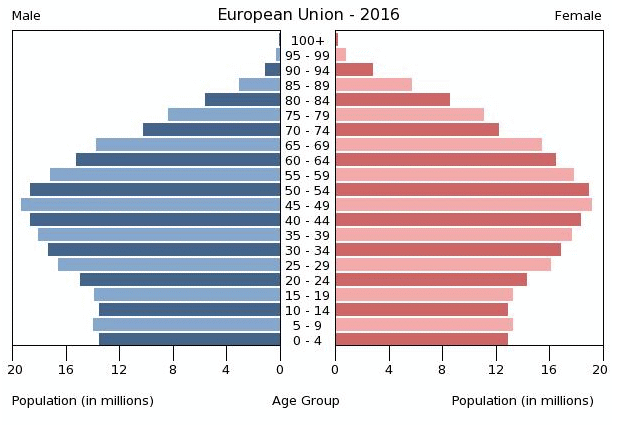

Looking at the age structure of the EU’s population, we can see that the biggest age groups are now getting to the 55-plus years, which is the inflection point for consumption. Therefore, it is hardly surprising that the EU is now starting to exhibit the same symptoms that Japan has been experiencing for a couple of decades.

EU age pyramid 2016

(Source: Indexmundi)

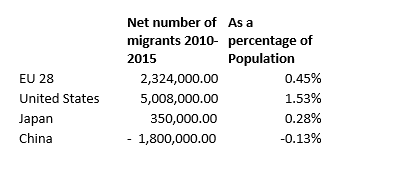

However, we should mention that there is one mitigating factor for the EU, nearly absent from Japan, we are referring to immigration. Immigration has helped to balance the age structure by adding young workers to the country’s population. Compared to Japan, the EU28 has more than quintupled the net inflow of workers as a percentage of the population in the 2010 to 2015 period.

Net migrants for US, UE, China and Japan (2010-2015)

(Source: migrationpolicy.org)

Since immigrants are usually young adults looking for a new life and new opportunities, European immigration has helped to staff the working-age groups. The US has benefited from this effect to a higher degree. For the same period, the immigration impact on the population has tripled that of Europe.

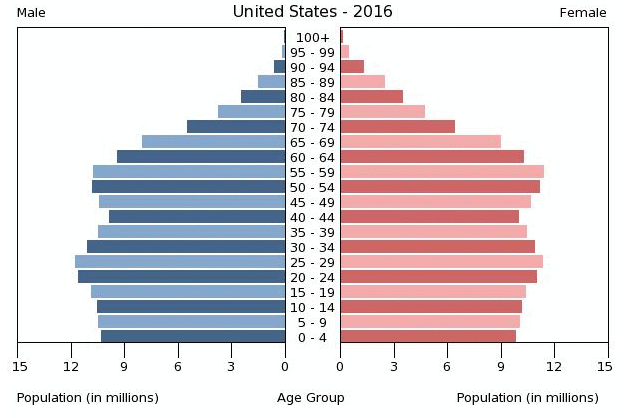

US age pyramid 2016

(Source: Indexmundi)

Looking at the US demographic pyramid, we can see that it is much more balanced than that of Europe or Japan. The US will have an important segment of people entering the 30+ years old bracket in the following years. The next two decades seem much more promising than for Europe and Japan. Now, let’s look at China.

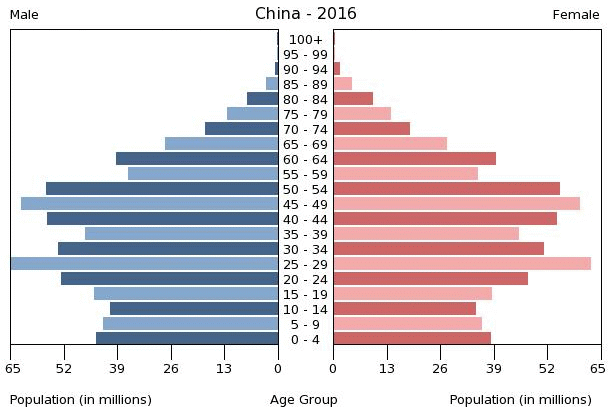

China age pyramid 2016

(Source: Indexmundi)

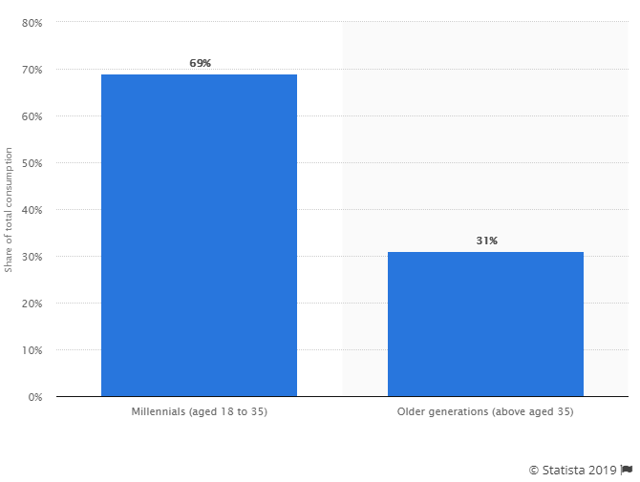

China has a huge generation of millennials reaching the 30+ years bracket. The graph below shows the consumption potential, soon to be unleashed, in China.

Share of total consumption by millennials versus old generation in China by 2021

(Source: Statista)

There will be a consumption torrent to be unleashed, gradually, during the following years. Better life conditions lead to lower birth rates, which are already here, but its impact will only be evident in two or three decades.

China will have huge growth opportunities

Likely, Europe and Japan will lag and will have lots of problems with health and social security liabilities. Therefore, lots of liabilities, in Europe and Japan, will be monetized. Also, consumption will be feeble. Those will be de-growth economies.

On the other hand, the US and China are the economic blocs with the best demographics. The US is still holding some generational balance, while China has a young workforce that will last for years. There are some warning signs in China, like the 0 to 14 years brackets, but that will have to be reassessed again in the future.

All that means the US will not become a zombie, like Japan just yet. The US capital markets will keep its importance in the world, while China will rise to rival the US financial infrastructure. The US will remain important for global investors. However, as we have seen in the demographics, China has a huge fringe of young adults that will push for more consumption. However, China does not have the same retail density as Europe or the US. For that reason, online commerce has appeared as an alternative, allowing access to a huge catalog of products to millions of consumers in rural areas.

Additionally, since Deng Xiaoping started the free-market reforms, China has developed and nurtured a capitalistic culture. China already has some of the biggest corporate powerhouses in the world. For instance, Alibaba (NYSE:BABA) and Tencent (OTCPK:TCEHY) are among the top 10 companies by market capitalization. Nonetheless, they’re not just big, they are sophisticated too. Companies like Baidu (NASDAQ:BIDU) are at the forefront of artificial intelligence (AI), fostering innovation at the frontier of technological innovation. On a more mundane note, the payments industry, in China, has gone completely digital, surpassing the west on this regard.

How to take advantage of this?

However, for the US-based investor, the risk of accounting fraud has always been present, and it has been a slight deterrent. In my opinion, the solution to that problem is to buy a diversified basket of stocks. That would prevent a loss from an eventual fraud (or another event arising from the lack of information) from having too much weight on your returns. That’s why I believe that for investors lacking a huge insight into the Chinese market, the best way to invest there is through an exchange-traded fund (ETF). You can find dozens of Chinese ETFs here. There are some strategy differences between them, but mostly, they invest in the biggest Chinese companies.

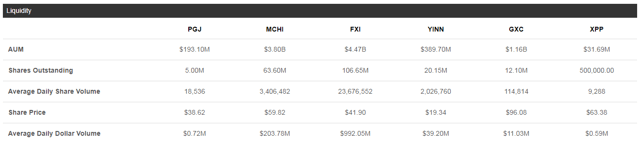

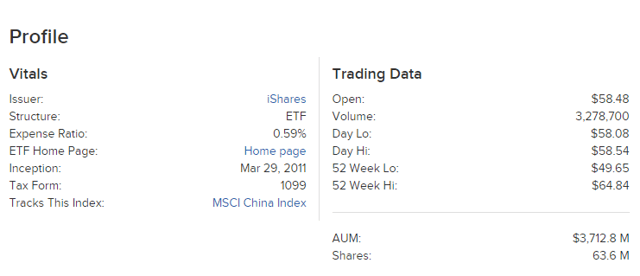

I recommend going with one that has both high liquidity and high net assets. The biggest two are iShares China Large-Cap ETF (FXI) and iShares MSCI China ETF (MCHI).

Volume for MSCI China ETF and peers

(Source: Seeking Alpha)

The first one is more skewed toward financials, while the second has a slight technology bias. I will go with the MCHI because I think that technological development will keep roaring during the next decade, it just won’t be a straight line up.

iShares MSCI China ETF

(Source: etfdb.com)

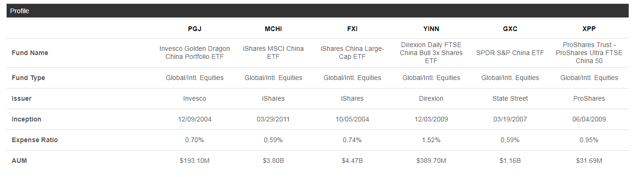

However, others might be more conservative and go with FXI, or be more aggressive and get one using leverage to enhance returns, like the Direxion Daily FTSE China Bull 3x Shares ETF (YINN).

MSCI China ETF and some peers

(Source: Seeking Alpha)

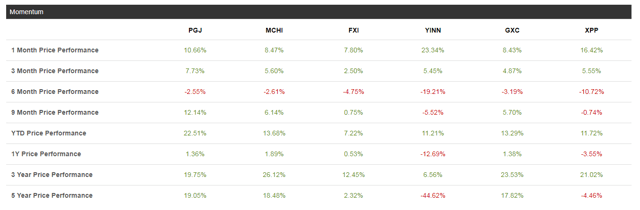

Looking at the previous table, the expense ratio of the MCHI stands out as being the lowest (on par with the GXC). While, at the same time, it presents a very consistent performance for the different time frames.

Performance for MSCI China ETF and peers

(Source: Seeking Alpha)

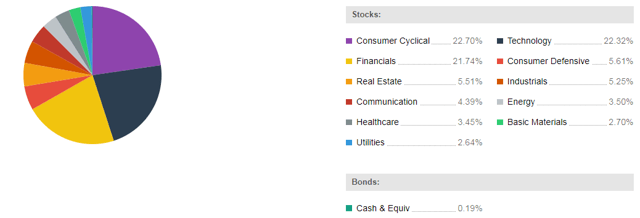

All-in-all, I feel that the MCHI is the right choice for investors that want a balanced Chinese portfolio with significant exposure to technology and consumer spending.

MCHI – Sector breakdown

(Source: Seeking Alpha)

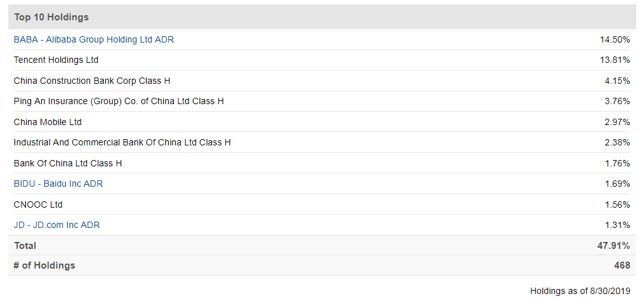

The other side of the coin, and likely its biggest caveat, might be the fact that the top two holdings represent more than 28% of the fund.

Top 10 Holdings for the MCHI

(Source: Seeking Alpha)

In any case, I believe, the trick for a timely buy is to wait for the next US recession. That will allow the repricing of the Chinese tech companies on a lower level.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.